Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

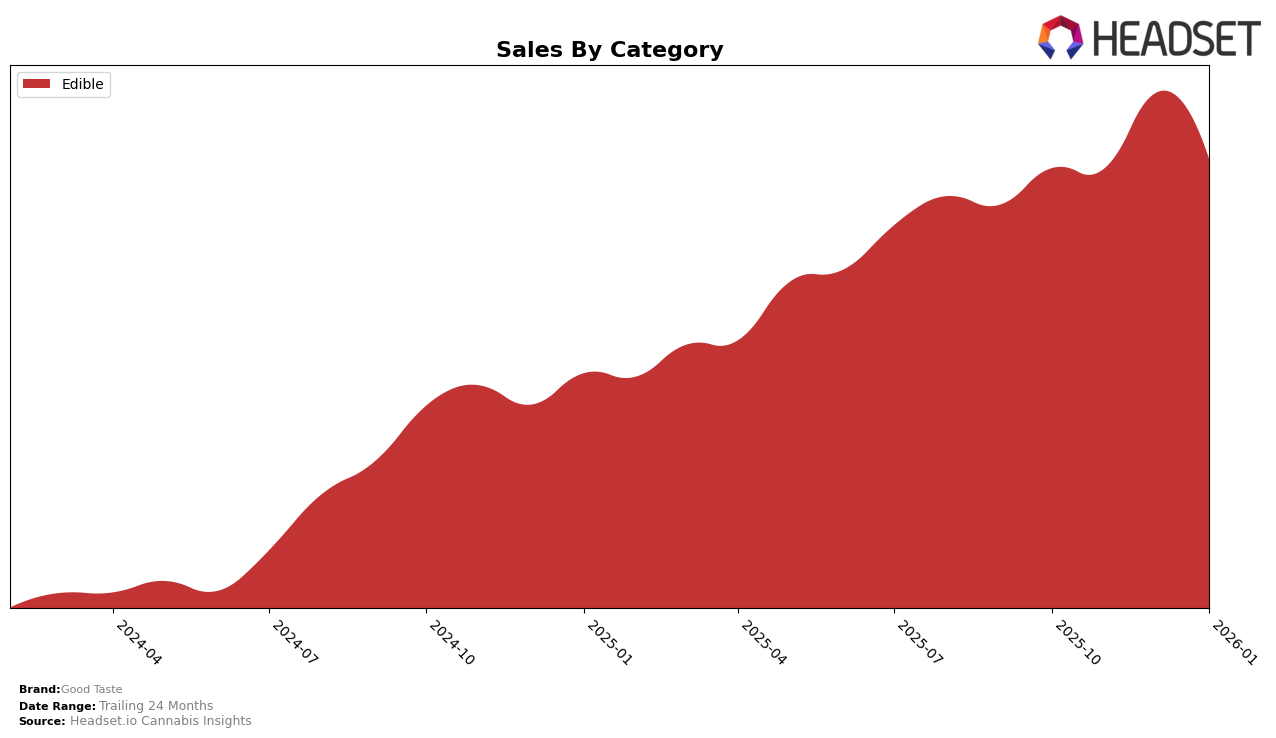

Good Taste has demonstrated consistent performance in the Missouri market within the Edible category. Over the past few months, the brand has maintained a strong presence, holding the 5th position in both October and November 2025, and slightly dropping to the 6th position in December 2025 and January 2026. This slight decline in rank, despite a notable increase in sales during December 2025, suggests a competitive landscape where other brands might be gaining traction. However, Good Taste's ability to remain in the top 10 indicates a stable market presence and continued consumer interest.

In other states and categories, Good Taste's absence from the top 30 rankings highlights areas where the brand could potentially expand or improve its market strategy. Being absent from these rankings could be seen as a missed opportunity, especially if other brands are capturing significant market share in those regions or categories. This information could be pivotal for Good Taste as they consider strategic adjustments or new marketing initiatives to enhance their visibility and performance across different markets.

Competitive Landscape

In the Missouri edible market, Good Taste has maintained a stable position, ranking consistently at 5th or 6th place from October 2025 to January 2026. Despite a slight dip in rank from 5th to 6th in December 2025, Good Taste's sales exhibited a positive trend, peaking in December before a slight decline in January. This performance is noteworthy given the competitive landscape, where Smokiez Edibles consistently held the 4th rank with significantly higher sales, and Illicit / Illicit Gardens climbed from 7th to 5th, surpassing Good Taste in December. Meanwhile, Wana and Zen Cannabis showed more fluctuation in their rankings, with Wana dropping from 6th to 8th and Zen Cannabis improving from 9th to 7th by January 2026. This competitive dynamic suggests that while Good Taste is holding its ground, there is pressure from both higher-ranked and improving brands, indicating a need for strategic initiatives to enhance market share and rank stability.

Notable Products

In January 2026, Blue Razzberry Gummies 10-Pack (100mg) emerged as the top-performing product for Good Taste, climbing from third place in December 2025 to first place, with a notable sales figure of 6271. Sativa Clementine Gummies 10-Pack (100mg) maintained its consistent second-place ranking throughout the last four months, indicating stable popularity. Blackberry Yuzu Gummies 20-Pack (1000mg), previously the leading product for three consecutive months, fell to third place in January 2026. The Patriot Pop Gummies 10-Pack (1000mg) entered the rankings for the first time in January, securing the fourth position. Pink Lemonade High Dose Gummies 10-Pack (300mg) remained steady in fifth place, showing a slight decline in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.