Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

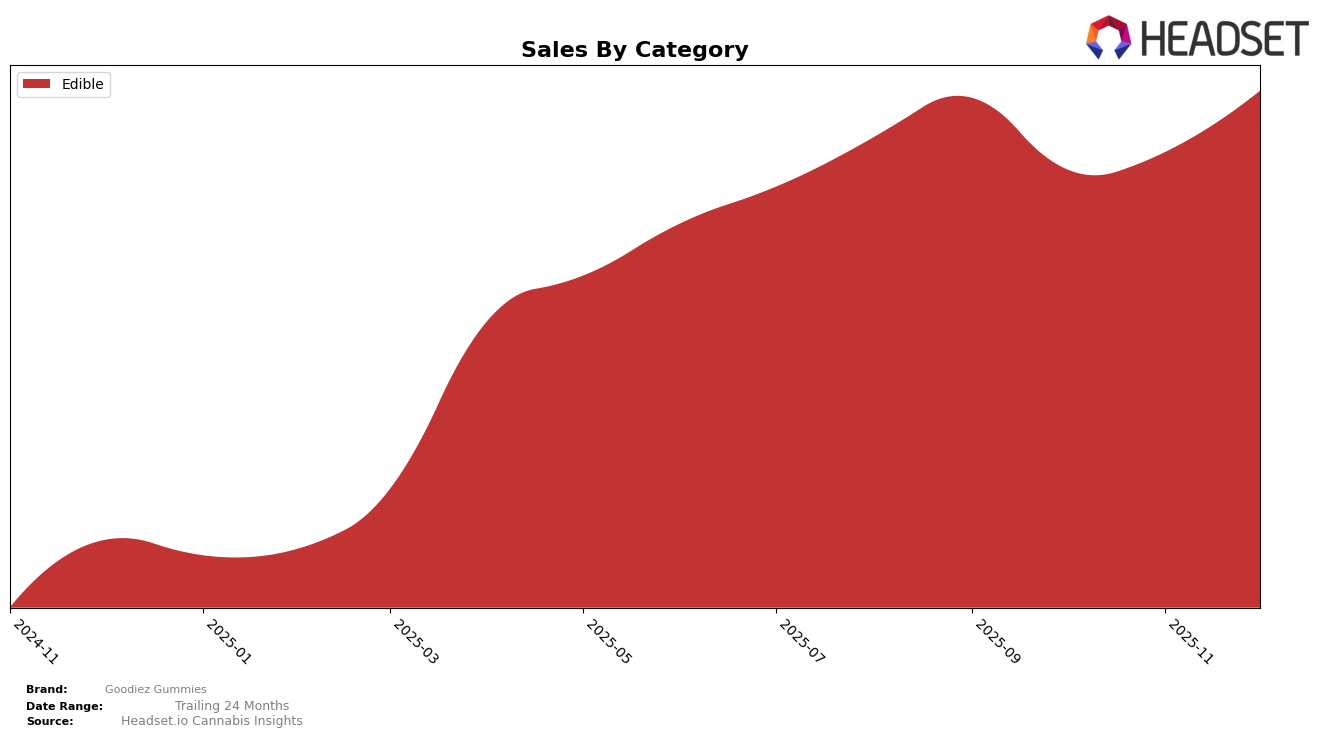

Goodiez Gummies has shown a consistent presence in the Washington market, particularly in the Edible category. Over the last four months of 2025, their ranking has fluctuated slightly, moving from 22nd place in September to 25th in December. This indicates a slight decline in their market position within the state, although they have maintained a presence in the top 30. The sales figures also reflect this trend, with a noticeable dip in October followed by a recovery in December, suggesting some level of volatility but also resilience in their sales performance.

Interestingly, the fact that Goodiez Gummies consistently appears in the top 30 rankings each month in Washington implies a stable consumer base and brand recognition in this region. However, the lack of a top 30 presence in other states or provinces might suggest that their market penetration is currently limited to specific regions. This could be an area of potential growth or a strategic focus for the brand moving forward. Understanding the dynamics of their performance in Washington could provide insights into how they might replicate success in other markets.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, Goodiez Gummies has experienced a notable shift in its ranking and sales performance from September to December 2025. Initially ranked at 22nd in September, Goodiez Gummies saw a decline to 25th by December, indicating increased competition and potential challenges in maintaining market share. In contrast, Soulshine Cannabis improved its position from 24th to 23rd, showcasing a steady upward trend in sales. Meanwhile, SnacMe and Koko Gemz remained relatively stable, with SnacMe dropping slightly from 25th to 26th and Koko Gemz fluctuating around the 27th and 28th positions. Notably, Kelly's Sweet Hash Edibles demonstrated significant growth, climbing from 32nd to 24th, which suggests a successful strategy in capturing consumer interest. These shifts highlight the dynamic nature of the market and suggest that Goodiez Gummies may need to innovate or adjust its marketing strategies to regain its competitive edge.

Notable Products

In December 2025, the top-performing product from Goodiez Gummies was the CBG/THC 1:2 Strawberry Lemonade Gummies 10-Pack, maintaining its number one rank with sales reaching 1955 units. The CBD/CBG/CBN/THC 1:1:1:1 Shirley Temple Gummies 10-Pack held steady in second place with a consistent upward trend in sales throughout the months. The CBD/CBG/CBN/THC 1:1:1:1 Watermelon Candy Gummies 10-Pack improved its position from fifth in November to third in December, showing a strong recovery in sales to 1003 units. The CBD/THC 40:1 Pineapple Mango Gummies 10-Pack remained in fourth place, experiencing a slight decline in sales compared to previous months. The CBN/THC 2:1 Mixed Berry Punch Gummies 10-Pack consistently ranked fifth, reflecting stable but modest sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.