Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

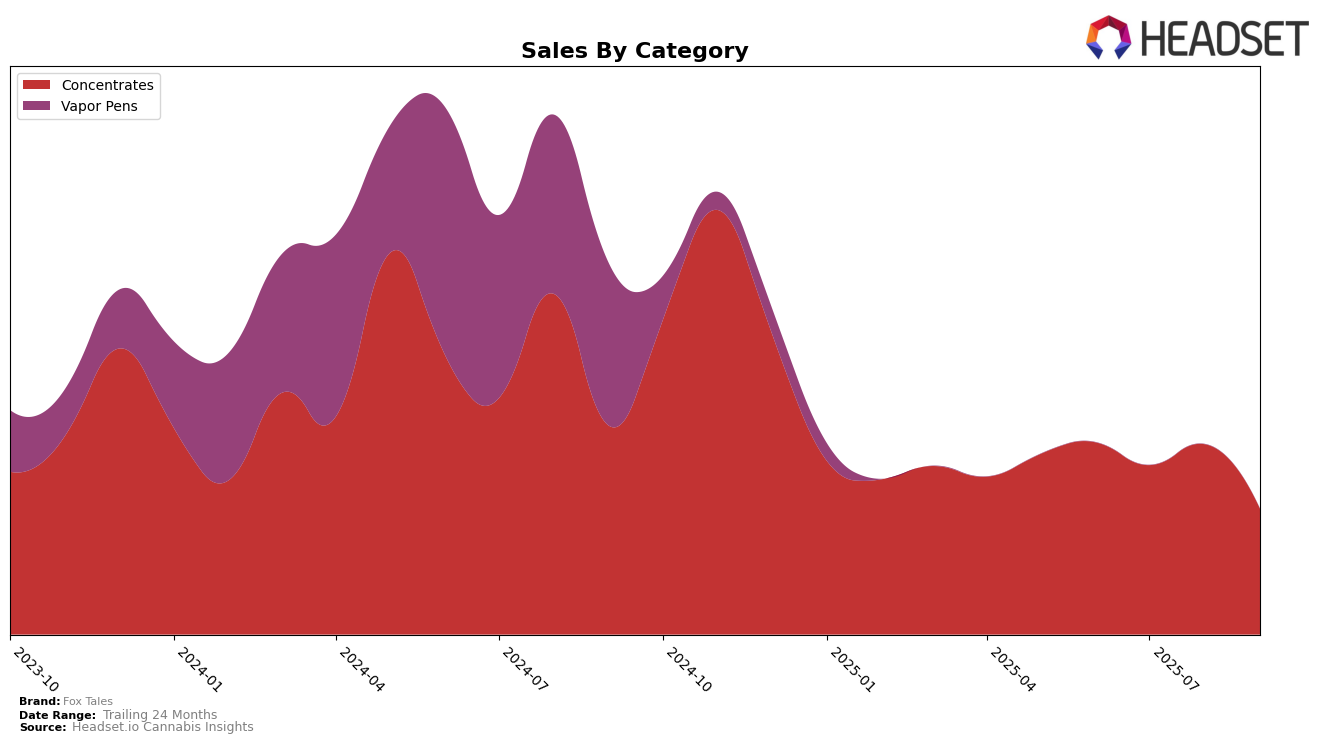

Fox Tales has shown a dynamic performance across various states and categories, with notable fluctuations in its ranking within the Concentrates category in Massachusetts. Over the past few months, the brand has experienced some shifts in its positioning, starting at the 16th rank in June 2025 and moving to 18th in July, climbing back to 14th in August, and then slightly dropping to 17th in September. This movement suggests a competitive landscape where Fox Tales is managing to maintain a presence within the top 20 but has yet to solidify a more stable upward trajectory.

While Fox Tales has managed to stay within the top 30 in Massachusetts, its sales figures reflect a downward trend from June to September, with a notable dip in September. This could indicate either a seasonal fluctuation or increased competition in the Concentrates category. The absence of Fox Tales in the top 30 rankings in other states might suggest either a lack of market penetration or a focus on specific regional strategies. Understanding these dynamics could be crucial for stakeholders looking to evaluate the brand's potential for growth and expansion in other markets.

Competitive Landscape

In the Massachusetts concentrates market, Fox Tales experienced notable fluctuations in its ranking and sales performance from June to September 2025. Starting at rank 16 in June, Fox Tales saw a slight dip to rank 18 in July, followed by an improvement to rank 14 in August, before dropping again to rank 17 in September. This volatility in rank coincided with a decline in sales from June's peak, with a significant drop in September. In contrast, Treeworks showed a consistent upward trend, climbing from rank 21 in June to 15 in September, indicating a strong competitive position with rising sales. Similarly, Dabl demonstrated impressive growth, moving from rank 30 in June to 16 in September, reflecting a strategic gain in market share. Meanwhile, Dab Fx experienced a decline, dropping from rank 14 in June to 21 in September, suggesting a loss in competitive edge. These shifts highlight the dynamic nature of the Massachusetts concentrates market, where Fox Tales faces both challenges and opportunities amidst changing consumer preferences and competitive strategies.

Notable Products

In September 2025, Cartoons and Cereal Sugar (3.5g) emerged as the top-performing product for Fox Tales, climbing from third place in August to first place with sales of 136 units. Coughy Cake Sugar Wax (3.5g) followed closely, rising from an unranked position in August to secure the second spot. Grape Zorilla Sugar (3.5g) dropped from second to third place despite maintaining a strong sales performance. Forbidden Spice Cured Wax (3.5g) re-entered the rankings in fourth place after being unranked in August. Zombie Cured Sugar (3.5g) saw a significant decline, falling from first place in August to fifth place in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.