Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

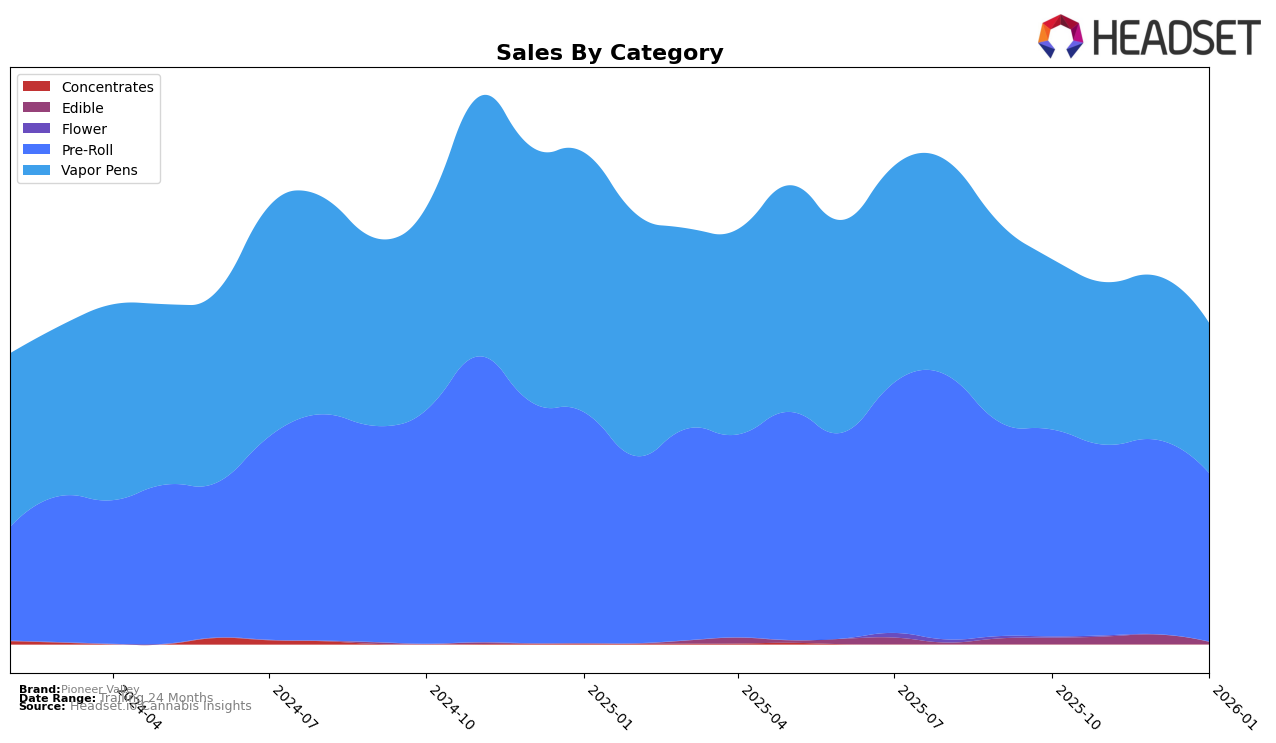

In the state of Massachusetts, Pioneer Valley has demonstrated varied performance across different product categories. In the Edible category, the brand did not make it into the top 30 rankings from October 2025 through January 2026, which suggests a potential area for improvement or lack of market penetration in this segment. On the other hand, Pioneer Valley's Pre-Roll products have maintained a relatively stable presence, with rankings fluctuating slightly from 17th in October 2025 to 18th in January 2026, indicating consistent consumer demand and competitive positioning in this category.

For Vapor Pens, Pioneer Valley experienced a gradual decline in rankings over the same period, starting at 21st in October 2025 and moving to 25th by January 2026. This downward trend might suggest increasing competition or shifting consumer preferences in the Vapor Pens market segment. Despite the decline, the brand's presence within the top 30 indicates a solid foothold. The sales figures for Pre-Rolls, while not specified here, show a notable volume, suggesting that this category might be a key revenue driver for Pioneer Valley in Massachusetts.

Competitive Landscape

In the competitive landscape of the Massachusetts pre-roll category, Pioneer Valley has shown resilience despite fluctuating ranks over the past few months. From October 2025 to January 2026, Pioneer Valley's rank shifted from 17th to 18th, with a dip to 20th in December. This indicates a slight decline in market position, yet it remains within the top 20. In comparison, Native Sun has demonstrated a significant upward trajectory, climbing from 23rd in October to 16th by January, suggesting a robust increase in sales performance. Meanwhile, Fathom Cannabis and Root & Bloom have shown more modest improvements, with Fathom Cannabis reaching the 20th position in January and Root & Bloom improving to 19th. Headliners has maintained a relatively stable rank, moving from 21st to 17th, closely aligning with Pioneer Valley's performance. These dynamics highlight the competitive pressures Pioneer Valley faces, emphasizing the need for strategic initiatives to bolster its market position amidst rising competitors.

Notable Products

In January 2026, the top-performing product from Pioneer Valley remains the Firecrackers - Grapeness Infused Pre-Roll, maintaining its consistent number one rank from previous months despite a dip in sales to 3113. The Firecracker - Raspberry Skywalker OG Terp Oil Infused Pre-Roll climbed to second place, improving its rank from third in the preceding months. A notable new entry, the M80 - Tropical Trainwreck Infused Pre-Roll, debuted strongly at the third spot. Meanwhile, the M80 - Mango Super Silver Haze kief Infused Pre-Roll slipped to fourth position, continuing its descent from second place in October 2025. Lastly, the Firecrackers - Mango Super Silver Haze Terps oil Infused Pre-Roll held steady at fifth place, showcasing resilience despite fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.