Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

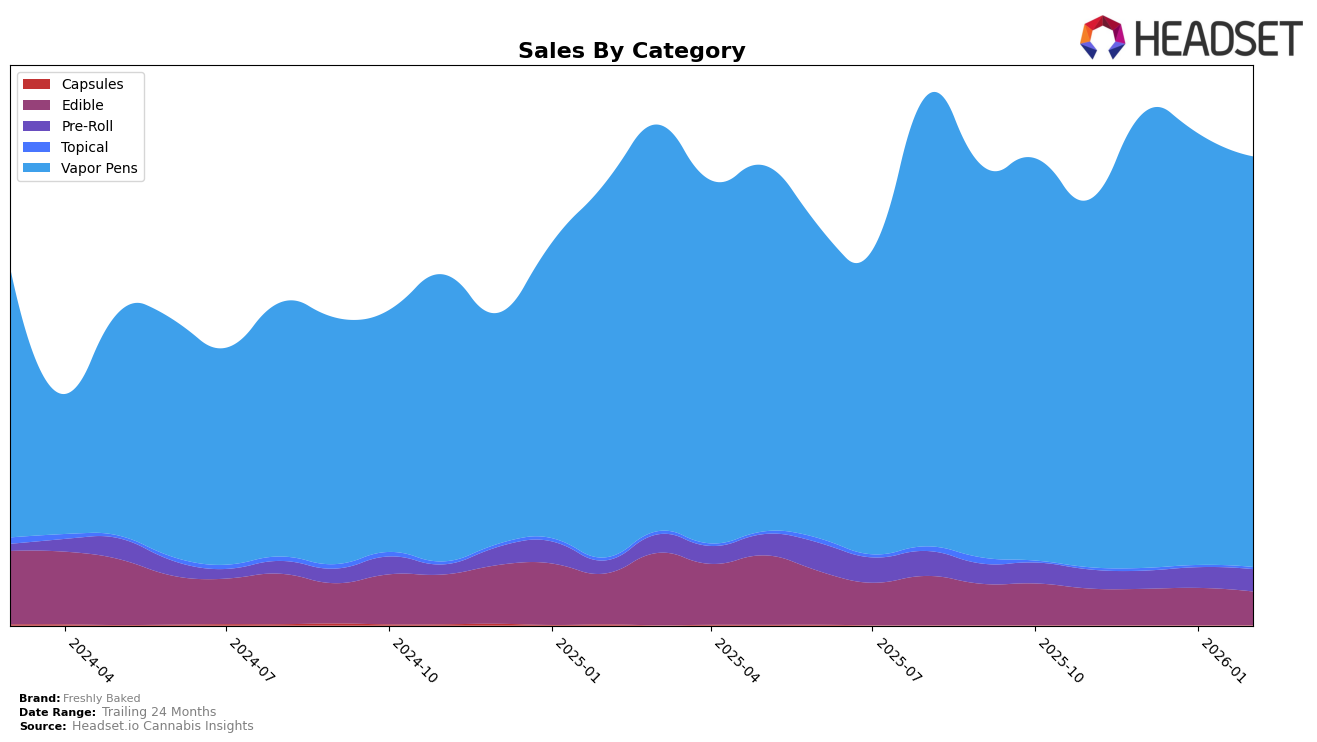

Freshly Baked has shown a consistent presence in the Massachusetts market, particularly in the Vapor Pens category. Over the four-month period from November 2025 to February 2026, the brand maintained a strong position, ranking consistently at 9th place from December onwards, after climbing from 12th in November. This indicates a solid foothold in the Vapor Pens category, with sales peaking in December 2025. In contrast, the Edible category tells a different story. Freshly Baked did not make it into the top 30 rankings throughout this period, indicating a potential area for growth or strategic reevaluation.

While the Vapor Pens category showcases Freshly Baked's strength, the brand's performance in the Edible category in Massachusetts suggests room for improvement. Despite not breaking into the top 30 rankings, there was a slight increase in sales from November to January, before a decline in February. This fluctuating trend might point to seasonal variations or shifts in consumer preferences, but without a top 30 ranking, the brand may need to reassess its strategy or product offerings in this category. The contrasting performance across categories highlights the importance of targeted marketing and product development strategies to capitalize on existing strengths and address areas of weakness.

Competitive Landscape

In the Massachusetts Vapor Pens category, Freshly Baked has demonstrated a notable upward trajectory in brand ranking, moving from 12th place in November 2025 to consistently holding the 9th position from December 2025 through February 2026. This improvement in rank is indicative of a positive trend in sales performance, as Freshly Baked's sales figures have shown a steady increase, peaking in December 2025. In contrast, Jeeter and Simply Herb have maintained higher ranks, with Jeeter slightly declining in sales over the months, while Simply Herb has shown more stability. Strane and Cultivators Classic have experienced more fluctuation in their rankings, with Cultivators Classic making a significant leap from 16th to 10th place, potentially posing a competitive threat to Freshly Baked if their upward trend continues. Freshly Baked's consistent rank improvement suggests a strengthening market presence, yet the brand must remain vigilant of competitors like Cultivators Classic, which are rapidly climbing the ranks.

Notable Products

In February 2026, the Blue Dream Distillate Cartridge (1g) maintained its position as the top-selling product for Freshly Baked, with impressive sales of 2950 units. The Northern Lights Distillate Cartridge (1g) followed closely, holding the second rank consistently from the previous month with 2508 units sold. The Ghost Train Haze Distillate Cartridge (1g) re-entered the rankings at third place, showing a strong comeback after a brief absence. The Grand Daddy Purple Distillate Cartridge (1g) slipped to fourth place, continuing its decline from the first position it held in November 2025. Meanwhile, the Jack Herer Distillate Cartridge (1g) rounded out the top five, showing a gradual decline in rank over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.