Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

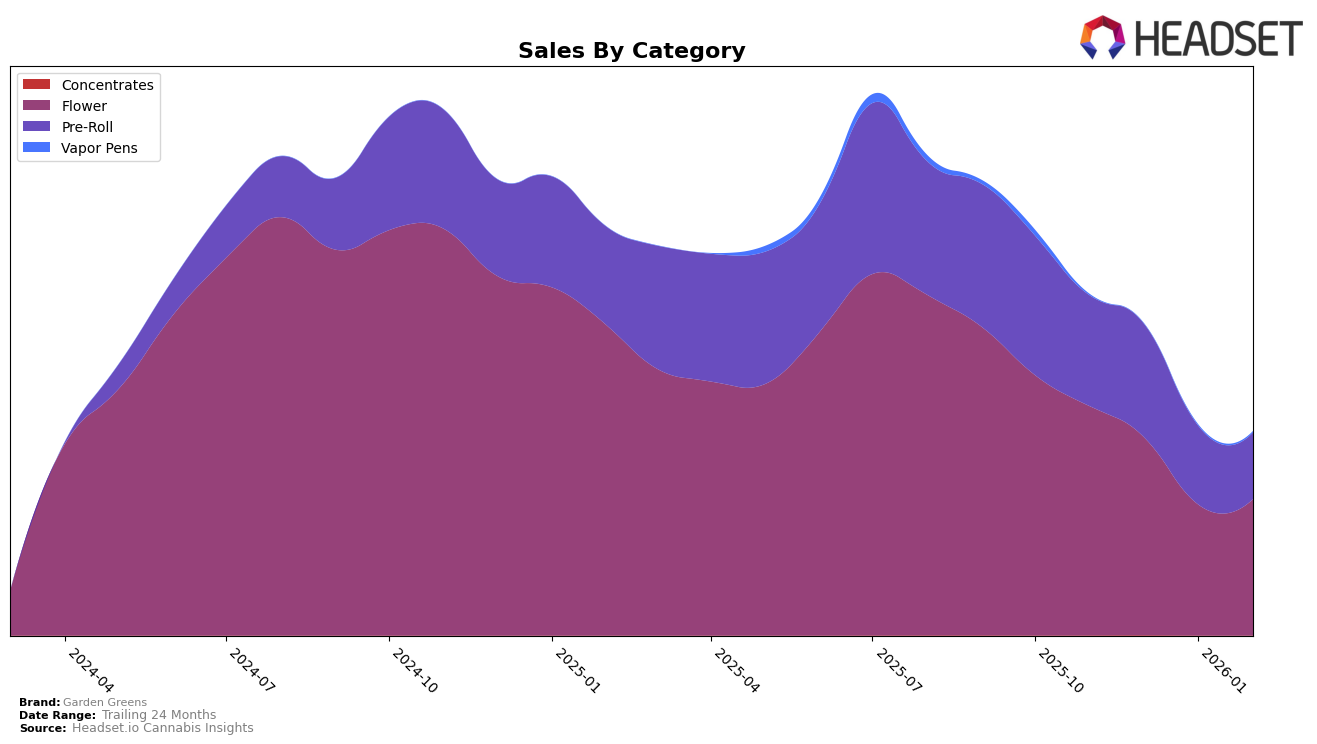

Garden Greens has demonstrated a notable performance in the New Jersey market, particularly in the Flower category. Despite facing a dip in rankings from November 2025 to January 2026, where it fell from 1st to 6th place, the brand managed to climb back to 3rd place by February 2026. This fluctuation indicates a resilient recovery and a strong market presence, even amidst competitive pressures. The sales figures reflect this trend, with a noticeable drop in December 2025 and January 2026, followed by a recovery in February 2026, hinting at strategic adjustments or market dynamics that favored Garden Greens' offerings.

In the Pre-Roll category, Garden Greens maintained a robust position in New Jersey, holding the top spot in November and December 2025. However, by February 2026, the brand experienced a slight decline, moving to 3rd place. This shift suggests increased competition or changes in consumer preferences, impacting their market share. Despite this, Garden Greens' consistent presence in the top rankings highlights its strong brand recognition and consumer loyalty within the state. The brand's ability to stay within the top three positions across both categories in New Jersey signifies a solid foothold in the market, although the absence of other states or categories suggests potential areas for growth and expansion.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Garden Greens has experienced notable fluctuations in its market position, impacting its sales trajectory. Initially ranked as the top brand in November 2025, Garden Greens saw a decline to fourth place by December 2025, further dropping to sixth in January 2026 before recovering to third in February 2026. This volatility contrasts with the consistent performance of Ozone, which climbed steadily to secure the top rank by January 2026, and Clade9, maintaining a strong second position in the first two months of 2026. Meanwhile, Find. experienced a decline from first place in December 2025 to fifth by February 2026. The ascent of Simply Herb from twelfth in November 2025 to fourth by February 2026 highlights the dynamic shifts within the market. These changes underscore the competitive pressures Garden Greens faces, as it navigates a challenging environment to regain its leading position amidst strong contenders.

Notable Products

In February 2026, Rainbow Guava Pre-Roll 2-Pack (1g) reclaimed its top spot as the leading product for Garden Greens, after briefly dropping to second place in January. This pre-roll pack achieved sales of 2,667 units, making it the standout performer. Rainbow Guava (3.5g) entered the rankings at second place, showcasing its growing popularity. Ice Wookie (3.5g) followed closely in third, maintaining its position from January. Notably, the Ice Wookie Pre-Roll 2-Pack (1g) slipped from first in January to fifth in February, indicating a shift in consumer preference within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.