Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

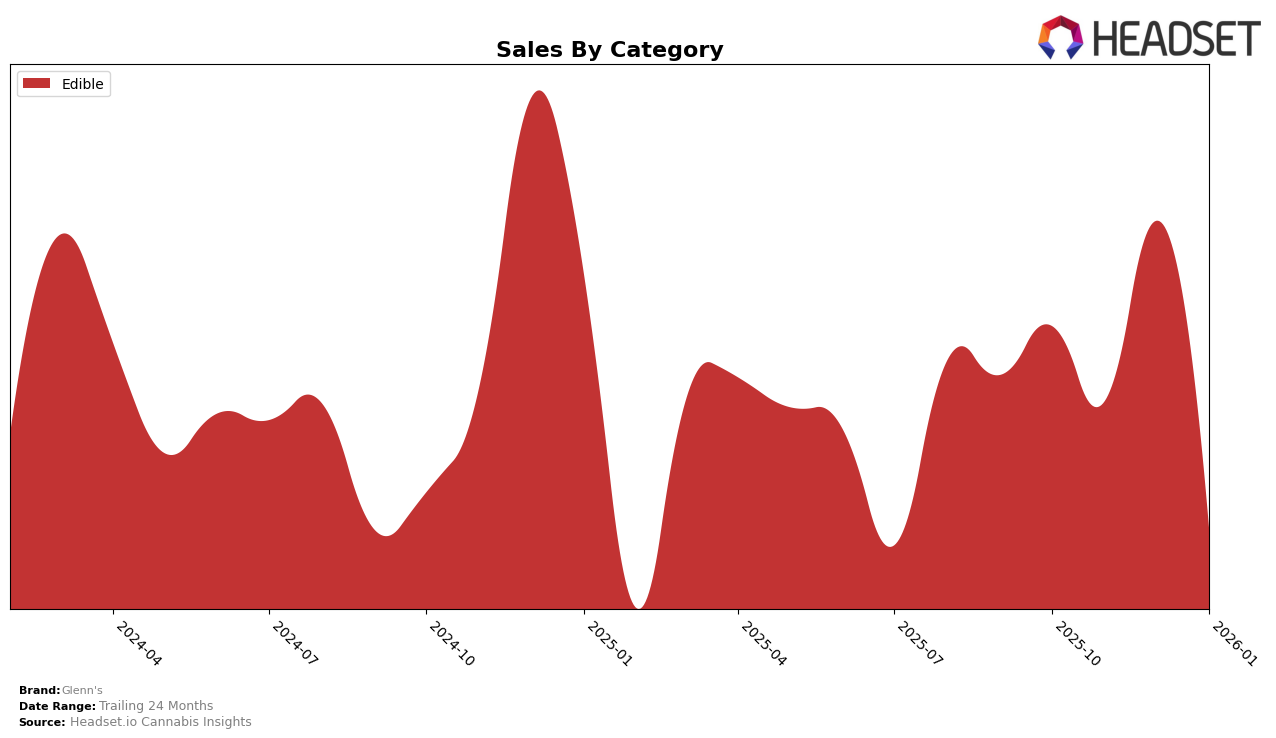

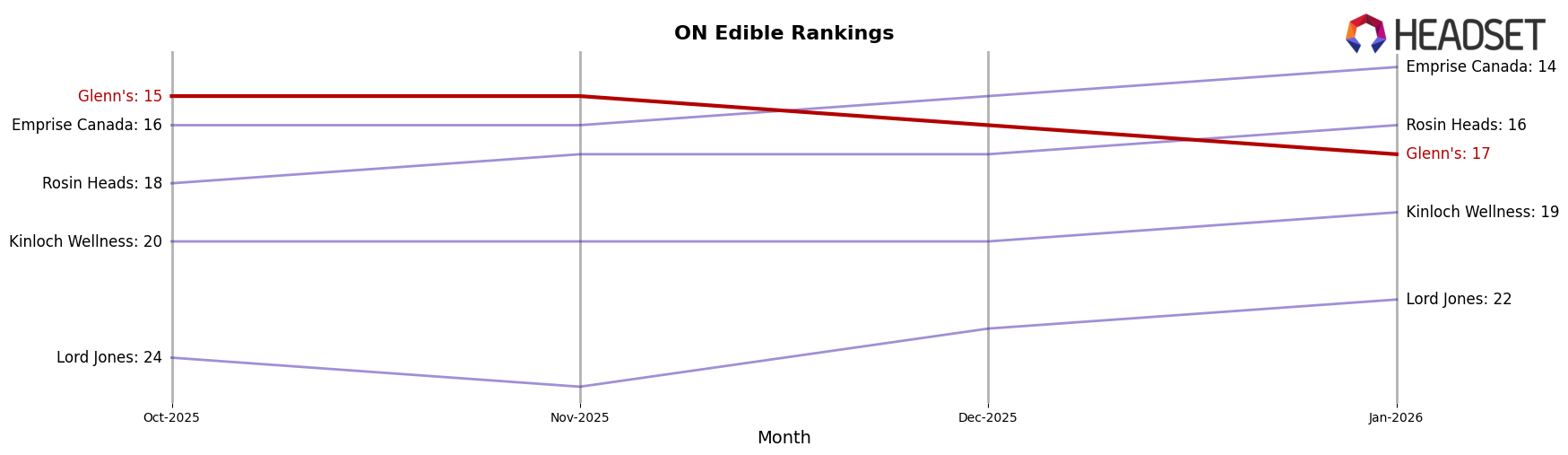

Glenn's has displayed a consistent presence in the Edible category within Ontario, maintaining a rank within the top 20 brands over the observed months. Starting at the 15th position in October 2025, the brand slightly dropped to 16th in December and further to 17th by January 2026. Despite the decline in ranking, Glenn's experienced a notable increase in sales in December, suggesting a temporary boost in consumer interest, potentially due to seasonal factors. The subsequent drop in both sales and rank in January might indicate increased competition or changing consumer preferences, a trend worth monitoring for future implications.

Interestingly, Glenn's absence from the top 30 brands in other states or provinces during this period highlights potential areas for expansion or improvement. The brand's performance in Ontario suggests a strong foothold in the Edible category, but the lack of presence elsewhere could be seen as a missed opportunity or a strategic focus on a specific market. Understanding the factors contributing to their success in Ontario, such as consumer demographics, marketing strategies, or product offerings, could provide insights into how Glenn's might replicate this success in other regions or categories. Further analysis could reveal whether this regional focus is part of a broader strategy or if there are barriers preventing broader market penetration.

Competitive Landscape

