Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

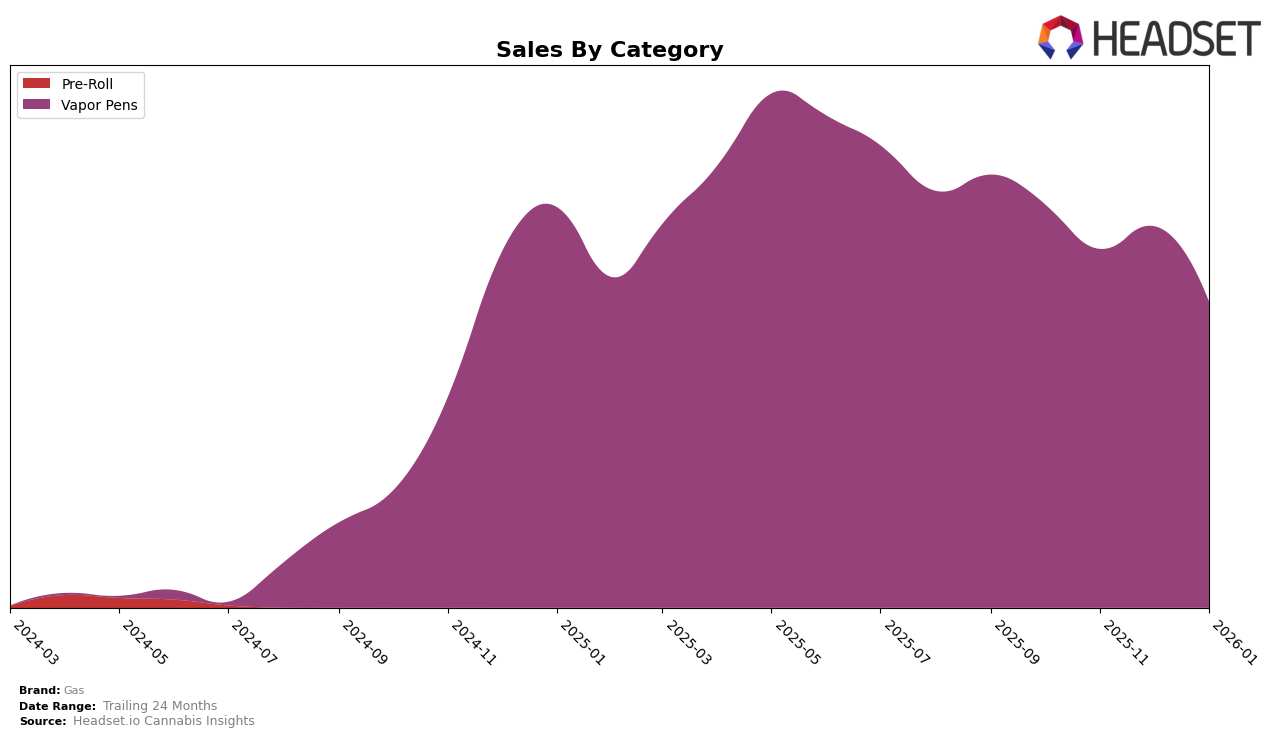

The performance of the cannabis brand Gas in the Vapor Pens category across different regions shows notable fluctuations. In Alberta, Gas maintained a steady presence within the top 30 rankings from October 2025 to January 2026, though it experienced a gradual decline, moving from 27th to 30th place. This downward trend is accompanied by a consistent decrease in sales, highlighting potential challenges in maintaining market share. In contrast, Gas did not feature in the top 30 rankings in Ontario during the same period, suggesting that the brand is facing more significant competition or market dynamics in this province.

While Gas's performance in Alberta indicates a struggle to retain its position, its absence from the top 30 in Ontario could be seen as a more pressing issue. The brand's sales in Alberta dropped from CAD 158,624 in October 2025 to CAD 120,427 by January 2026, reflecting a need for strategic adjustments to regain momentum. On the other hand, the fluctuations in Ontario's rankings, with Gas peaking at 36th in December 2025, suggest potential opportunities for growth if the brand can capitalize on favorable market conditions. Overall, Gas's performance highlights the importance of regional strategies to address varying competitive landscapes and consumer preferences.

