Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

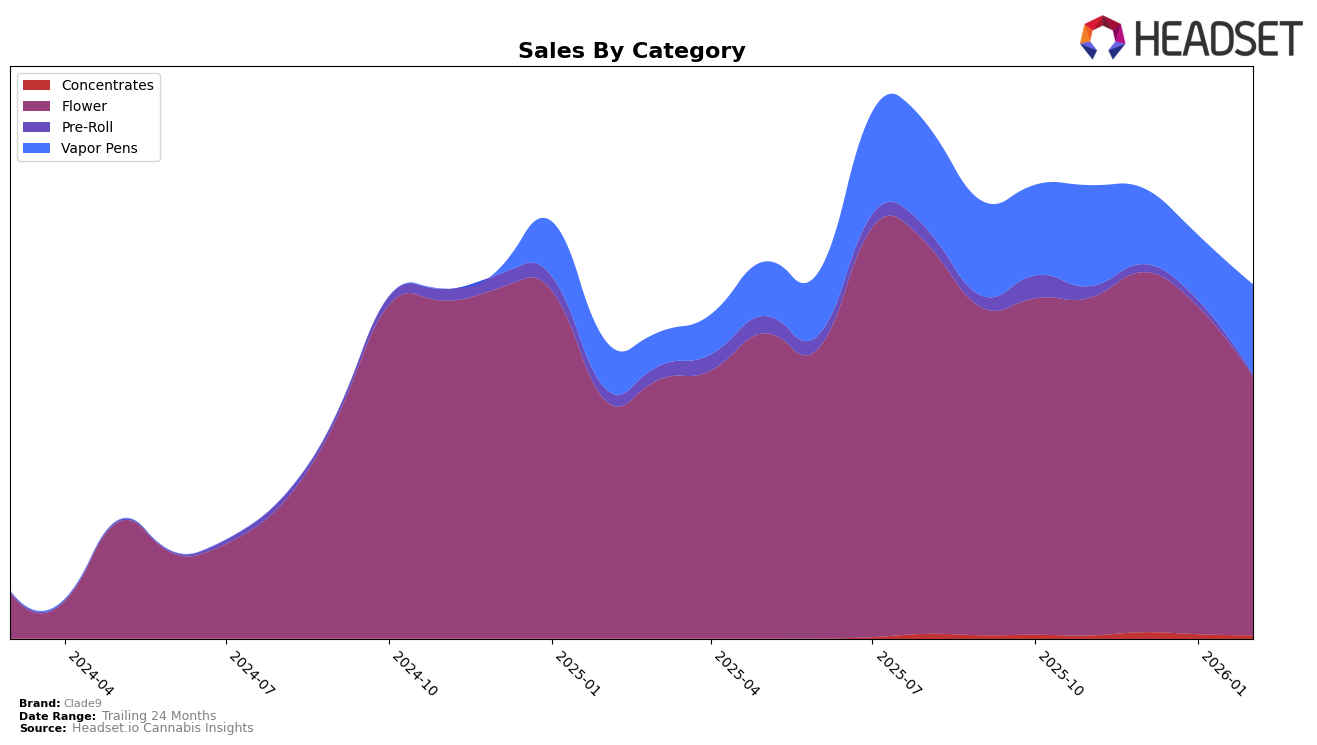

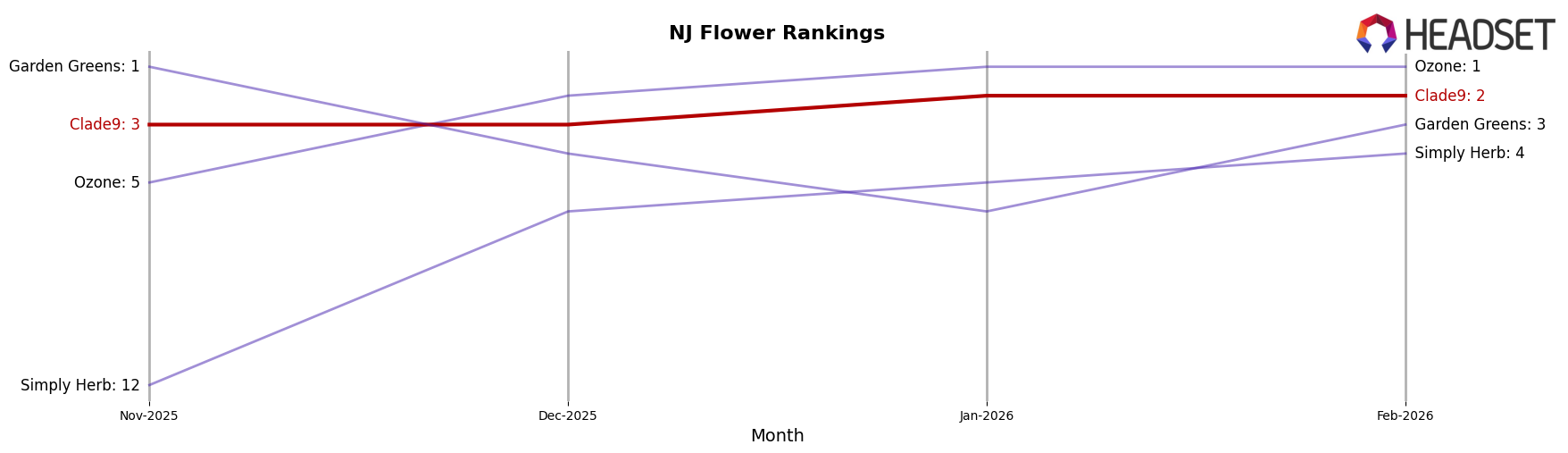

Clade9 has demonstrated a strong presence in the New Jersey market, particularly in the Flower category. The brand consistently maintained a high ranking, moving from third place in November and December 2025 to second place in January and February 2026. This upward trend indicates a solid consumer preference and possibly effective market strategies in this category. However, their performance in the Pre-Roll category did not make it into the top 30, suggesting that there might be room for growth or a need to reassess their approach in this segment. In the Vapor Pens category, Clade9's ranking fluctuated slightly, yet showed a notable improvement from 14th place in January 2026 to 7th place by February, reflecting a successful adjustment or increased demand for their products.

While Clade9 has made impressive strides in the Flower and Vapor Pens categories in New Jersey, the absence of a top 30 ranking in the Pre-Roll category might be a cause for concern or an opportunity for strategic development. The brand's ability to climb in rankings within the Vapor Pens category, despite a dip in sales in December 2025, indicates resilience and potential for further growth. This pattern of performance showcases Clade9's capacity to adapt and capitalize on market dynamics, although the exact strategies leading to these changes remain to be explored further.