Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

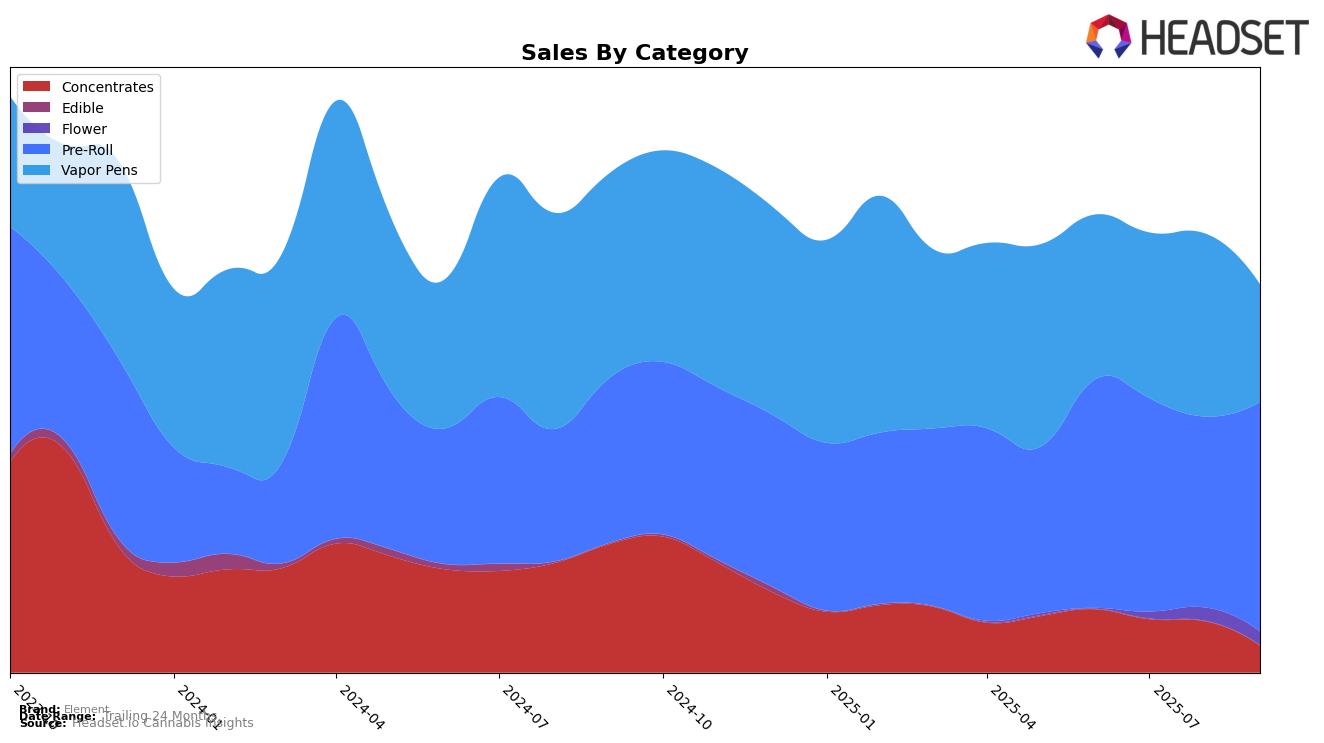

Element's performance across various categories in Michigan has shown a mix of both promising and challenging trends in recent months. In the Pre-Roll category, Element has demonstrated a commendable recovery, climbing from rank 35 in August 2025 to 25 by September 2025. This upward movement suggests a strengthening foothold in the Pre-Roll market, potentially driven by strategic product offerings or consumer preferences. Conversely, the Concentrates category has been less favorable for Element, with a consistent decline from rank 36 in June 2025 to 66 by September 2025, indicating potential challenges in maintaining competitive positioning within this segment.

In the Vapor Pens category, Element experienced fluctuations, with a notable dip in September 2025, falling from rank 33 in August to 45. This decline might reflect increased competition or shifting consumer trends that Element has yet to address effectively. It's worth noting that in some months, Element failed to secure a spot within the top 30 in certain categories, highlighting areas where the brand might need to reassess its market strategies. Overall, while Element shows resilience in specific areas like Pre-Rolls, there's a clear need for strategic adjustments in other categories to regain momentum and improve overall market presence in Michigan.

