Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

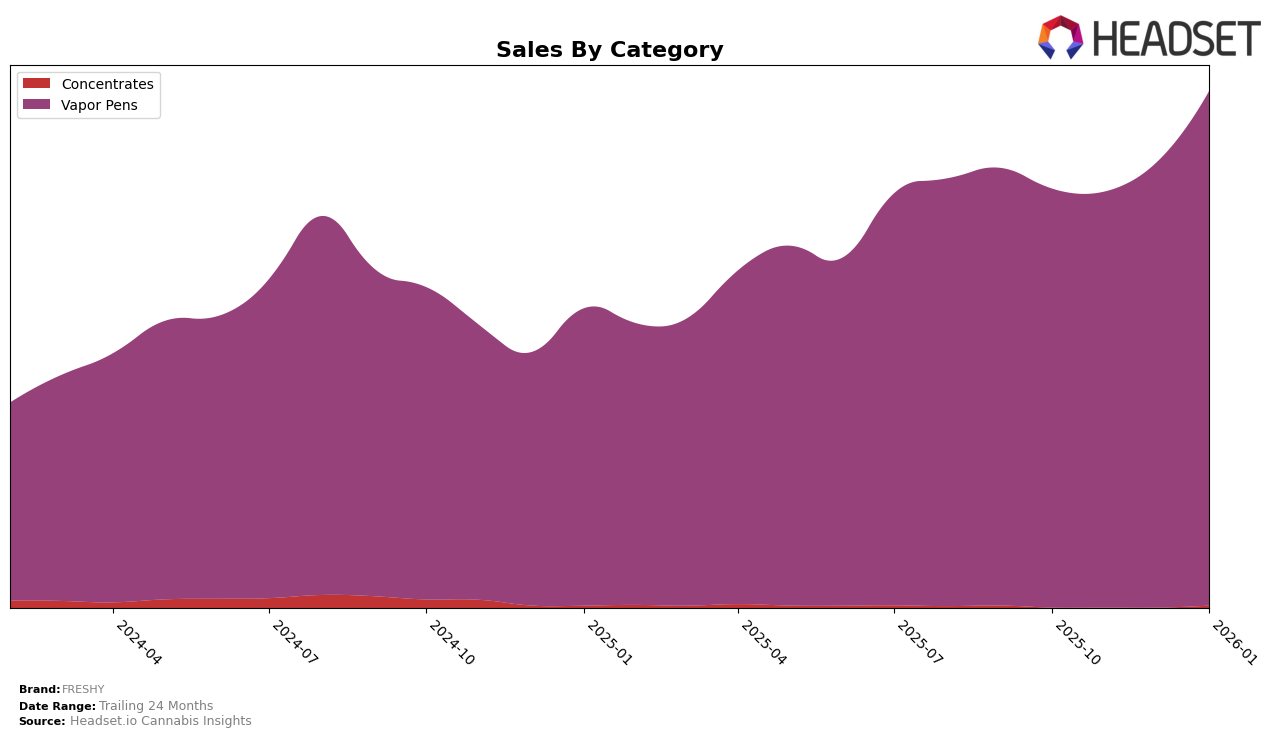

FRESHY has demonstrated notable performance in the Vapor Pens category within the state of Oregon. Over the four-month period from October 2025 to January 2026, FRESHY improved its ranking from fifth to third place. This upward trajectory is indicative of a strong market presence and growing consumer preference. The brand's sales figures also reflect this positive trend, with a significant increase from October to January, culminating in over 1.38 million in sales in January 2026. This growth suggests that FRESHY is successfully capturing a larger share of the Vapor Pens market in Oregon, positioning itself as a rising competitor against other top brands.

However, FRESHY's performance across other states and categories remains undisclosed, which could imply varying success levels in different regions or product lines. Not being ranked in the top 30 in certain states or categories might indicate challenges in market penetration or competition intensity. This absence from the top rankings could be a point of concern or an opportunity for strategic adjustments to expand their footprint. Understanding these dynamics could provide valuable insights into FRESHY's overall market strategy and potential areas for growth or improvement.

Competitive Landscape

In the competitive landscape of Vapor Pens in Oregon, FRESHY has shown a notable upward trajectory in rankings, moving from 5th place in October 2025 to 3rd place by January 2026. This improvement in rank is indicative of a significant increase in sales, particularly evident in January 2026, where FRESHY surpassed its previous months' sales figures. Despite this positive trend, FRESHY still faces stiff competition from brands like Entourage Cannabis / CBDiscovery, which maintained the top rank until January 2026, and Buddies, which claimed the number one spot in January 2026. Additionally, Oregrown has shown a strong performance, jumping from 10th to 5th place in the same period, indicating a dynamic and competitive market environment. FRESHY's strategic positioning and sales growth suggest a promising potential to further climb the ranks, but continuous innovation and marketing efforts will be essential to outpace these leading competitors.

```

Notable Products

In January 2026, FRESHY's top-performing product was the Maui Wowie x Fruit Punch Flavored Live Resin Cartridge (1g) in the Vapor Pens category, which rose to the first rank with impressive sales of 3,584 units. Following closely was the Tiger's Blood Live Resin Cartridge (1g), which held the second position, showing a slight decline from its top spot in November 2025. The Watermelon Splash Flavored Live Resin Cartridge (1g) secured the third rank, maintaining consistent performance since October 2025. New entrants to the top five include the Strainz- Mango Strawberry Smoothie Flavored Live Resin Cartridge (1g) and Blueberry Burst Live Resin Cartridge (1g), which ranked fourth and fifth, respectively. These changes indicate a dynamic shift in consumer preferences within the Vapor Pens category for FRESHY.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.