Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

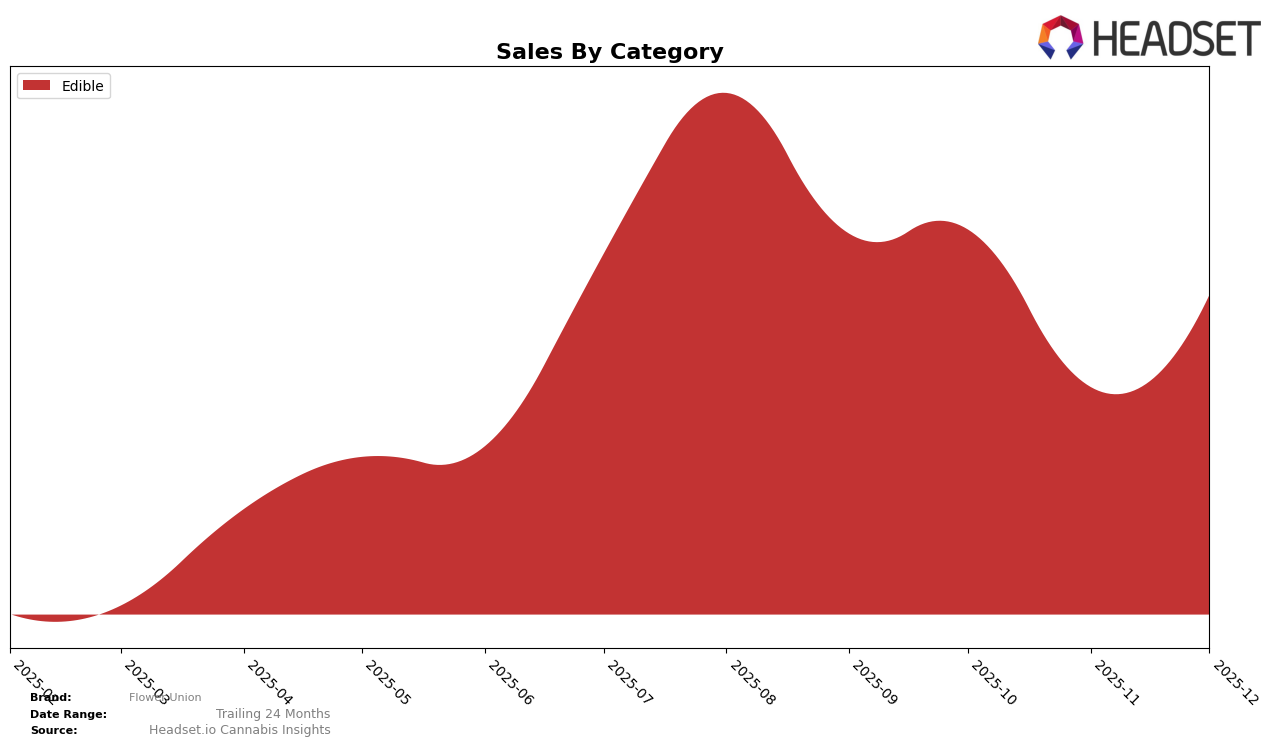

Flower Union has shown varied performance across different states and categories. In Colorado, the brand has maintained a presence within the top 30 for the Edible category, although its ranking fluctuated slightly towards the end of the year. Starting at 26th in September, Flower Union dropped to 28th in October, fell out of the top 30 in November, but managed to climb back to 30th in December. This indicates a slight recovery after a dip in sales, which saw a significant decrease from September to November. The brand's ability to re-enter the top 30 by December highlights a positive trend, albeit with room for improvement.

In contrast, Flower Union's performance in New Jersey underlines a different challenge. The brand did not appear in the top 30 rankings for the Edible category for most of the observed months, with a brief appearance at 52nd in October and a re-entry at 49th in December. This suggests that while Flower Union is making some headway in New Jersey, it remains outside the top tier of competitors. The sales figures reflect a modest increase from October to December, hinting at potential growth if the brand can continue to improve its market position.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Flower Union has experienced fluctuating rankings from September to December 2025, starting at 26th and ending at 30th. This downward trend in rank is indicative of a challenging market environment, particularly as competitors like Canyon and Mountain High Suckers have shown more stable or slightly improving ranks. Notably, Canyon managed to climb from 30th to 29th by December, while Mountain High Suckers improved from 30th to 28th. Flower Union's sales have also seen a decline, with a notable drop from October to November, which could be attributed to the competitive pressure from these brands. Additionally, ROBHOTS and Lazercat Cannabis have maintained a presence in the market, with Lazercat Cannabis re-entering the top 20 in December. These dynamics suggest that Flower Union may need to reassess its strategies to regain its competitive edge in the Colorado edible market.

Notable Products

In December 2025, the top-performing product for Flower Union was the Boost - Strawberry x Cliffhanger Gummies 10-Pack (100mg), which maintained its first-place rank consistently since September despite a sales drop from 983 to 670. Recover - Modified Gary Fast Acting Gummies 10-Pack (100mg) saw a significant climb in rankings, moving from fifth in November to second in December with sales reaching 181. Boost - Night Charmer Gummy 10-Pack (100mg) reappeared in the rankings at third place, showing a sales increase to 151. Boost - Blueberry Flavored Gummies 10-Pack (100mg) dropped to fourth place, with sales slightly decreasing from 135 to 128. Lastly, Boost - Strawberry Gummy 10-Pack (100mg) re-entered the rankings at fifth place, showing resilience with a sales figure of 104.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.