Competitive Landscape

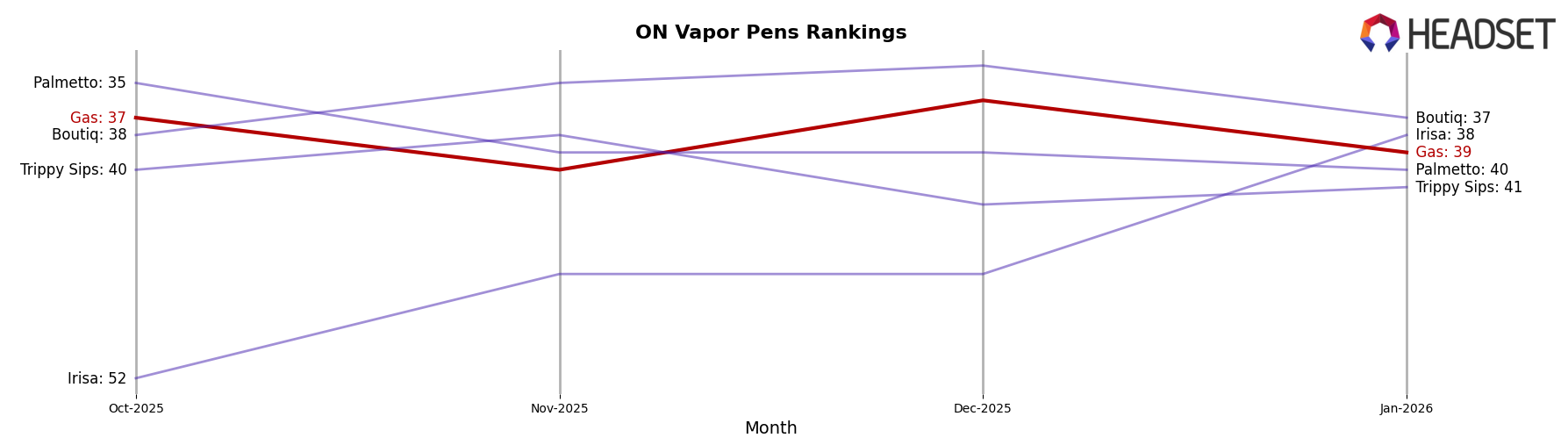

In the competitive landscape of Vapor Pens in Ontario, Gas has experienced fluctuating rankings from October 2025 to January 2026, reflecting a dynamic market environment. Gas started at rank 37 in October 2025, dipped slightly to 40 in November, improved to 36 in December, but fell again to 39 in January 2026. This volatility in rank is mirrored in its sales figures, which peaked in December before declining in January. Notably, Palmetto and Boutiq have been close competitors, with Palmetto consistently ranking slightly higher than Gas, except in January when it dropped to 40. Meanwhile, Boutiq has shown a steady improvement, surpassing Gas in December and maintaining a higher rank into January. Irisa and Trippy Sips have also been notable players, with Irisa improving its rank significantly by January, while Trippy Sips remained relatively stable. This competitive pressure highlights the need for Gas to strategize effectively to regain and sustain higher rankings and sales in the Ontario Vapor Pens market.

Notable Products

In January 2026, the top-performing product for Gas was the Strawberry Boba Live Resin & Liquid Diamonds Disposable (1g) in the Vapor Pens category, maintaining its first-place rank from December 2025 with a sales figure of 1617 units. The Peach Boba Live Resin & Liquid Diamond Disposable (1g) followed closely in second place, a slight improvement from its third-place position in December. The Golden Guava Live Resin & Liquid Diamond Disposable (1g) held steady in third place, consistent with its performance from the previous month. The Strawberry Boba Live Action Disposable (1g) rose to fourth place, re-entering the rankings after a period of absence. Lastly, the Blue Dream Live Resin Disposable (1g) maintained its fifth-place rank, having been introduced to the rankings in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.