Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

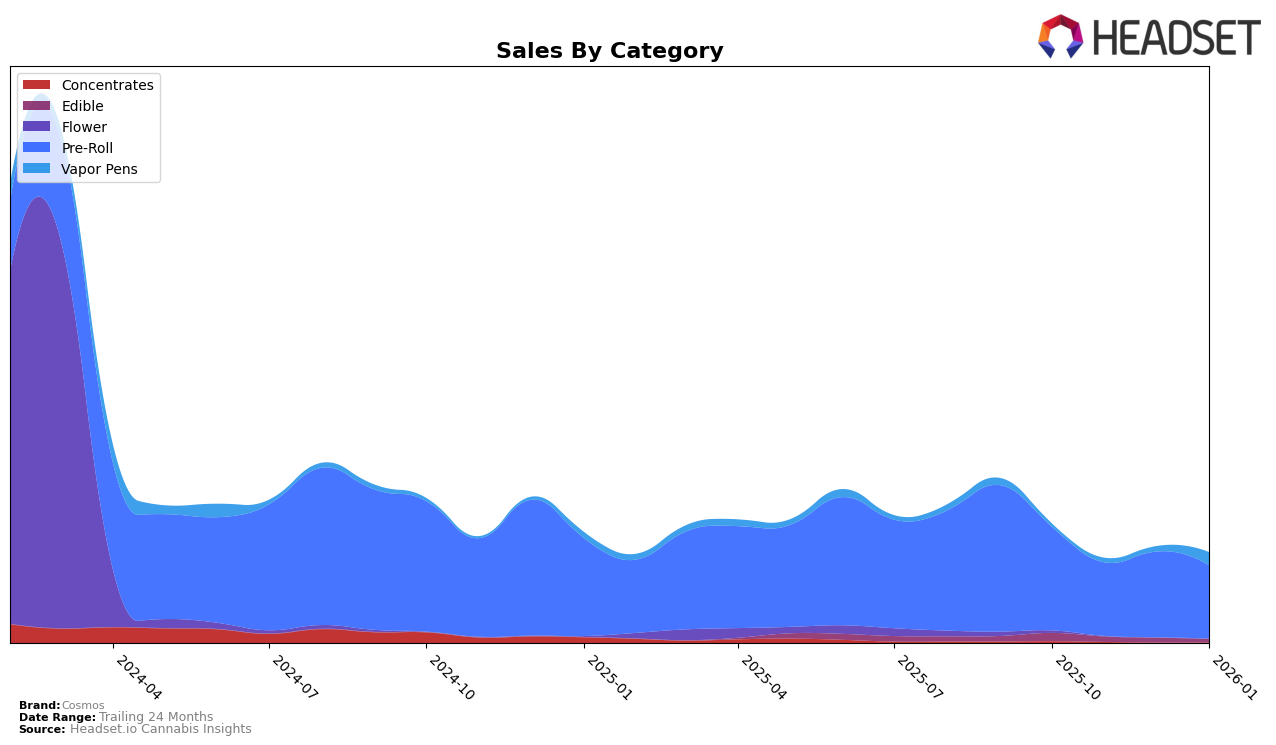

Cosmos has shown varied performance across different product categories and states. In Colorado, the brand's presence in the Edible category has been declining, with rankings slipping from 34th in October 2025 to falling out of the top 30 by January 2026. This downward trend is mirrored in their sales figures, which decreased steadily over the same period. On the other hand, Cosmos has maintained a consistent position in the Pre-Roll category, holding steady at the 12th spot from November 2025 through January 2026, despite a slight dip in sales in January 2026. This consistency in ranking suggests a stable demand for their Pre-Roll products, even as other categories fluctuate.

In the Vapor Pens category, Cosmos has made notable progress. Initially absent from the top 30 in October 2025, the brand climbed to the 80th position in November and December, before making a significant jump to 64th in January 2026. This improvement is reflected in their sales, which saw a substantial increase, particularly in January 2026. The movement in the Vapor Pens category indicates a growing acceptance and potential for Cosmos products within this segment in Colorado. While the brand faces challenges in some areas, these shifts highlight their ability to adapt and find opportunities for growth.