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Clade9 has maintained a strong position, consistently ranking 3rd in November and December 2025, before climbing to 2nd place in January and February 2026. This stable performance highlights Clade9's resilience and ability to capture market share despite the dynamic shifts among competitors. Notably, Ozone has shown impressive growth, moving from 5th to 1st place by January 2026, which may pose a significant challenge to Clade9's market position. Meanwhile, Simply Herb has also made strides, improving from 12th to 4th place over the same period, indicating a rising competitive pressure. Garden Greens, once the leader in November 2025, experienced fluctuations, dropping to 6th in January 2026 before recovering to 3rd in February. These shifts suggest that while Clade9 remains a strong contender, the brand must strategize effectively to maintain its position amidst the aggressive advancements of its competitors.

Notable Products

In February 2026, the top-performing product from Clade9 was J1 (3.5g) in the Flower category, which climbed to the number one spot despite a decrease in sales to $3,179. Orange Push Pop (3.5g) maintained strong performance, securing the second position after leading in previous months. Diamond Bar (3.5g) fell to third place, showing a decline from its peak in January. Lemon Cherry Gelato (3.5g) dropped to fourth place, continuing its downward trend since December. Notably, Orange Push Pop Distillate Disposable (1g) entered the rankings at fifth place, marking its debut in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.