Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

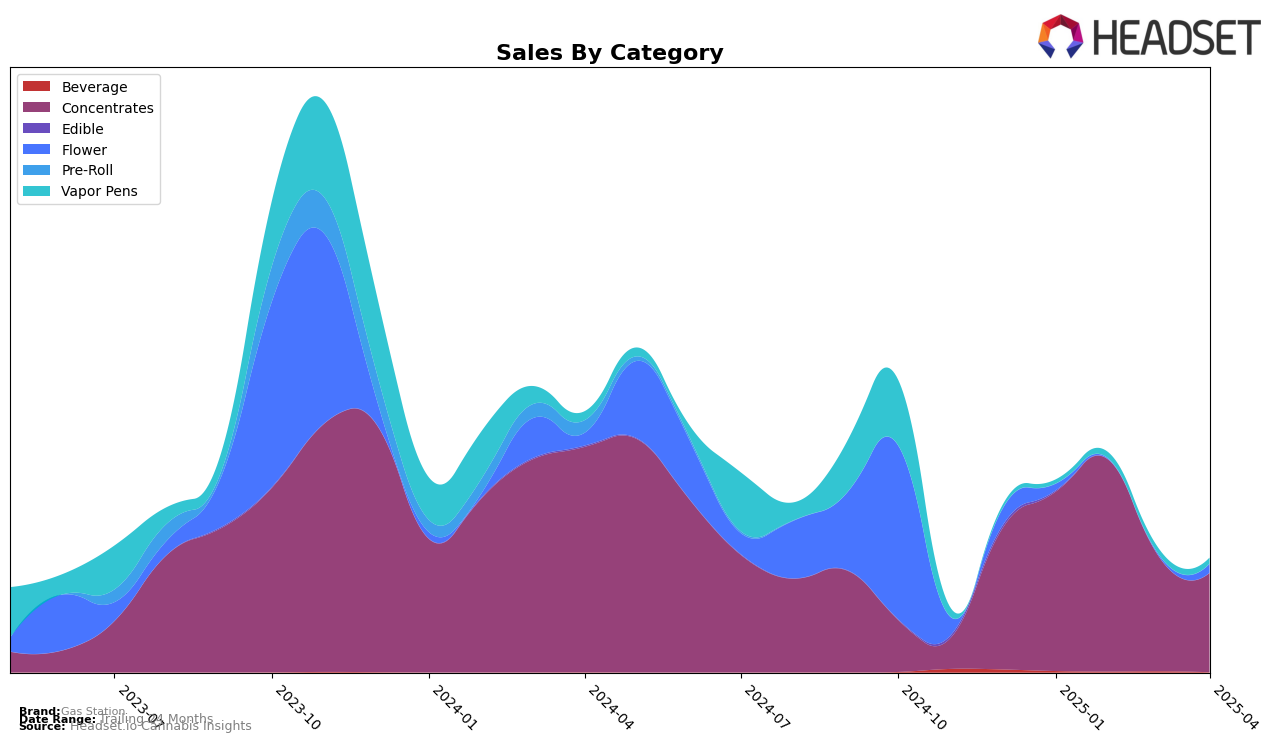

The performance of Gas Station in the Michigan market has shown some noteworthy fluctuations, particularly in the Concentrates category. In January 2025, Gas Station was ranked 27th, and they improved to 22nd in February. However, by March and April, they had dropped out of the top 30, which indicates a significant decline in their market position. This drop in ranking is accompanied by a decrease in sales, from over $200,000 in February to less than $94,000 by April. Such a decline suggests potential challenges in maintaining consumer interest or increased competition within the Concentrates category in Michigan.

While Gas Station's presence in the Concentrates category in Michigan saw a decline, this data could reflect broader trends or shifts in consumer preferences that the brand may need to address. The initial improvement in February signifies that there was a period where Gas Station managed to capture more market share, but sustaining that momentum appeared challenging. The data highlights the importance of strategic adjustments, whether in product offerings or marketing strategies, to regain a competitive edge. It's vital for stakeholders to analyze the underlying factors contributing to these movements to strategize effectively for future growth in the Michigan market.

Competitive Landscape

In the Michigan concentrates category, Gas Station has experienced notable fluctuations in its market position from January to April 2025. Starting strong with a rank of 27 in January, Gas Station improved to 22 in February, indicating a positive reception and increased sales momentum. However, the brand faced challenges in March and April, dropping to 42nd place, which suggests intensified competition and possibly market saturation. Competitors like Element and True North Collective have shown more stable rankings, with Element maintaining a presence in the top 50 and True North Collective consistently improving its rank. Meanwhile, Lit Labs and Made By A Farmer have also been fluctuating, but Made By A Farmer's significant rise to 37th in April highlights its growing influence. These dynamics suggest that while Gas Station initially captured consumer interest, sustaining its competitive edge will require strategic adjustments to counteract the upward trends of its rivals.

Notable Products

In April 2025, California Orange Badder (1g) from the Concentrates category emerged as the top-performing product for Gas Station, securing the number one rank with sales reaching 1467 units. Apple Mint Distillate Cartridge (1g) from the Vapor Pens category slipped to second place after holding the top position in March 2025. Candy Fumez Live Resin Sugar (1g) remained steady in third place, showing consistent demand in the Concentrates category. Afgoo Badder (1g) debuted in the rankings at fourth place, while Garlic Budder Live Resin Sugar (1g) rounded out the top five. The rankings indicate a shift in consumer preference towards concentrates, as evidenced by the strong performance of several products in that category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.