Competitive Landscape

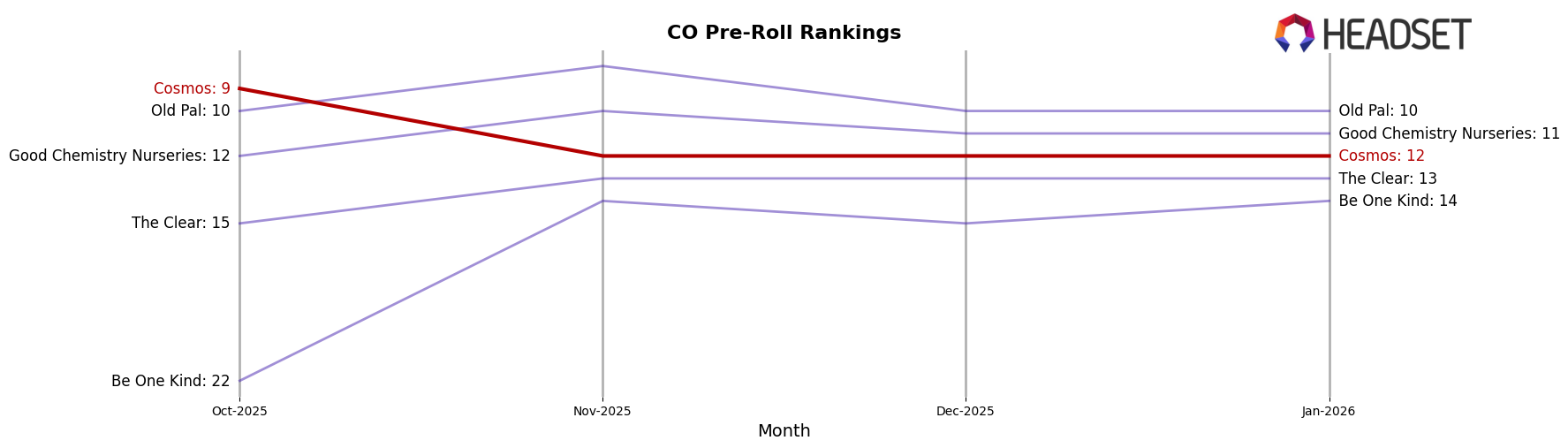

In the competitive landscape of the Pre-Roll category in Colorado, Cosmos has experienced notable fluctuations in its ranking and sales over the past few months. Starting from a strong position at 9th place in October 2025, Cosmos saw a decline to 12th place by November and maintained this position through January 2026. This drop in rank coincides with a decrease in sales from October to November, although there was a slight recovery in December before dipping again in January. In contrast, Old Pal consistently held a top 10 position, indicating a stable market presence. Meanwhile, Good Chemistry Nurseries improved its rank from 12th to 11th, showing a positive trend in sales, particularly in November. The Clear remained steady at 13th place from November through January, reflecting consistent performance. Notably, Be One Kind made a significant leap from 22nd to 14th place in November, suggesting a growing presence in the market. These dynamics highlight the competitive pressures Cosmos faces, emphasizing the need for strategic adjustments to regain its earlier momentum in the Colorado Pre-Roll market.

Notable Products

In January 2026, Jupiter Joint - Baja Blastoff Infused Pre-Roll (1g) maintained its top position in the Cosmos lineup, with sales reaching 2471 units. The Jupiter Joint - Mojito Moonrise Infused Pre-Roll (1g) climbed to the second rank, improving from fourth in December 2025, indicating strong consumer interest. Jupiter Joint - Supernova Strawberry Infused Pre-Roll (1g) made an impressive entry, securing the third position without prior rankings. Meanwhile, Jupiter Joints - Big Bang Blueberry Infused Pre-Roll (1g) debuted at fourth place, showing competitive performance. Lastly, Jupiter Joint - Nebula Nectar Infused Pre-Roll (1g) saw a slight decline, moving from third to fifth rank, yet still maintaining significant sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.