Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

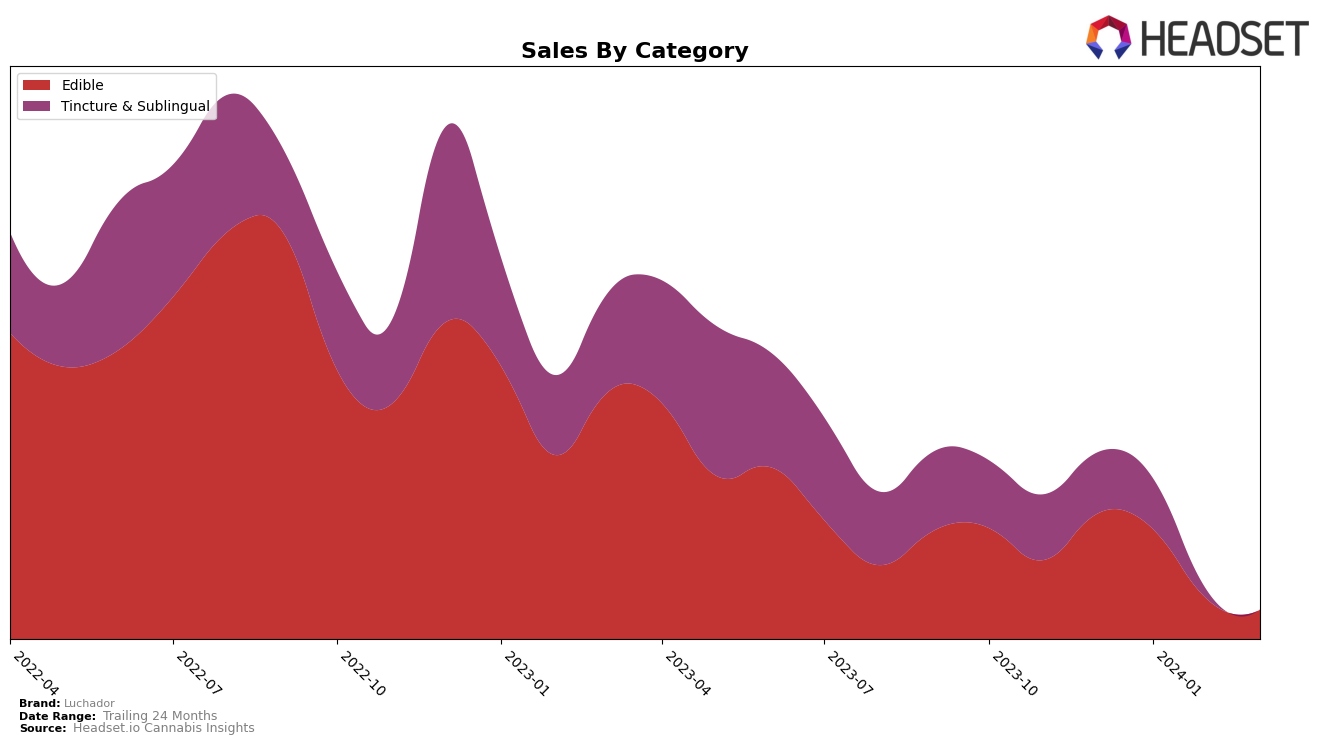

In the competitive cannabis market of California, Luchador has shown a consistent presence across different product categories, albeit with varying degrees of success. Within the Edible category, Luchador maintained its rank in the early months, holding the 63rd position in December 2023 and January 2024, before experiencing a slight drop to the 73rd and 74th positions in February and March 2024, respectively. This decline in ranking suggests a need for strategic adjustments to regain its footing in the Edibles category. On the sales front, there was a noticeable decrease from $27,699 in December 2023 to $10,966 in March 2024, indicating a significant downturn in market performance that could impact the brand's overall standing.

Conversely, in the Tincture & Sublingual category, Luchador's performance tells a different story. Starting at the 25th rank in December 2023, the brand saw a slight improvement moving up to the 24th position in January 2024. However, the subsequent months saw a minor slip in rankings to 27th and 29th in February and March 2024, respectively. Despite the slight decline in rankings towards the end of the period, the fact that Luchador remained within the top 30 brands in this category speaks to its resilience and potential for growth. Sales in this category also followed a downward trend, but the consistent top 30 ranking could be seen as a positive aspect, highlighting the brand's ability to maintain a foothold amidst competitive market dynamics in California.

Competitive Landscape

In the competitive landscape of the edible cannabis market in California, Luchador has experienced fluctuating ranks over the recent months, indicating a dynamic position amidst its competitors. Starting at rank 63 in December 2023, Luchador maintained its position in January 2024 but saw a decline to rank 73 in February before slightly recovering to rank 74 in March 2024. This trajectory suggests challenges in maintaining or improving its market position, particularly when compared to competitors like Korova, which has shown a more stable rank with minor fluctuations, and Platinum Vape, which entered the top ranks in February and improved further by March. Meanwhile, Cam Premium Quality Cannabis and Honu have experienced significant rank changes, indicating volatility in consumer preferences or operational challenges. Luchador's sales trends, with a notable drop from January to February 2024 before a slight recovery in March, mirror its rank changes and highlight the competitive pressures it faces in maintaining its market share amidst these dynamic shifts.

Notable Products

In March 2024, Luchador's top-performing product was Cucumber Chili Lime Gummies 10-Pack (100mg) from the Edible category, with sales reaching 317 units. Following closely behind in second place was Strawberry Pitaya Vegan Gummies 10-Pack (100mg), also in the Edible category, maintaining its rank from the previous month. The third spot was held by Watermelon Chamoy Gummies 10-Pack (100mg), which dropped from the top position in February to third place in March. Pineapple Mango Gummies 10-Pack (100mg) experienced a significant rank change, moving from the top position in January to fourth place in March. Lastly, the Pineapple Habanero Super Strength Tincture (1000mg THC, 2oz) from the Tincture & Sublingual category made it to the fifth position, indicating a stable interest in high-potency options among Luchador's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.