Competitive Landscape

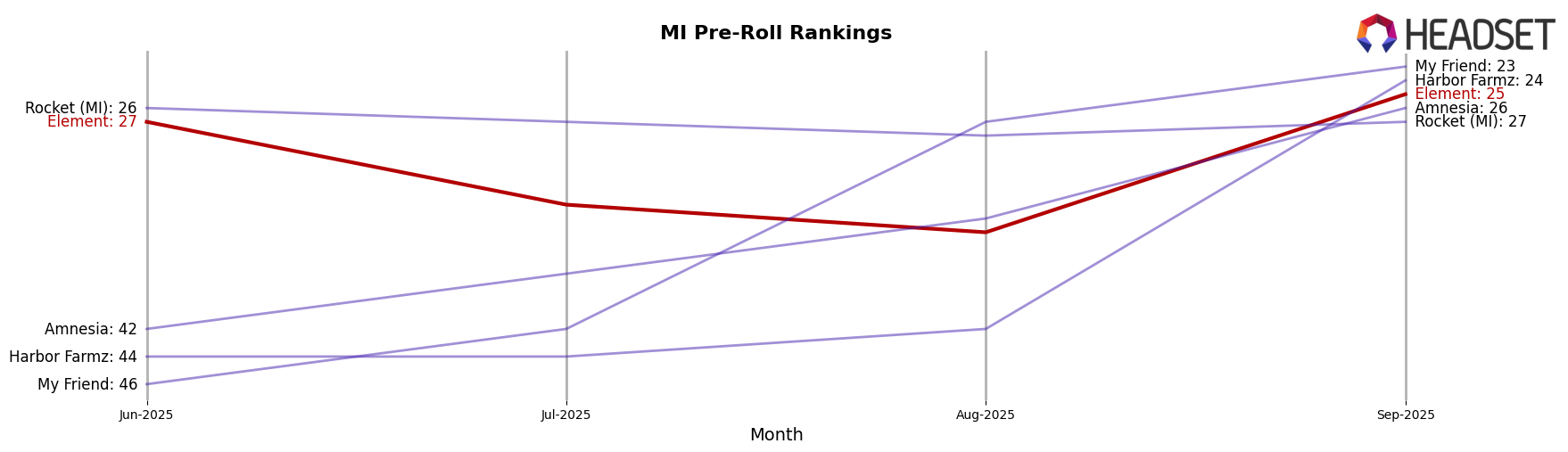

In the competitive landscape of the Michigan Pre-Roll category, Element has experienced a dynamic shift in its ranking and sales performance over the past few months. Despite a slight dip in rankings from June to August 2025, Element rebounded in September, climbing to the 25th position. This resurgence is noteworthy as it coincides with a sales increase, contrasting with the declining trend observed in previous months. Notably, Harbor Farmz made a significant leap, surpassing Element in September with a 24th rank, driven by a notable sales surge. Meanwhile, Amnesia and My Friend also demonstrated upward momentum, with My Friend achieving a remarkable 23rd rank in September. In contrast, Rocket (MI) maintained a steady presence, consistently ranking in the top 30. These shifts highlight the competitive pressures Element faces, emphasizing the need for strategic adjustments to maintain and enhance its market position.

Notable Products

In September 2025, the top-performing product from Element was Permanent Marker x Devil Driver Live Hash Infused Pre-Roll (1g), leading the sales with 2488 units sold. It was followed by Detroit Kandy x Big League Grape Live Hash Infused Pre-Roll (1g) and Lemon Cherry Gelato x Pudding Pop Live Resin Infused Pre-Roll (1g), which secured the second and third ranks, respectively. Super Pure Runtz x Devil Driver Live Hash Infused Pre-Roll (1g) and Detroit Kandy x Papaya Punch Live Resin Infused Pre-Roll (1g) completed the top five. Notably, this was the first month these products were ranked, indicating a strong market entry. The Pre-Roll category dominated the rankings, showcasing a trend towards infused products in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.