Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

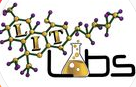

In the Michigan market, Lit Labs has shown varied performance across different product categories. In the Concentrates category, the brand experienced a notable fluctuation in its rankings, starting at 66th place in October 2025 and climbing to 58th by January 2026. This upward trajectory indicates a positive trend, despite not being in the top 30 brands. The sales figures reflect this movement with a dip in November and December followed by a recovery in January. Conversely, in the Edible category, Lit Labs has maintained a more stable presence, consistently climbing from 63rd to 54th place over the same period, with sales peaking in December. This steady improvement suggests a growing consumer base for their edibles in Michigan.

Interestingly, in the Topical category, Lit Labs made a significant leap into the top 10 by January 2026, reaching 6th place. This is a remarkable achievement considering the absence of any ranking in the previous months, indicating a strategic focus or a successful product launch that resonated well with consumers. The sales data for topicals, although only available for January, supports this surge with a notable figure. However, Lit Labs still faces challenges in the Concentrates category, where it has not yet broken into the top 30, despite its positive ranking movement. These insights suggest that while Lit Labs is gaining traction in some areas, there are opportunities for further growth and market penetration across other product categories in Michigan.

Competitive Landscape

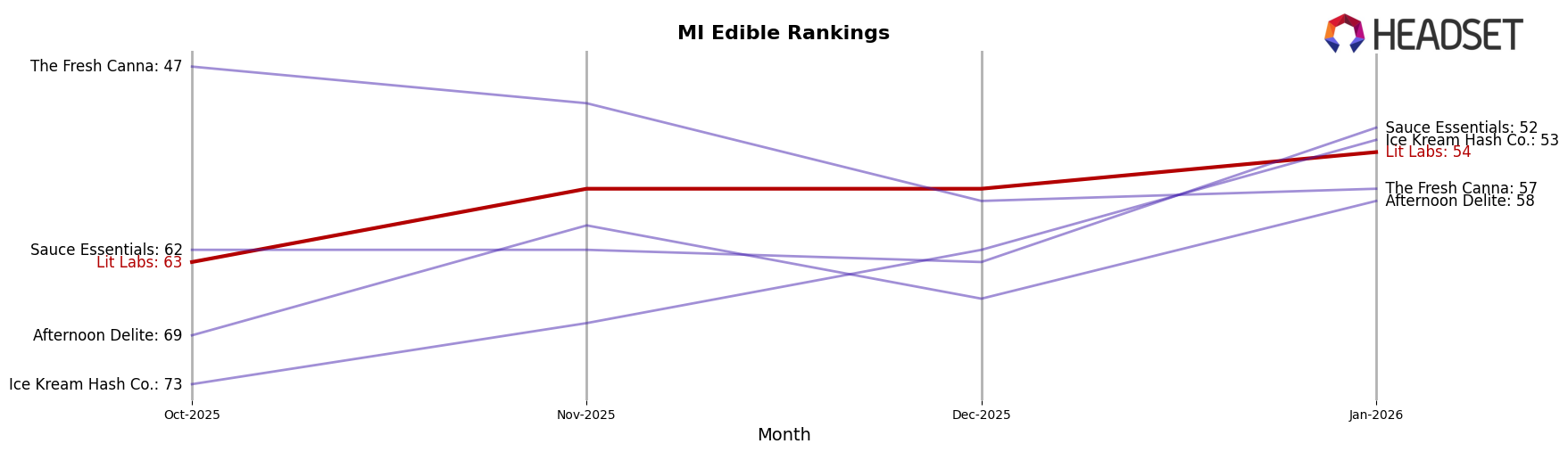

In the competitive landscape of the Michigan edible cannabis market, Lit Labs has demonstrated a consistent upward trajectory in its rankings from October 2025 to January 2026. Initially ranked 63rd in October, Lit Labs climbed to 54th by January, showcasing a steady improvement in its market position. This upward movement is particularly notable when compared to competitors such as Afternoon Delite, which fluctuated between 66th and 58th, and Sauce Essentials, which also improved but remained slightly behind Lit Labs in January. Meanwhile, The Fresh Canna experienced a decline, moving from 47th to 57th, indicating a potential opportunity for Lit Labs to capture more market share. Additionally, Ice Kream Hash Co. showed significant improvement, moving from 73rd to 53rd, suggesting a competitive edge that Lit Labs must monitor closely. Overall, Lit Labs' consistent sales growth and improved ranking highlight its strengthening presence in the Michigan edible market, positioning it well against its competitors.

Notable Products

In January 2026, the top-performing product from Lit Labs was Sour Strawberry Pomegranate Rosin + Resin Full Spectrum Vegan Gummies 10-Pack (200mg), maintaining its number one rank from December 2025. The Watermelon Rosin + Resin Full Spectrum Vegan Gummies 10-Pack (200mg) improved its position to rank second, up from fourth in the previous two months, with sales figures reaching 1,967 units. Blue Razz Rosin + Resin Full Spectrum Gummies 10-Pack (200mg) held steady at third place, while Pineapple Rosin + Resin Full Spectrum Vegan Gummies 10-Pack (200mg) dropped to fourth after being second for two consecutive months. Mango Rosin + Resin Full Spectrum Vegan Gummies 10-Pack (200mg) re-entered the top five, ranking fifth, after not being ranked in November and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.