Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

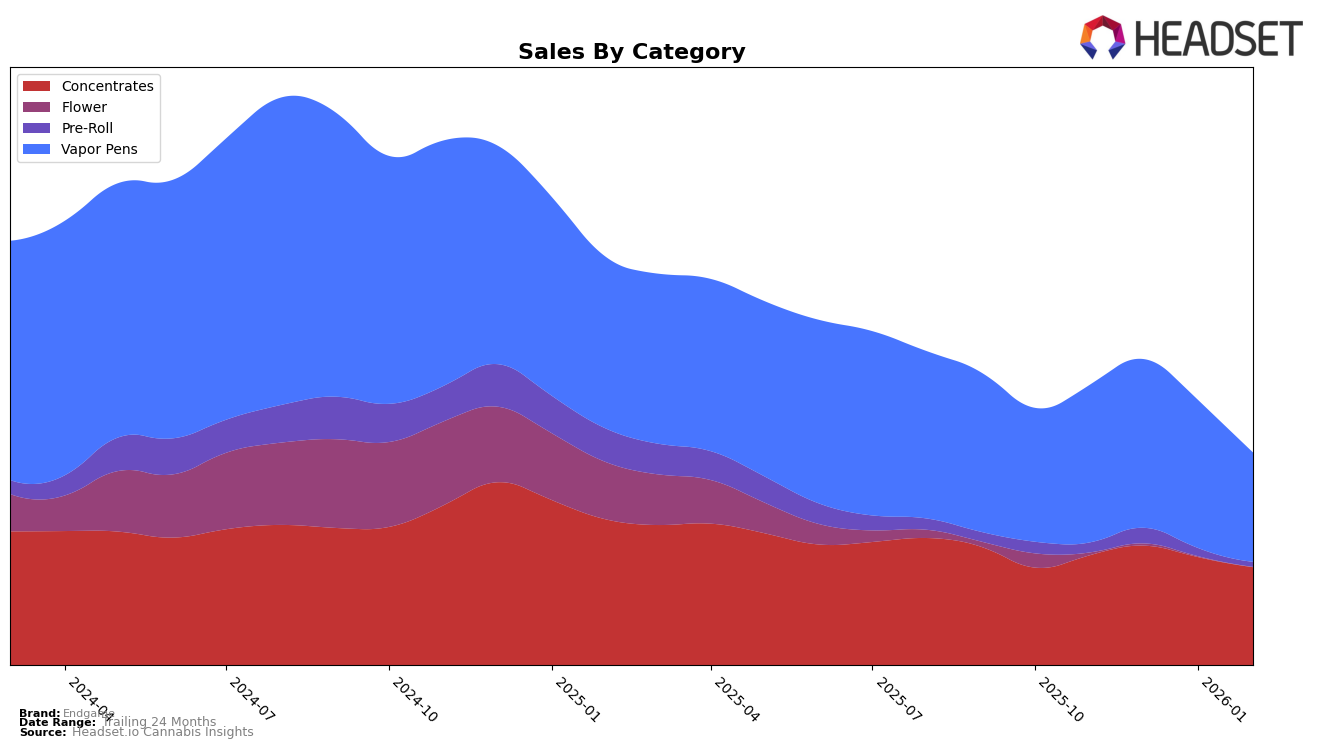

Endgame has shown a strong performance in the Concentrates category across several Canadian provinces. In British Columbia, Endgame consistently held the top position from November 2025 through February 2026, indicating a solid market presence and consumer preference. In Alberta and Ontario, the brand maintained a steady presence within the top four ranks, showcasing its robust foothold in these regions as well. However, in Saskatchewan, Endgame's presence in the Concentrates category was notable only up to December 2025, after which it was not among the top 30 brands, suggesting a potential decline or shift in market dynamics.

