Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

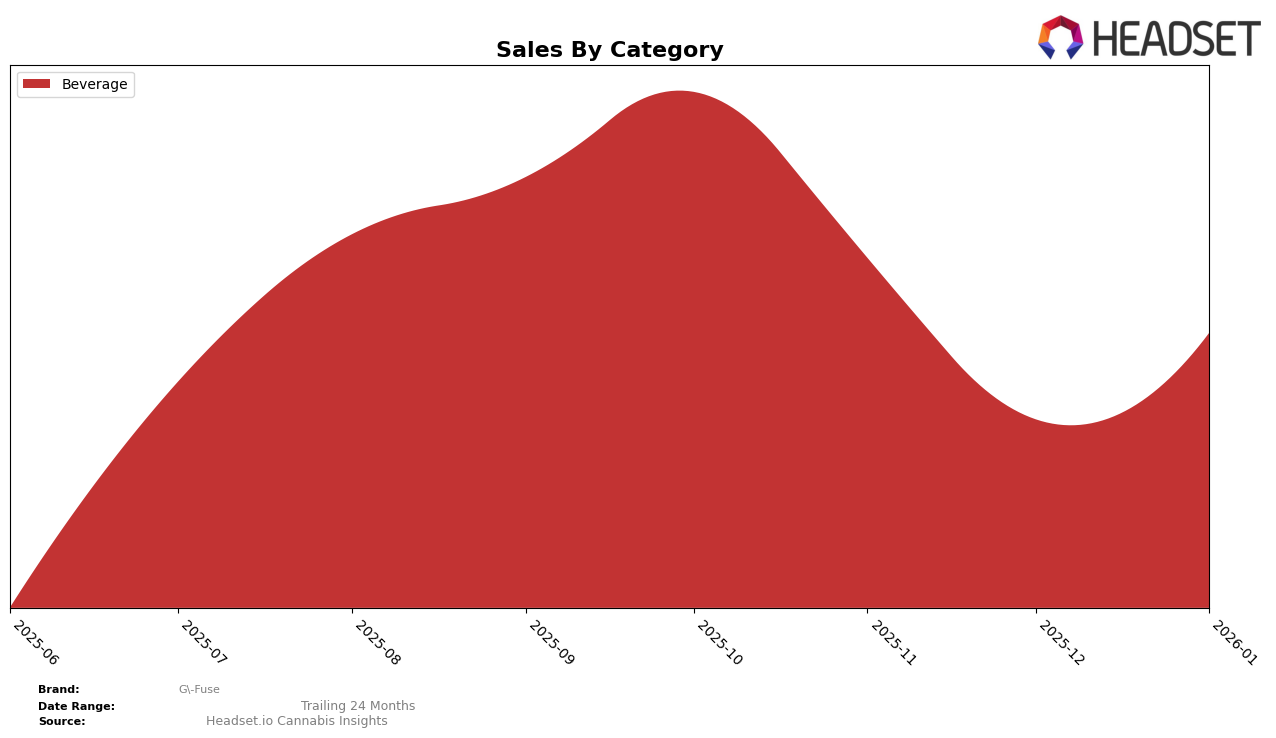

G-Fuse has shown notable performance in the beverage category in New Jersey. The brand climbed from the 4th position in October 2025 to 3rd in November 2025, demonstrating a positive trend in the state. However, by December 2025 and January 2026, G-Fuse was not listed in the top 30 brands, indicating a significant drop in its ranking, which could be a point of concern for stakeholders. Despite this, the sales figures from October to November suggest a dynamic shift in consumer preferences or competitive landscape, as sales decreased from 15,151 units to 10,397 units, possibly affecting their ranking.

While the available data for G-Fuse is limited to New Jersey, the brand's performance across other states and categories remains undisclosed, leaving room for speculation about its broader market strategy and adaptation. The absence of G-Fuse in the top 30 rankings for December 2025 and January 2026 in the beverage category might hint at increased competition or a strategic pivot by the brand. Observing how G-Fuse adapts or recovers in the upcoming months could provide insights into its resilience and market positioning.

Competitive Landscape

In the competitive landscape of the beverage category in New Jersey, G-Fuse has experienced notable fluctuations in its market position. Starting from October 2025, G-Fuse was ranked 4th, but by November, it climbed to 3rd, overtaking Zero Proof, which was absent from the rankings in November. This shift indicates a positive momentum for G-Fuse, as it capitalized on the absence of Zero Proof to improve its standing. However, by December and January, G-Fuse's rank was not recorded, suggesting it fell out of the top 20 brands during these months. Meanwhile, Major maintained a consistent 2nd place ranking throughout this period, despite a decline in sales from October to December, before a slight recovery in January. This competitive dynamic highlights the volatility and opportunity within the New Jersey beverage market, where G-Fuse's initial rise was promising but underscores the need for strategic adjustments to regain and sustain its competitive edge.

Notable Products

In January 2026, G-Fuse's top-performing product was Purple Reign Syrup (100mg THC, 2oz, 60ml), which ascended to the number one spot from a previous rank of fifth in December 2025, achieving sales of 175 units. Focus Berry Blast Syrup (100mg THC, 4oz, 120ml) maintained a strong presence, moving up to second place from fourth, indicating a significant resurgence in popularity. Extreme Citrus Bliss Syrup (100mg, 4oz, 120ml) experienced a slight drop, moving from second to third place, while Chill Tropical Splash Liquid Drink Mix (100mg THC, 120ml, 4oz) held steady in fourth place. Unflavored Culinary Syrup (100mg THC, 4oz, 120ml) saw a notable decline, dropping from first place in December to fifth in January, reflecting a shift in consumer preferences. Overall, the Beverage category showed dynamic changes in rankings, highlighting the competitive nature of G-Fuse's product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.