Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

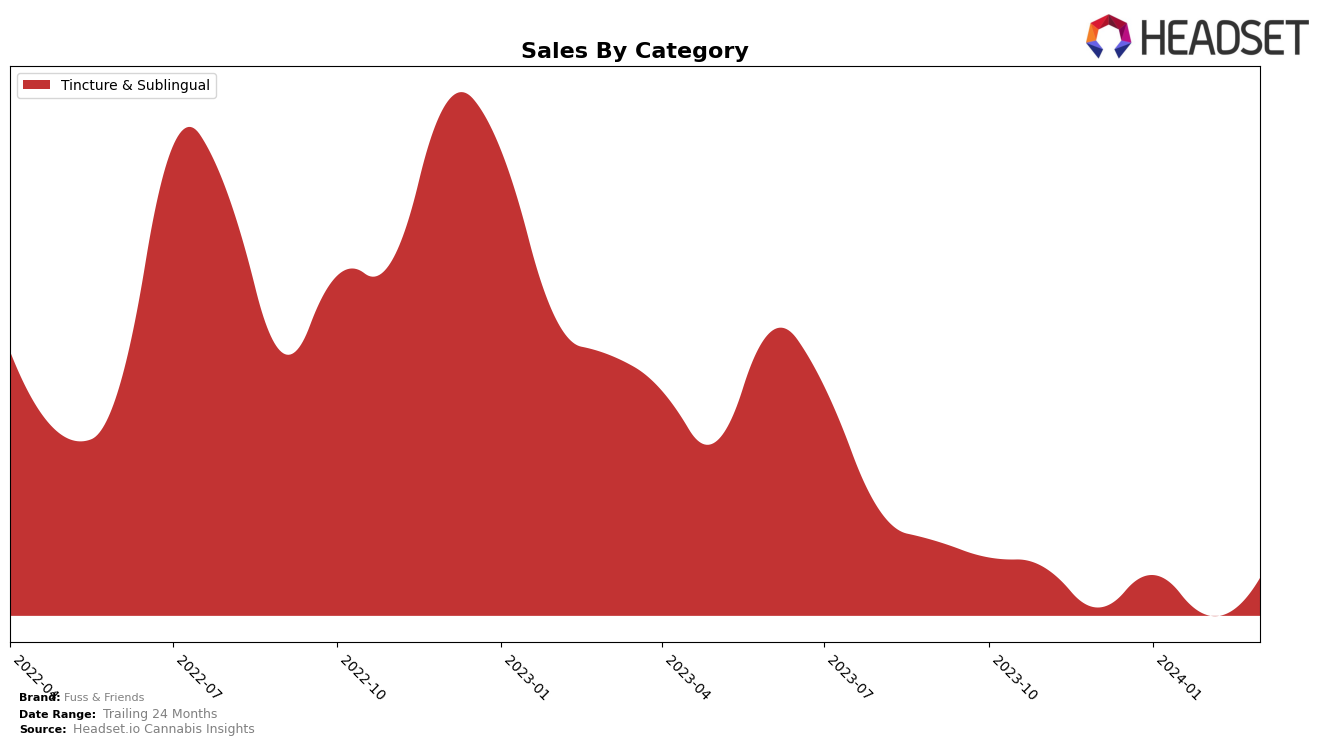

In the tincture and sublingual category within California, Fuss & Friends has shown a notable fluctuation in its rankings over the recent months. Starting from a position outside the top 30 in December 2023, with a rank of 35, the brand made a significant leap into the 28th spot by January 2024. This movement indicates a strong start to the year, possibly driven by strategic marketing or product launches. However, the brand experienced a slight dip in February, falling to the 33rd position, before rebounding to the 27th spot in March 2024. This roller-coaster performance suggests that Fuss & Friends is on a path of growth, but faces challenges in maintaining a steady upward trajectory in the competitive California market. The sales figures, peaking at 6709 in January 2024, reflect this volatility but also highlight the brand's potential to capture consumer interest when positioned effectively.

Despite the absence of detailed rankings across other states or provinces, the provided data from California offers valuable insights into the performance dynamics of Fuss & Friends. The brand's ability to re-enter the top 30 and even improve its standing after a fall indicates resilience and a potentially responsive market strategy. However, the fluctuation in rankings also underscores the competitive nature of the cannabis market in California, where brand visibility can significantly impact consumer preference and sales. While specific sales numbers for months other than January 2024 are withheld, the general trend suggests that Fuss & Friends is navigating the complexities of the market with a degree of success. Observers and potential investors should keep an eye on this brand as it continues to adjust and refine its approach in the evolving cannabis landscape.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Fuss & Friends has shown a notable trajectory in terms of rank and sales over the recent months. Starting from December 2023, Fuss & Friends was not within the top 20 brands, indicating a lower market presence. However, by March 2024, it improved its position significantly, moving up to the 27th rank. This progress is especially noteworthy when compared to its competitors. For instance, Kind Medicine experienced a decline, moving from the 19th rank in December 2023 to the 25th in March 2024. Similarly, Luchador and High Power also saw fluctuations but remained relatively stable in their rankings. Lime, on the other hand, maintained a position outside the top 20 throughout the same period. This analysis suggests that Fuss & Friends is on an upward trajectory in a competitive market, indicating potential for further growth and market capture if current trends continue.

Notable Products

In March 2024, Fuss & Friends saw the CBD/THC 20:1 Small Friends Daily Wellness Tincture (240mg CBD, 12mg THC, 30ml) lead their sales, maintaining its position from February with 146 units sold. Following closely was the CBD/THC 20:1 Medium Friends Daily Wellness Tincture (480mg CBD, 24mg THC, 60ml, 2oz), which also held its previous month's rank at second place. The CBD/THC 20:1 Large Friends Daily Wellness Tincture (960mg CBD, 48mg THC, 120ml, 4oz) made a comeback in the rankings, securing the fourth position after not being ranked in the previous months. This rebound highlights a notable shift in consumer preferences within the Tincture & Sublingual category. The consistent top rankings of these products underscore their popularity and the brand's strong presence in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.