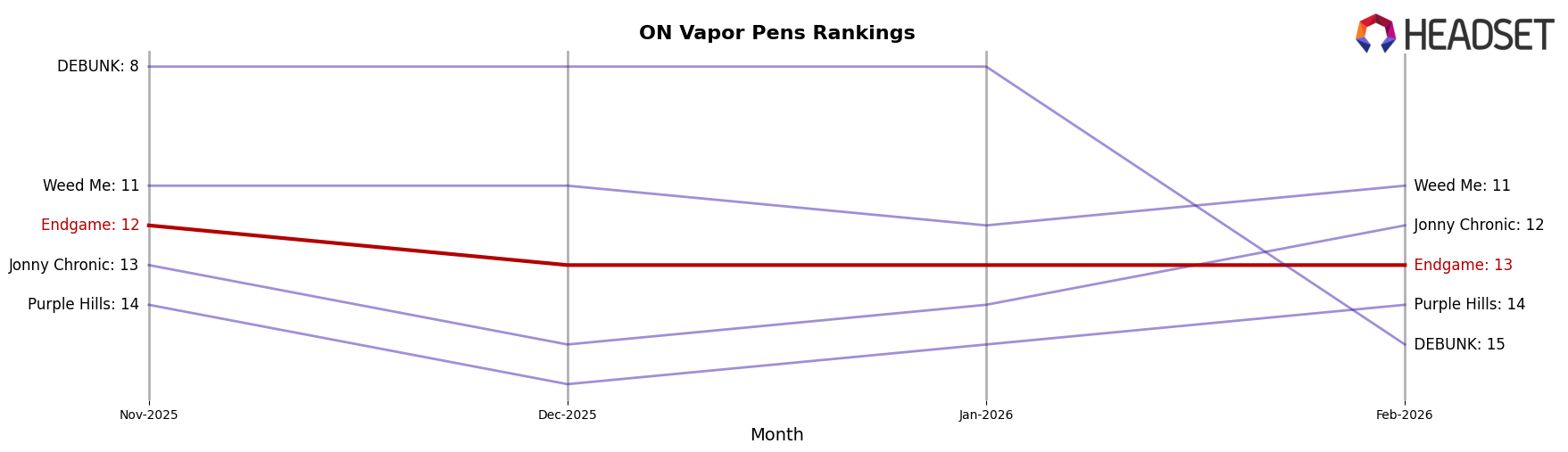

In the Vapor Pens category, Endgame's performance was more varied. In Alberta, the brand experienced a downward trend from 17th to 20th position over the four months, which might indicate increasing competition or changing consumer preferences. Conversely, in Saskatchewan, Endgame improved its ranking from 19th in November 2025 to 8th in December 2025, before experiencing some fluctuation. Meanwhile, in British Columbia, the brand's rank dropped from 12th to 25th, highlighting a significant challenge in maintaining its market share. In Ontario, Endgame's rank remained stable at 13th, suggesting a steady but perhaps stagnant position in the Vapor Pens market.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Endgame has maintained a relatively stable position, ranking consistently at 12th or 13th from November 2025 to February 2026. Despite this stability, Endgame faces significant competition from brands like Weed Me, which consistently ranks higher, maintaining the 11th position for most months. DEBUNK also poses a notable challenge, initially ranking 8th before a dramatic drop to 15th in February 2026, indicating potential volatility. Meanwhile, Jonny Chronic and Purple Hills are close competitors, often trailing just behind Endgame. The data suggests that while Endgame has a stable foothold, there is room for strategic growth to surpass competitors and capitalize on the fluctuations observed in the rankings of other brands.

Notable Products

In February 2026, the Mimosa x Blood Orange Distillate Cartridge (1g) from Endgame maintained its position as the top-performing product, continuing its streak as the number one ranked product for four consecutive months, despite a sales dip to 7716 units. The Hard Hitters - Blueberry Octane Liquid Diamond Cartridge (1g) also held steady in second place, showing consistent performance across the same period. Designer Pink Shatter (1g) remained in third place, having climbed from fifth in November 2025, indicating a solid demand in the Concentrates category. Face Lock Shatter (1g) sustained its fourth-place ranking from January 2026, while Hard Hitters - Platinum Punch Liquid Diamond Cartridge (1g) entered the top five for the first time in February 2026. These rankings highlight the enduring popularity of Vapor Pens and Concentrates among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.