Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

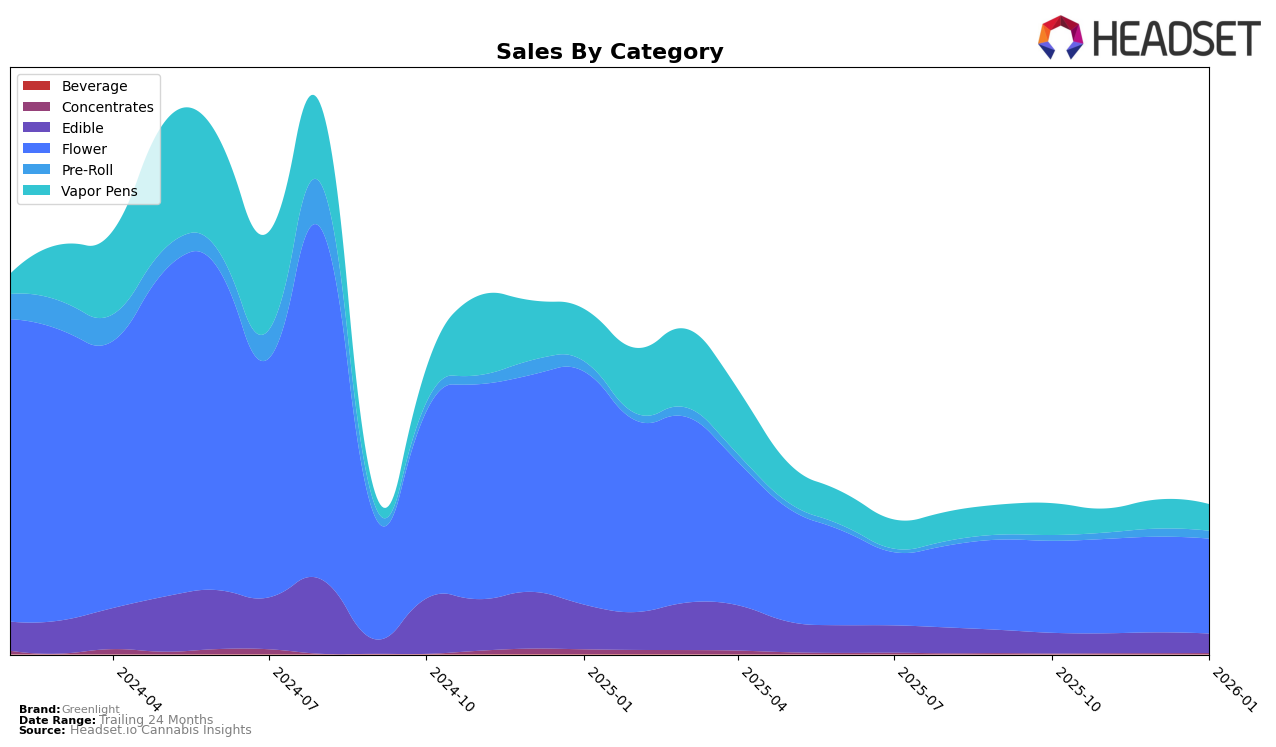

Greenlight's performance across various categories in Missouri shows a relatively stable presence, with some categories experiencing notable fluctuations. In the Edible category, Greenlight maintained a consistent ranking, hovering around the low 20s, with a slight dip in sales from October 2025 to January 2026. The Flower category, however, saw Greenlight holding steady at the 19th and 20th positions, with a subtle upward trend in sales figures, suggesting a solid foothold in this segment. Meanwhile, the Pre-Roll category demonstrated a significant improvement, with Greenlight climbing from the 56th to the 43rd position over the same period, indicating a growing consumer interest in their offerings.

In contrast, Greenlight's performance in New Jersey presents a different picture. The brand appeared in the Flower category rankings only in October 2025, positioned at 77th, and subsequently fell out of the top 30 rankings in the following months. This absence highlights a potential challenge for Greenlight in establishing a strong presence in New Jersey's competitive market. Additionally, their performance in the Vapor Pens category in Missouri, which saw fluctuating rankings between 32nd and 36th, suggests variability in consumer preferences or market conditions that could be influencing sales. These insights provide a glimpse into Greenlight's market dynamics, hinting at areas of strength and opportunities for growth.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Greenlight has maintained a relatively stable position, showing resilience amidst fluctuating ranks of its competitors. Over the four-month period from October 2025 to January 2026, Greenlight's rank oscillated slightly between 19th and 20th, indicating consistent performance. In contrast, Elevate experienced more volatility, dropping out of the top 20 in November before rebounding to 19th in December. Meanwhile, Nuthera showed significant improvement, climbing from 23rd to 17th, suggesting a strong upward trend in sales. Packs Cannabis (MO) also demonstrated strong sales momentum, peaking at 16th in November and December before dropping to 20th in January. Galactic displayed a similar pattern of improvement, ending the period at 18th. Greenlight's steady rank amidst these shifts highlights its consistent market presence, though the upward trends of Nuthera and Packs Cannabis (MO) suggest increasing competition that could impact Greenlight's future positioning.

Notable Products

In January 2026, Sativa Strawberry Gummies 10-Pack (100mg) maintained its position as the top-performing product for Greenlight, with sales reaching 1605 units. Watermelon Gummies 10-Pack (100mg) also consistently held the second spot, showing strong performance in the Edible category. Notably, Platinum - Chem Cake (3.5g) emerged as a new entrant in the rankings, securing third place. Cherry Limeade Gummies 10-Pack (500mg) experienced a slight decline, moving from third to fourth place. Meanwhile, Gold - Zerealz (3.5g) debuted in the rankings at fifth place, showcasing a promising entry into the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.