Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

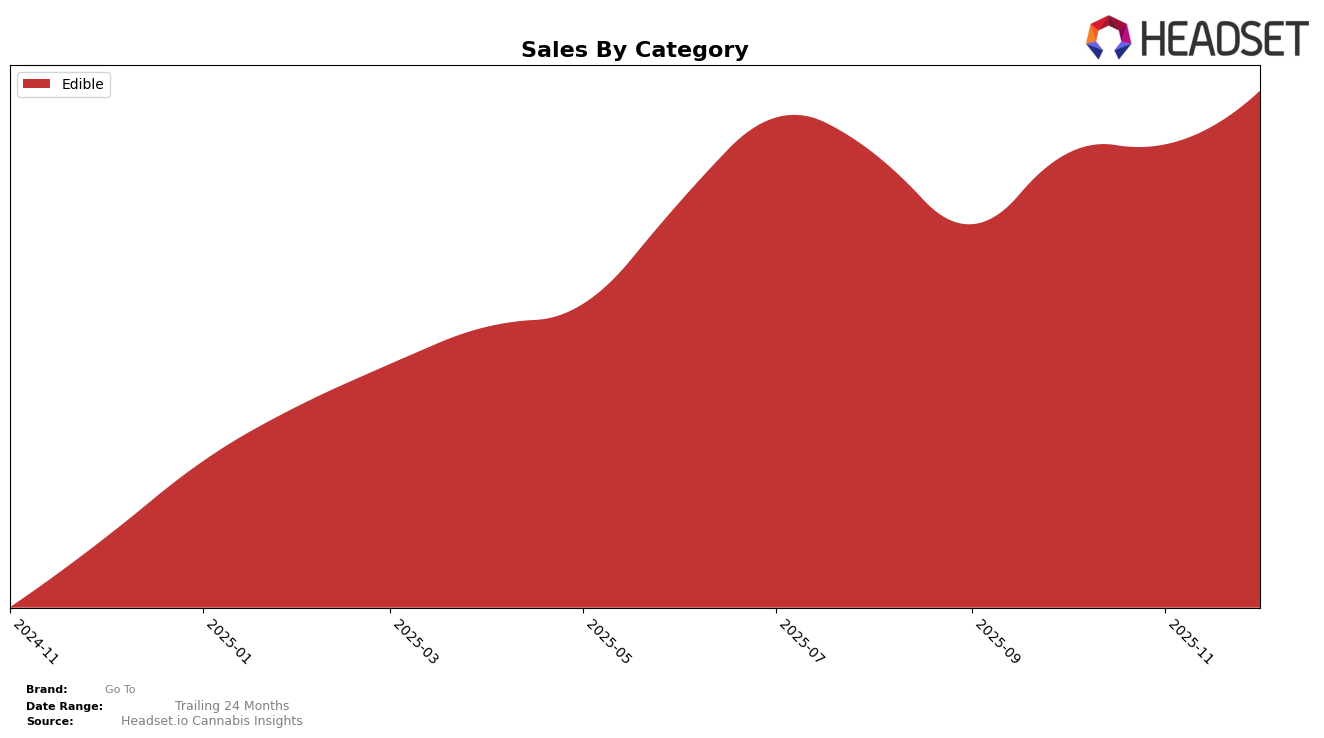

In the state of Massachusetts, Go To has shown a steady improvement in the Edible category over the last few months of 2025. Starting from September, where they were just outside the top 30 at rank 31, they managed to climb to rank 27 in October and November, and further improved to rank 26 by December. This upward trajectory is indicative of a growing market presence and possibly an increase in consumer preference for their products. The increase in rank is accompanied by a notable rise in sales, with December sales figures reflecting a significant growth from September.

The consistent presence of Go To in the top 30 brands in the Edible category in Massachusetts suggests a robust performance in this market, particularly as they continue to climb the rankings. However, the absence of Go To from the top 30 in other states or categories may imply either a strategic focus on Massachusetts or challenges in penetrating other markets. This selective success can be a double-edged sword, presenting both opportunities for further expansion and risks if Massachusetts trends were to shift unfavorably. Understanding the factors driving their success in Massachusetts could provide insights for potential growth strategies in other regions.

Competitive Landscape

In the Massachusetts edible cannabis market, Go To has shown a steady improvement in its rankings, moving from 31st in September 2025 to 26th by December 2025. This upward trajectory in rank is indicative of a positive trend in sales, which increased from $74,992 in September to $97,188 in December. Despite this progress, Go To remains behind competitors like Sparq Cannabis Company, which consistently ranks higher, reaching 24th place in December with a notable sales increase. Meanwhile, Ahh and Jams have experienced fluctuations in their rankings, with Ahh dropping to 28th and Jams to 27th in December. Effin' Edibles also shows a competitive edge, maintaining a rank of 25th in December with strong sales growth. Go To's consistent rise in rank suggests a growing market presence, yet it faces stiff competition from these established brands, highlighting the need for strategic marketing and product differentiation to continue its upward momentum.

Notable Products

In December 2025, Blueberry Gummies 20-Pack (100mg) maintained its top position as the leading product for Go To, with sales reaching 2489 units. Cranberry Lime Gummies 20-Pack (100mg) climbed to the second spot, showing a consistent increase from third place in November, with notable sales of 2113 units. Sour Apple Gummies 20-Pack (100mg) dropped slightly to third, while Lemon Lime Gummies 20-Pack (100mg) improved its ranking to fourth, showcasing a significant rise in sales. A new entry, Mango Lime Gummies 20-Pack (100mg), debuted in fifth place, indicating a strong market entry. This month’s rankings reflect a dynamic shift in consumer preferences, with notable improvements in sales for the Cranberry Lime and Lemon Lime variants.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.