In the competitive landscape of the Edible category in Ontario, Glenn's experienced a notable decline in rank from October 2025 to January 2026, slipping from 15th to 17th place. This downward trend in rank is accompanied by a decrease in sales, which could be attributed to the rising performance of competitors such as Emprise Canada and Rosin Heads. Emprise Canada maintained a strong upward trajectory, improving its rank from 16th to 14th, while Rosin Heads also climbed from 18th to 16th during the same period. Meanwhile, Lord Jones and Kinloch Wellness showed more modest improvements, yet still managed to close the gap with Glenn's. These shifts indicate a highly competitive environment in which Glenn's must strategize to regain its footing and counter the advances of its rivals.

Notable Products

In January 2026, Glenn's top-performing product was the Watermelon No 15 Delta 9 Distillate Soft Chew (100mg), maintaining its position as the leading product since October 2025, with sales reaching 7410. The Tropical Smoothie Gummy (10mg) ranked second, showing a slight improvement from its third position in December 2025. Cotton Candy Gummies (10mg) climbed to the third spot, up from fourth, indicating a steady increase in popularity. The Watermelon Delta 9 Distillate Gummy (100mg) dropped to fourth place, marking a significant decline in sales compared to previous months. New to the rankings, the Multi-Flavours Gummies 4-Pack (10mg) debuted in fifth place, suggesting a growing interest in diverse edible options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.