Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

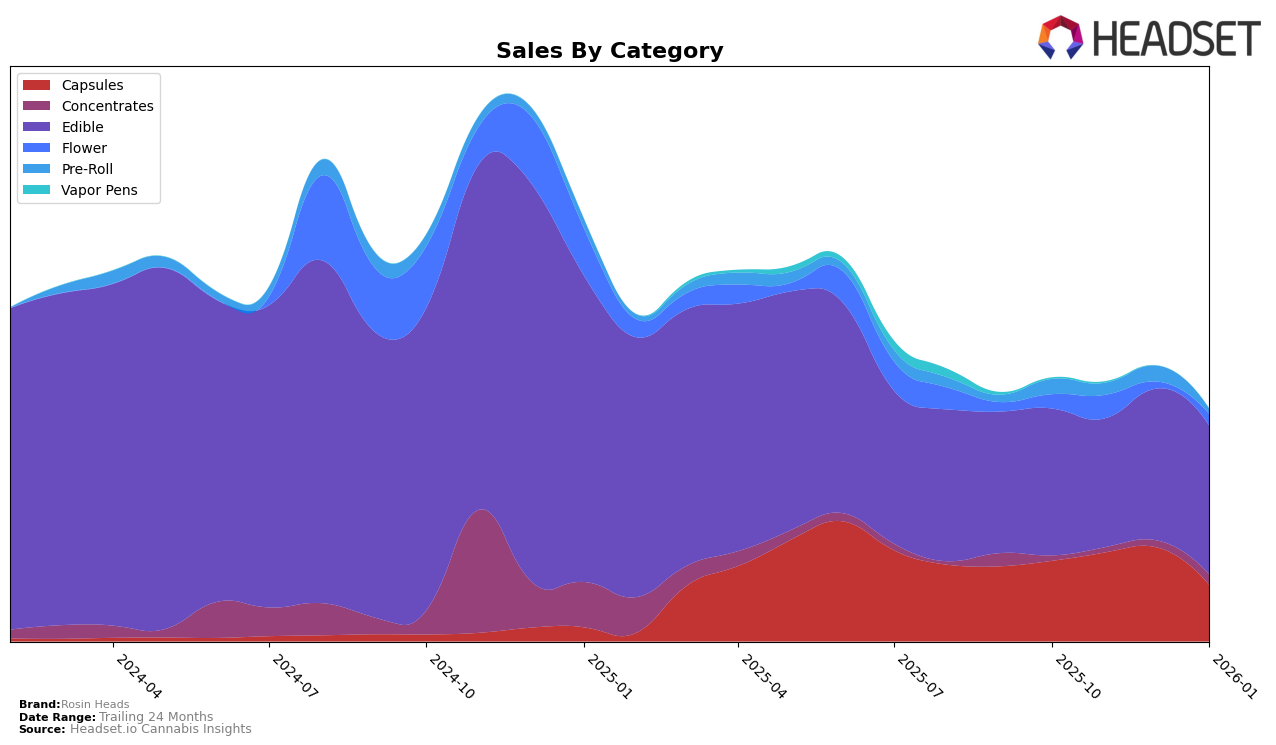

Rosin Heads has shown fluctuating performance across different states and categories over recent months. In British Columbia, the brand maintained a strong presence in the Capsules category, although it experienced a gradual decline in rankings from October 2025 to January 2026, moving from 5th to 9th place. Despite this downward trend, their sales in November 2025 peaked, indicating a strong market presence even as their ranking slipped. In contrast, Ontario saw Rosin Heads consistently holding the 10th position in the Capsules category until January 2026, when they dropped to 14th. This decline in ranking could indicate increased competition or a shift in consumer preferences within the region.

In the Edibles category within Ontario, Rosin Heads showed a positive trajectory, moving up from 18th place in October 2025 to 16th by January 2026. This upward movement suggests a growing interest or improved market strategies in this category, despite the brand not breaking into the top 15. Notably, the sales figures for Edibles remained relatively stable compared to other categories, hinting at consistent consumer demand. The absence of Rosin Heads from the top 30 brands in certain states or categories could signal missed opportunities or areas needing strategic focus, but it also highlights regions where the brand could potentially expand its market presence.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ontario, Rosin Heads has shown a steady improvement in its rankings from October 2025 to January 2026. Starting at 18th place in October, Rosin Heads climbed to 16th by January, indicating a positive trajectory despite the competitive pressures. Notably, Chowie Wowie maintained a strong position, consistently ranking within the top 13, although it experienced a slight decline from 9th to 13th place over the same period. Meanwhile, Emprise Canada showed a gradual rise, moving from 16th to 14th, suggesting an increase in consumer preference or market penetration. Glenn's experienced fluctuations, dropping from 15th to 17th, which might indicate challenges in maintaining its market share. Kinloch Wellness remained at the lower end of the rankings, moving slightly from 20th to 19th. These dynamics highlight Rosin Heads' ability to improve its market position amidst a competitive field, potentially signaling effective marketing strategies or product offerings that resonate with consumers.

Notable Products

In January 2026, the top-performing product from Rosin Heads was the Hash Rosin Drops Mints 50-Pack, maintaining its first-place ranking for four consecutive months with sales of 2162 units. The Hash Rosin Wafer Stix Milk Chocolate held steady in the second position, though its sales saw a decline from December. The Hash Rosin Caramel Stix Milk Chocolate rose to third place, marking an improvement from its previous fifth-place rankings in November and December. The Hybrid Hash Rosin Drops Capsules dropped to fourth place, experiencing a significant decrease in sales. Lastly, the Sativa Hash Rosin Drops Tablets entered the rankings in fifth place, having not been ranked in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.