Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

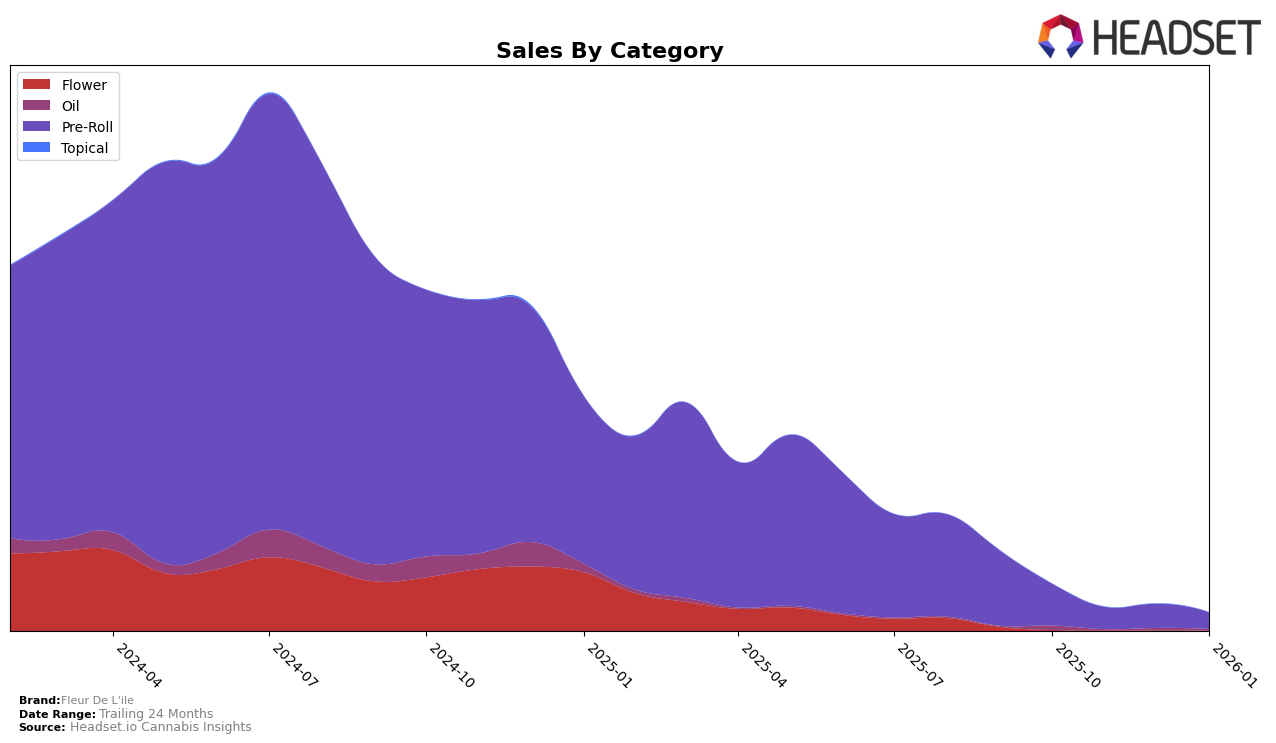

Fleur De L'ile's performance in the Pre-Roll category in Saskatchewan shows a recent upward trend, although the brand did not make it into the top 30 rankings in the final months of 2025. By January 2026, the brand had improved its position to 44th place, indicating a positive movement in the market. Despite not being in the top 30, this progress suggests a growing presence and potential for further advancement. The sales figures in this period reflect a slight decline from November to January, but the brand's ability to climb the rankings suggests strategic efforts that may be paying off.

It is noteworthy that while Fleur De L'ile did not appear in the top 30 rankings in October and November of 2025, their subsequent rankings in December and January demonstrate resilience and a potential trajectory for growth. This could imply that the brand is gaining traction with consumers in Saskatchewan, possibly through improved product offerings or marketing strategies. While the sales numbers alone do not tell the full story, the brand's progress in rankings provides a promising outlook for its future in the Pre-Roll category within this market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Fleur De L'ile has shown a modest yet consistent presence, particularly in the last two months of the observed period. Starting from a non-ranking position in October and November 2025, Fleur De L'ile emerged in December 2025 at rank 45, slightly improving to rank 44 in January 2026. This upward trend, although gradual, positions Fleur De L'ile behind competitors such as Phyto Extractions and Virtue Cannabis, which held ranks 40 and 38 respectively in December 2025. Notably, Dom Jackson consistently outperformed Fleur De L'ile, securing a rank of 34 in January 2026. Despite this, Fleur De L'ile's sales figures in January 2026 were competitive, indicating potential for future rank improvement if the brand continues to leverage its market presence effectively.

Notable Products

In January 2026, Fleur De L'ile's top-performing product was the Mix & Twist Pre-Roll 20-Pack (10g), maintaining its first-place rank from December 2025 with notable sales of 315 units. The Blue Dream Pre-Roll 7-Pack (3.5g) held a consistent second place, although its sales declined significantly to 67 units from previous months. CBD Oil (30ml) improved its position to third place, moving up from fourth in December 2025. Alaskan Ice Pre-Roll 7-Pack (3.5g) and Gorilla Breath Pre-Roll 7-Pack (3.5g) shared the fourth rank, with both products seeing a drop in sales. The trends indicate that while Mix & Twist Pre-Roll remains popular, other products in the pre-roll category have experienced fluctuating demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.