Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

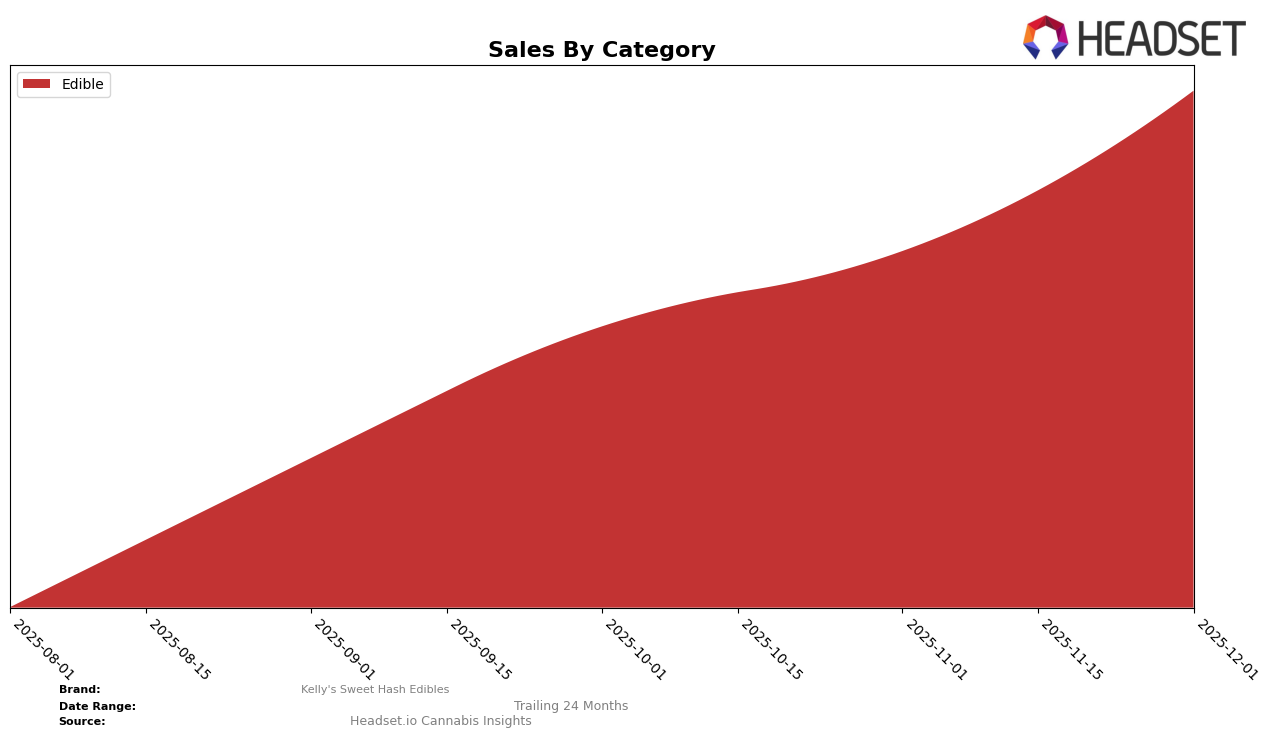

Kelly's Sweet Hash Edibles has shown a consistent upward trajectory in the Washington market within the Edible category over the final months of 2025. Starting from a rank of 32 in September, the brand improved its position to 26 in both October and November, and further advanced to 24 by December. This steady climb is indicative of the brand's growing popularity and consumer acceptance in the state. Notably, the sales figures reflect this positive trend, with a significant increase from September to December, highlighting the brand's expanding market presence and potential to further climb the rankings.

While Kelly's Sweet Hash Edibles is making notable strides in Washington, it is important to note that the brand did not make it into the top 30 rankings in other states or provinces for the Edible category during this period. This absence can be interpreted as a potential area for growth or a challenge in expanding their market reach beyond Washington. The brand's performance in Washington could serve as a model for strategies to replicate in other markets, but it also underscores the competitive nature of the cannabis industry and the need for targeted marketing and distribution efforts in diverse regions.

Competitive Landscape

In the competitive landscape of Washington's edible cannabis market, Kelly's Sweet Hash Edibles has shown a notable upward trajectory in rankings from September to December 2025. Starting from a rank of 32 in September, Kelly's Sweet Hash Edibles improved to 24 by December, indicating a significant enhancement in market presence. This upward movement is particularly impressive when compared to competitors like Soulshine Cannabis, which fluctuated between ranks 20 and 24, and Swell Edibles, which maintained a relatively stable position around rank 22. Meanwhile, Goodiez Gummies experienced a decline, moving from rank 22 to 25 over the same period. The consistent rise in Kelly's Sweet Hash Edibles' rank suggests a strong growth in consumer preference, likely driven by strategic marketing or product innovation, positioning it as a formidable contender in the Washington edibles market.

Notable Products

In December 2025, Kelly's Sweet Hash Edibles saw Cookies N Cream Mini Waffle Cone (10mg) rise to the top spot with sales of 829 units, marking a significant increase from its third-place ranking in November. The Cookie Butter Mini Waffle Cone (10mg) maintained its strong performance, holding steady in second place, though it had previously secured the top rank in October. The Cookie Butter Mini Waffle Cones 10-Pack (100mg) dropped to third place after leading in November, showing a slight decline in its dominance. Meanwhile, Cookies N Cream Mini Waffle Cones 10-Pack (100mg) consistently held the fourth position throughout the last four months. New to the rankings, Chocolate Chip Cookie Dough (10mg) entered the list in December at fifth place, indicating potential growth in the coming months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.