Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

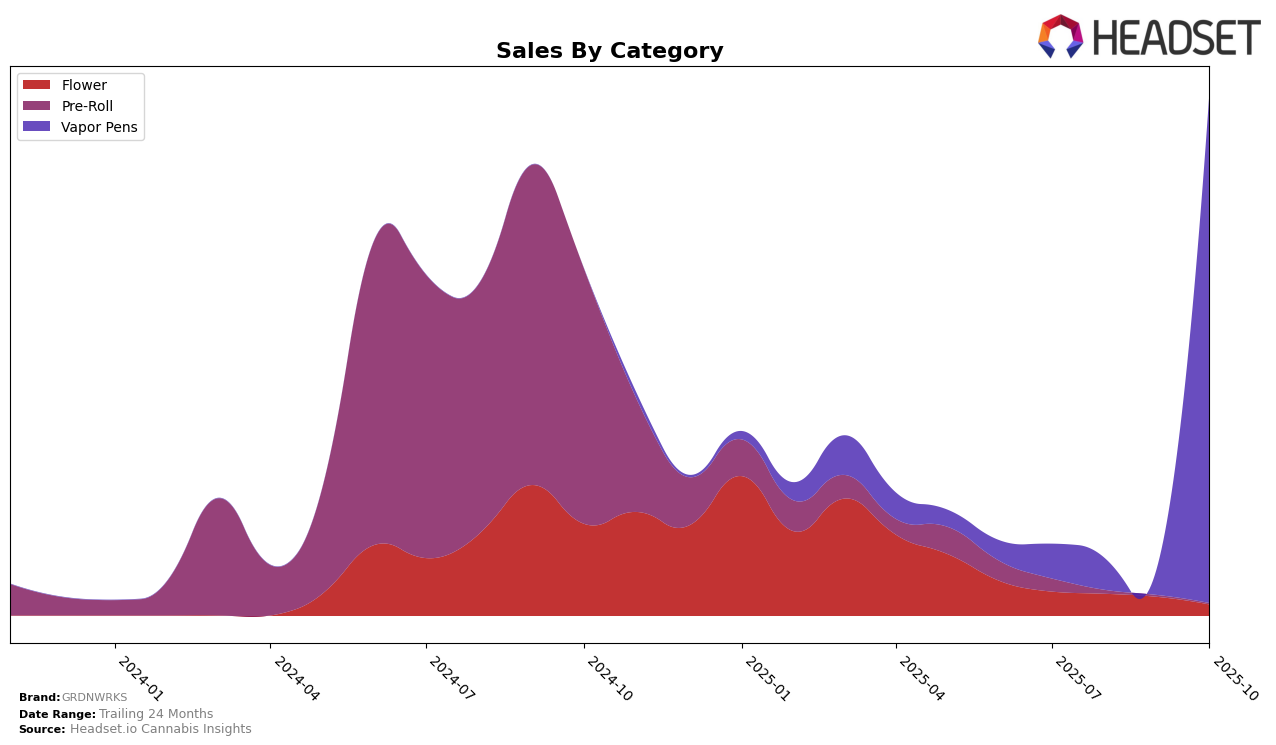

In Alberta, GRDNWRKS has shown an upward trajectory in the Vapor Pens category, moving from a rank outside the top 60 in July to securing the 60th position by October 2025. This improvement is underscored by a notable increase in sales, jumping from 16,289 in September to 28,059 in October. This growth indicates a strengthening presence in the Alberta market, suggesting effective strategies in product placement or consumer engagement. However, the brand's absence from the top 30 in previous months highlights a competitive landscape where GRDNWRKS has room for growth.

Meanwhile, in British Columbia, GRDNWRKS has made a significant entrance into the Vapor Pens category, ranking 17th in October. This debut suggests a strong market entry strategy, possibly leveraging local consumer preferences or effective distribution networks. The absence of rankings in the preceding months indicates that GRDNWRKS was not previously a major player in British Columbia's Vapor Pens market, making this sudden appearance noteworthy. Such a leap could reflect successful brand recognition efforts or a response to regional demand for specific product attributes.

Competitive Landscape

In the competitive landscape of Vapor Pens in British Columbia, GRDNWRKS has shown a notable entry into the top 20 brands as of October 2025, securing the 17th rank. This marks a significant milestone for GRDNWRKS, as it was not ranked in the top 20 in the preceding months, indicating a positive upward trend in market presence. In contrast, brands like Versus have demonstrated fluctuating ranks, peaking at 11th in September before dropping to 15th in October, while Vox experienced a sharp decline from a consistent top 6 position to 18th in October. Meanwhile, Pistol and Paris made its first appearance in the rankings at 20th in October. The entry of GRDNWRKS into the rankings amidst these shifts suggests a growing consumer interest and potential for increased sales momentum, especially as other established brands experience variability in their standings.

Notable Products

In October 2025, the top-performing product for GRDNWRKS was the Mr. Juice Distillate Cartridge (1g) in the Vapor Pens category, maintaining its rank at number one for the fourth consecutive month with a significant sales figure of 5552 units. The Mr. Juice Distillate Disposable (1g) also made an impressive debut, securing the second spot in its first recorded month. Sunrise Citrus Slurry Milled (7g) in the Flower category held steady at rank three, showing a slight decrease in sales from previous months. Sweet Thang Infused Pre-Roll 5-Pack (2.5g) remained at rank four, experiencing a consistent decline in sales over the months. Notably, Bedtime Bubble Berry Milled (7g), previously ranked third, did not appear in the rankings for October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.