Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

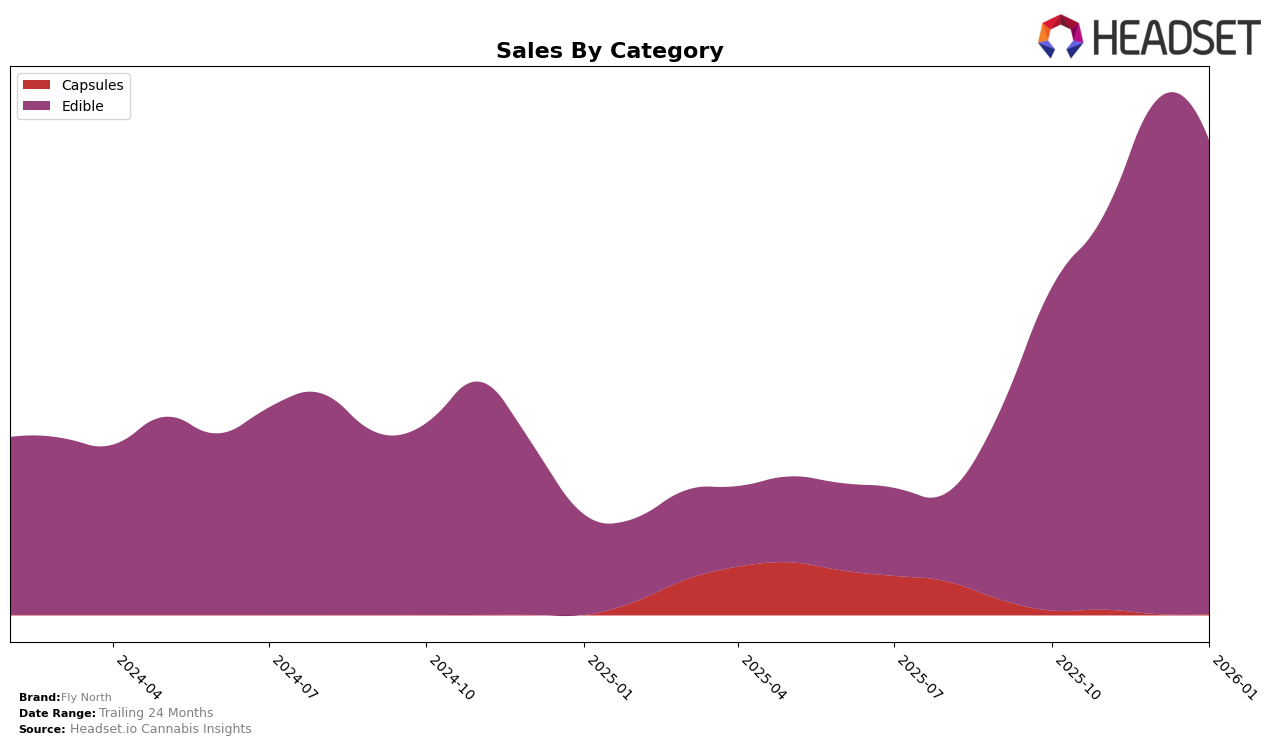

Fly North has shown a promising upward trajectory in the edible category, particularly in Ontario. Over the span from October 2025 to January 2026, the brand climbed steadily from the 8th to the 5th position in the rankings. This consistent improvement in ranking is mirrored by a notable increase in sales, peaking in December before a slight dip in January. Meanwhile, in Saskatchewan, Fly North maintained a steady 6th position throughout the same period. This consistency, despite the smaller market size compared to Ontario, indicates a stable presence and possibly a loyal consumer base.

While Fly North's performance in Ontario and Saskatchewan is commendable, the absence of rankings in other states or provinces suggests areas for potential growth or challenges in market penetration. The brand's ability to sustain its position in Saskatchewan despite the competitive landscape is noteworthy, yet the lack of broader geographical presence in the top 30 rankings could be a double-edged sword. This might imply either a strategic focus on specific markets or a need to diversify and expand its reach. The brand's trajectory in Ontario, with a peak in sales during December, could hint at seasonal factors or effective promotional strategies that could be leveraged in other regions.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ontario, Fly North has demonstrated a notable upward trajectory in brand ranking from October 2025 to January 2026. Initially positioned at 8th place in October, Fly North climbed to 5th place by January, showcasing a consistent improvement in market presence. This upward movement is significant when compared to competitors such as No Future, which experienced a decline from 4th to 7th place over the same period. Meanwhile, Gron / Grön and Shred maintained stable positions at 2nd and 3rd respectively, indicating a strong hold in the market. Fly North's sales figures also reflect this positive trend, with a substantial increase from October to December, before a slight dip in January, yet still outperforming No Future in terms of sales. This consistent rise in rank and sales suggests that Fly North is effectively capturing market share and could potentially challenge higher-ranked brands if this momentum continues.

Notable Products

In January 2026, Fly North's Key Lime Pie Soft Chew (10mg) maintained its top position as the best-performing product, continuing its streak from previous months despite a slight decline in sales to 7,322 units. The Space Tokens - Wild Strawberry Splash Live Rosin Chews 10-Pack (100mg) climbed to second place, improving from its third-place standing in December 2025. Space Tokens - Platinum Blueberry Live Rosin Soft Chew 10-Pack (100mg) also saw an upward movement, advancing to third place from fourth. A new entry in the rankings, Space Token Berry Tastic Gummies 10-Pack (100mg), debuted in fourth place, indicating strong consumer interest. Sour Passion Fruit Soft Chew (10mg) fell to fifth place, showing a significant drop from its consistent second-place ranking in prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.