Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

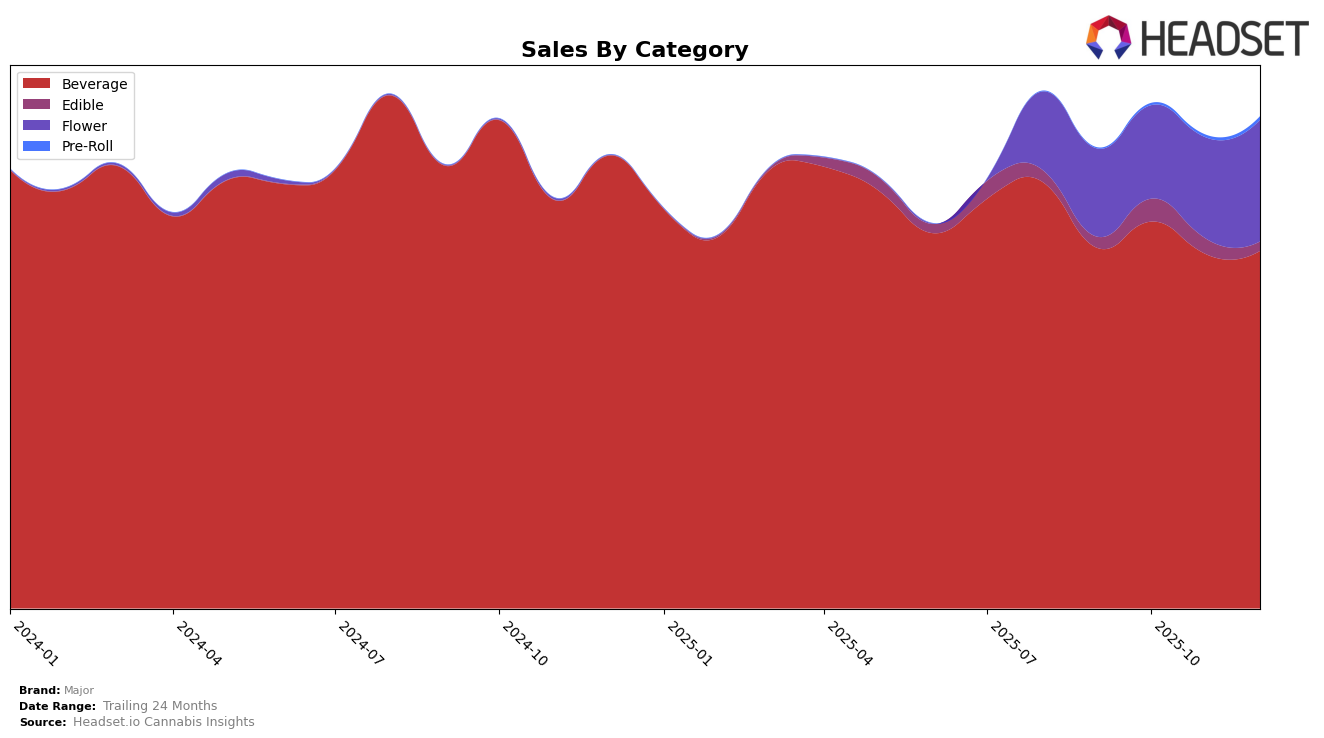

Major has demonstrated varied performance across different states and categories. In Colorado, the brand has consistently ranked in the top 10 for the Beverage category, though it slipped from 6th to 7th place by November 2025 and didn't make the top 30 in December, indicating potential challenges in maintaining market share. Meanwhile, in Missouri, Major showed resilience, fluctuating between the 3rd and 5th positions, with sales peaking in October before slightly declining towards December. This suggests a competitive but stable presence in the Missouri market.

In New Jersey, Major maintained a strong and steady 2nd position in the Beverage category throughout the last quarter of 2025, although sales saw a downward trend, which could indicate increased competition or market saturation. The brand's performance in Oregon was notable, as it entered the top 10 in the Beverage category by November and improved to 7th place by December. However, in the Edible category, it barely made the top 30 in November and slipped out of it by December, highlighting a potential area for growth. In Washington, Major maintained a consistent 3rd place in the Beverage category, showcasing a strong foothold in this market, with sales seeing a positive trend towards the end of the year.

Competitive Landscape

In the competitive landscape of the Washington beverage category, Major consistently holds the third rank from September to December 2025, indicating a stable position amidst strong competition. Notably, Ray's Lemonade maintains its lead at the top rank, while Journeyman secures the second spot throughout the same period. Despite the fierce competition, Major's sales show a positive trend, increasing from September to December, which suggests effective strategies in maintaining consumer interest and market share. Meanwhile, Green Revolution and Mary Jones remain in the fourth and fifth positions, respectively. This consistent ranking and sales growth for Major highlight its resilience and potential for further market penetration in the Washington beverage sector.

Notable Products

In December 2025, Major's top-performing product was the Blackberry Lemonade Blast Shot (100mg THC, 60ml, 2oz) in the Beverage category, maintaining its first-place ranking from previous months with sales reaching 15,399 units. The Original - Fruit Punch Blast Shot (100mg THC, 2oz) also held steady at the second position, showing consistent performance across the months. Blueberry Blast Shot (100mg THC, 2oz) remained in third place, although its sales dipped slightly compared to November. Apple Peach Blast Shot (100mg THC, 2oz) and Pacific Coast Blue Raspberry Fruit Drink (100mg THC, 6.7oz) also retained their fourth and fifth positions, respectively. Overall, the top five products demonstrated remarkable stability in their rankings from September to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.