Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

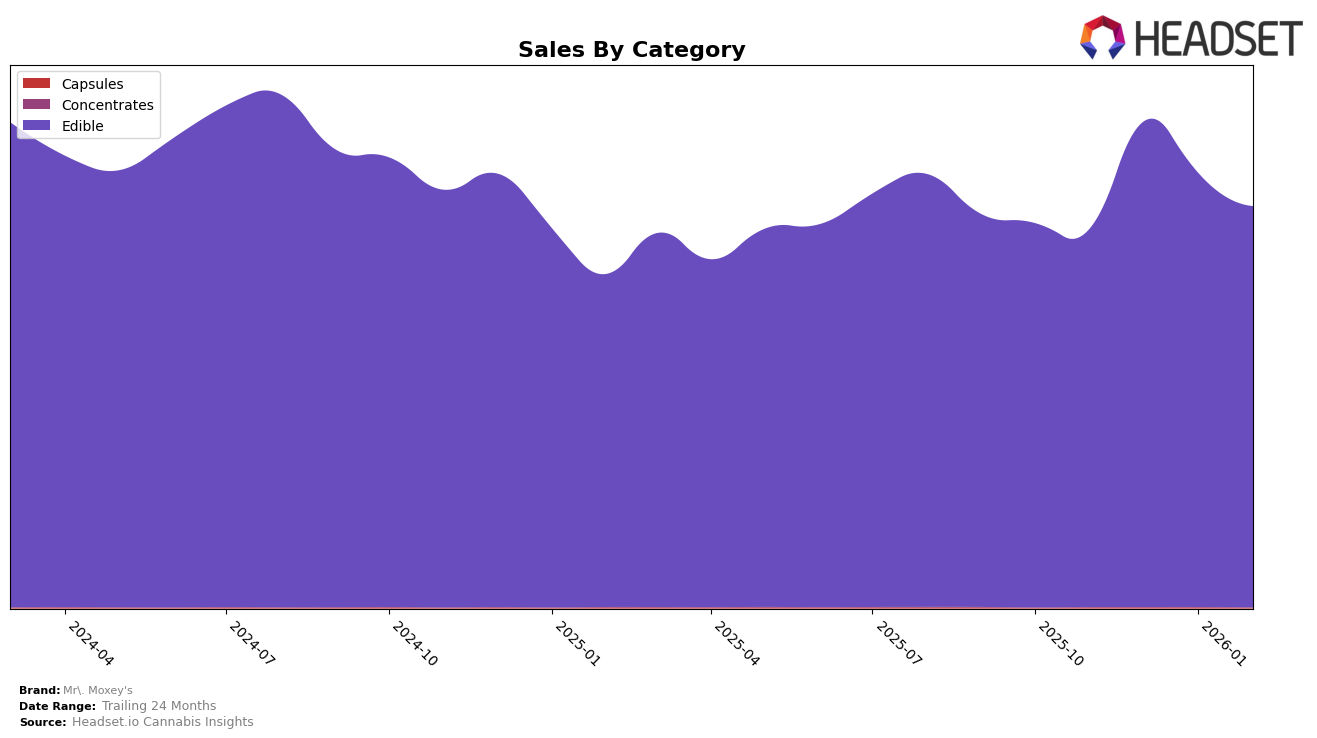

Mr. Moxey's has shown a consistent presence in the Colorado edibles market, maintaining a position within the top 15 brands from November 2025 to February 2026. The brand saw a slight dip in ranking from 11th to 12th place between January and February 2026, indicating a minor decrease in market competitiveness. Despite this, the brand's sales in Colorado experienced a notable peak in December 2025, reaching $195,077, before gradually declining in the subsequent months. In Washington, Mr. Moxey's has consistently held the 11th position from December 2025 to February 2026, suggesting a stable performance in a competitive market. This consistency is underscored by a peak in sales in December, followed by a gradual decrease, mirroring the trend in Colorado.

In contrast, Mr. Moxey's has not secured a top 30 position in the New Jersey edibles market, consistently ranking 34th from December 2025 to February 2026. This indicates potential challenges in capturing market share in this state. Meanwhile, in Oregon, the brand experienced a slight drop in ranking from 17th in December 2025 to 20th by February 2026, accompanied by a decrease in sales. This suggests that the brand may be facing increased competition or shifting consumer preferences. Overall, Mr. Moxey's demonstrates strong performance in established markets like Colorado and Washington, while facing challenges in expanding its footprint in other states like New Jersey and Oregon.

Competitive Landscape

In the Washington edible market, Mr. Moxey's has maintained a steady position, consistently ranking 11th from December 2025 through February 2026, after improving from 12th place in November 2025. This stability in rank indicates a solid market presence, although it trails behind competitors like Smokiez Edibles, which consistently holds the 9th position, and Drops, which maintains the 10th spot. Despite Cormorant slipping from 11th to 12th in December 2025, Mr. Moxey's has not capitalized on this shift to move ahead in rank. The brand's sales trajectory shows a decline from December 2025 to February 2026, mirroring a broader trend seen across the market, yet it still outpaces The 4.20Bar, which remains at 13th place. This analysis suggests that while Mr. Moxey's holds a competitive position, there is room for strategic initiatives to enhance its rank and sales performance further.

Notable Products

In February 2026, Mr. Moxey's top-performing product was the CBG/CBD/THC 1:1:1 Relief Lemon Ginger Mints 20-Pack, maintaining its first-place rank consistently from November 2025 through February 2026, with sales reaching 4470 units. The CBD/THC 1:1 Balance Peppermint Mints 20-Pack held steady in the second position, showing a slight decline in sales compared to previous months. Energizing Peppermint Mints 20-Pack remained in third place, following a drop from its peak rank in December 2025. The CBC/THC 1:1 Energize Peppermint Mints 20-Pack consistently ranked fourth across the months, showing stable sales figures. The CBN/CBD/THC 1:1:1 Dream Lavender Mints 20-Pack was ranked fifth, maintaining this position since January 2026 after a period of absence in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.