Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

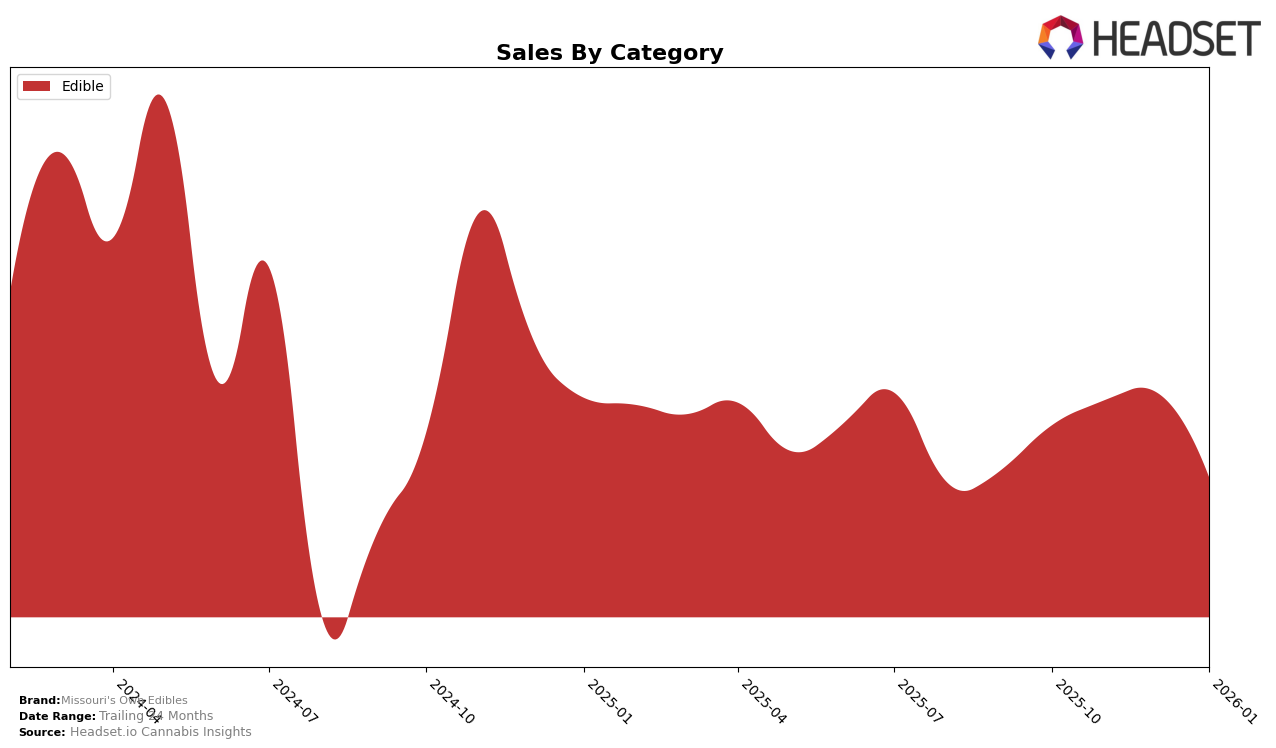

Missouri's Own Edibles has maintained a consistent presence in the Missouri edible market, holding steady in the rankings from October 2025 through January 2026. The brand was ranked 18th in both October and November, before slipping slightly to 19th in December and January. This stability in the top 20 suggests a solid consumer base and consistent demand for their products. However, the slight decline in rank towards the end of the period may indicate increased competition or a need for strategic adjustments to maintain their position.

Notably, Missouri's Own Edibles does not appear in the top 30 rankings in any other states or categories, which could be seen as a limitation in their market reach or product diversification strategy. This absence from other markets highlights a potential area for growth and expansion, as broadening their geographic footprint or category offerings could enhance their competitive edge. Despite the challenges, their performance in Missouri's edible market remains noteworthy, with sales peaking in November before experiencing a decline in January, which could be attributed to seasonal factors or market dynamics.

Competitive Landscape

In the competitive landscape of the edible category in Missouri, Missouri's Own Edibles has shown consistent performance, maintaining a stable rank between 18th and 19th from October 2025 to January 2026. This steadiness is notable given the fluctuations experienced by competitors such as Dixie Elixirs and Curio Wellness, which have seen more significant rank changes during the same period. For instance, Curio Wellness improved its position from 20th to 15th in December 2025, surpassing Missouri's Own Edibles, while Dixie Elixirs dropped to 18th in January 2026. Despite these shifts, Missouri's Own Edibles has maintained a competitive edge in terms of sales consistency, although it trails slightly behind the top performers like Vibe Cannabis (MO), which started strong in October 2025 but saw a decline to 20th by January 2026. This analysis suggests that while Missouri's Own Edibles remains a reliable choice for consumers, there is room for strategic initiatives to enhance its market position and capitalize on the volatility of its competitors.

Notable Products

In January 2026, the top-performing product from Missouri's Own Edibles was the CBD/THC 10:1 Sativa Concord Grape Gummies 10-Pack, which moved up to the number one spot with sales of 2225 units. The CBG/THC 1:1 Sweet Green Apple Gummies 10-Pack followed closely, maintaining its second-place ranking from previous months. The CBG/THC 1:2 Sour Watermelon Gummies 10-Pack made a notable leap to third place, improving from its fifth-place position in December 2025. Meanwhile, the CBN/THC 1:1 Indica Blackberry Gummies 10-Pack dropped to fourth place after consistently holding the top rank in prior months. Lastly, the Indica Pawpaw Fruit Gummies 10-Pack, while still in the top five, saw a decline in ranking and sales, landing in fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.