Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

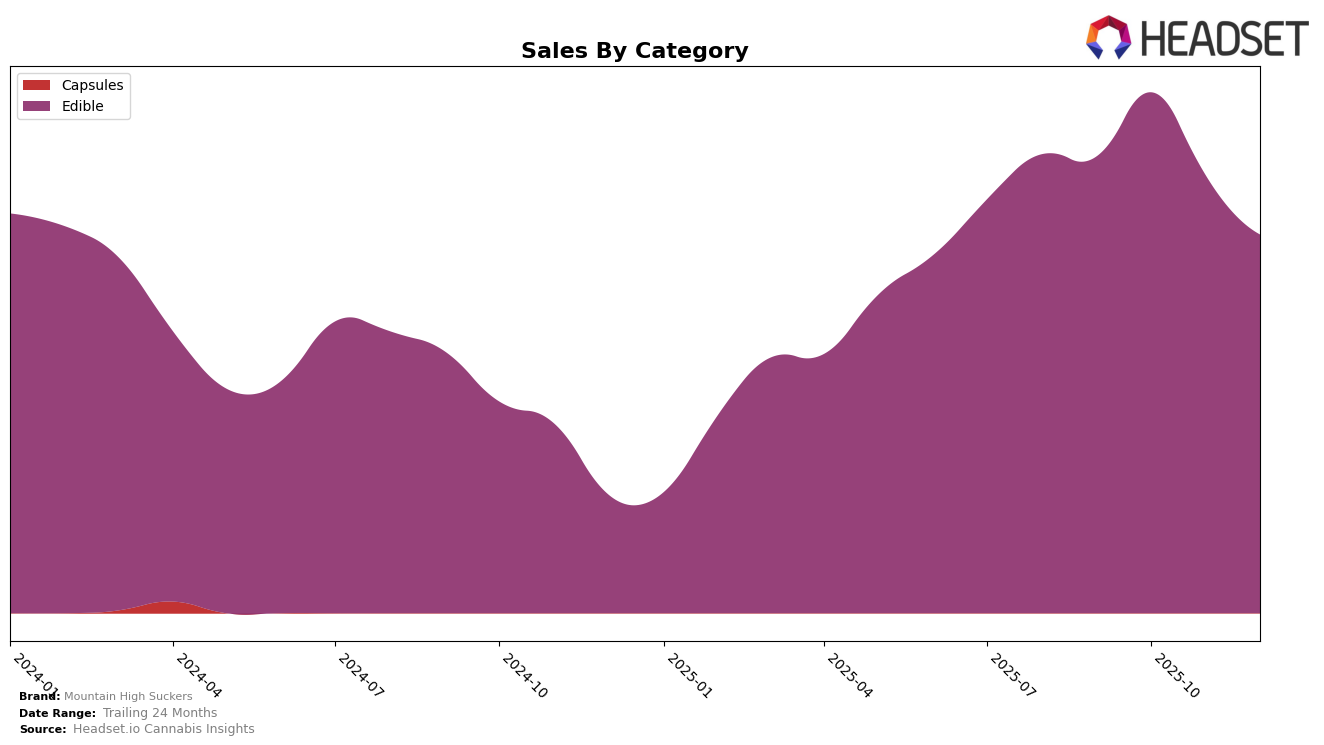

In the state of Colorado, Mountain High Suckers maintained a steady presence in the edible category, showing a slight upward trend in rankings from September to December 2025. The brand moved from the 30th position in September to the 28th by December, indicating a gradual improvement in market performance. This upward trajectory coincides with a notable increase in sales from September to October, although there was a dip in November before recovering slightly in December. This suggests a fluctuating yet resilient market presence in Colorado, which might be attributed to seasonal factors or competitive dynamics within the state.

Conversely, in New York, Mountain High Suckers did not make it into the top 30 brands in the edible category during the last quarter of 2025. The brand's rankings remained outside the top 60, indicating a challenging market environment or possibly a need for strategic realignment to boost visibility and sales. Sales figures show a slight decline from October to November, and the absence of a ranking in December suggests that the brand did not manage to capitalize on the holiday season, which is typically a peak period for edible sales. This could highlight potential areas for improvement in terms of market penetration and consumer engagement in New York.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Colorado, Mountain High Suckers has shown a consistent presence, maintaining a rank within the top 30 throughout the last quarter of 2025. Despite a slight dip in November, where it ranked 30th, Mountain High Suckers improved to 28th in December, indicating a positive trend in market positioning. This improvement is noteworthy when compared to competitors like Canyon, which fluctuated between ranks 25 and 30, and Flower Union, which saw a drop to 31st in November. Meanwhile, Billo consistently outperformed Mountain High Suckers, maintaining a rank in the mid-20s, and Freez-Its showed a similar upward trend, closing December at 26th. These dynamics suggest that while Mountain High Suckers is holding its ground, there is room for growth, particularly in capturing market share from higher-ranked competitors like Billo.

Notable Products

In December 2025, the top-performing product from Mountain High Suckers was the CBD/THC Cherry Lollipop (3mg CBD, 10mg THC), which climbed to the number one spot from fourth place in November, recording sales of 541 units. The CBD/THC Watermelon Lollipop (3mg CBD, 10mg THC), which had consistently held the top ranking from September to November, fell to second place. The Caramel Apple Sucker (10mg) entered the rankings for the first time in December, securing the third position. The Blueberry Sucker (10mg) dropped from second place in November to fourth in December. Meanwhile, the Strawberry Sucker (10mg) maintained its position at fifth place from October through December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.