Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

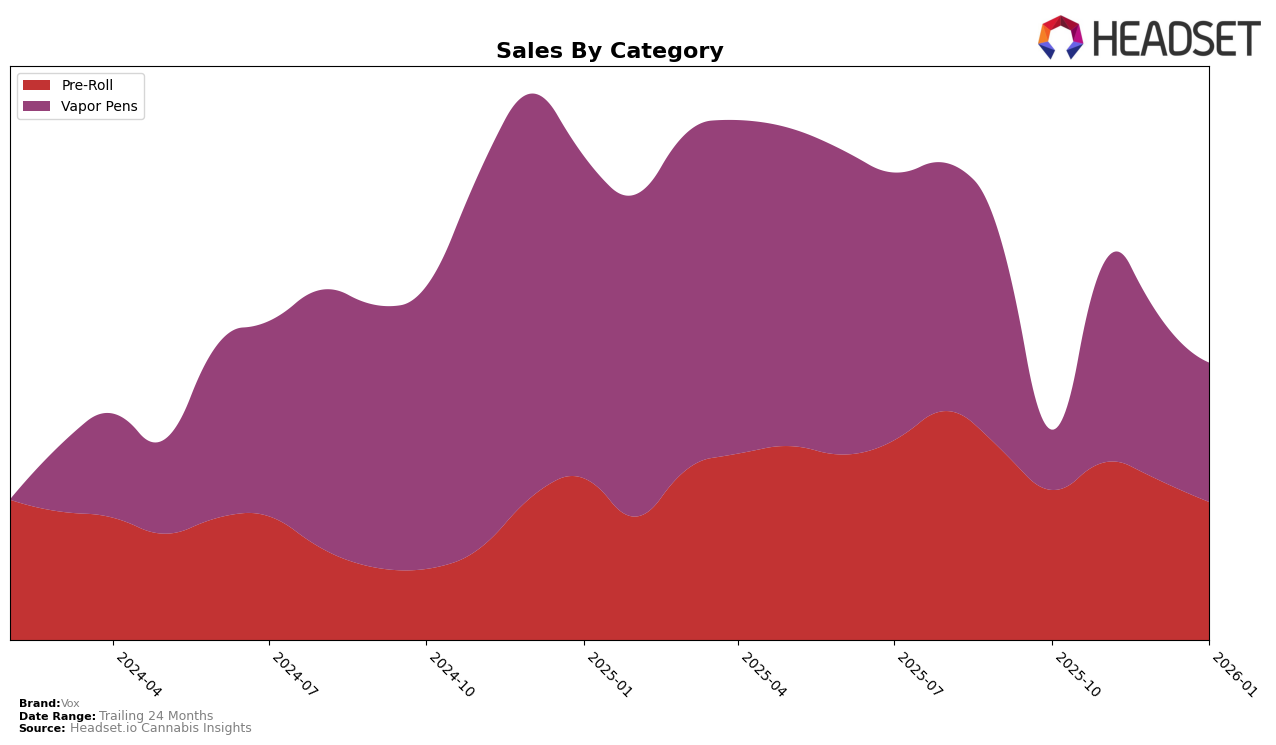

Vox has demonstrated varied performance across different states and categories, reflecting both challenges and opportunities. In Alberta, the brand's position in the Pre-Roll category has seen a consistent decline, moving from 37th place in October 2025 to 47th by January 2026. This downward trend is mirrored in their sales figures, which have decreased significantly over the same period. Similarly, in the Vapor Pens category in Alberta, Vox fell out of the top 30 by December 2025, indicating a struggle to maintain competitiveness in this segment. In contrast, British Columbia presents a more optimistic picture for Vox. Their Pre-Roll category performance improved, climbing from 54th in October 2025 to break into the top 30 by January 2026, suggesting a successful strategy or increased consumer preference in this market.

In British Columbia, Vox's performance in the Vapor Pens category has been particularly strong, where they achieved a top 5 ranking in both November and December 2025, before slightly dropping to 7th in January 2026. This indicates a robust presence and likely consumer loyalty in this product line. However, in Ontario, Vox's Pre-Roll performance has been less favorable, with rankings slipping from 57th in October 2025 to 75th by January 2026, suggesting room for improvement in this province. Additionally, the absence of a ranking for their Vapor Pens in Ontario after October 2025 could indicate a significant drop in market presence or sales, highlighting a potential area of concern for the brand in this region. Understanding the dynamics of these shifts could be crucial for Vox to strategize effectively across different markets.

Competitive Landscape

In the competitive landscape of Vapor Pens in British Columbia, Vox has shown a remarkable upward trajectory in brand ranking over the past few months. Starting from a rank of 19 in October 2025, Vox surged to the 4th position by November 2025, maintaining a strong presence in the top 10 through January 2026. This improvement in rank is indicative of a significant increase in sales, particularly when compared to competitors like Kolab, which started at a lower rank of 25 in October but climbed to 6th by January. Meanwhile, Sticky Greens maintained a stable rank around 8th, and Terra Labs experienced a decline from 2nd to 10th over the same period. DEBUNK consistently outperformed Vox in November and December but saw a slight dip in January. Vox's ability to climb the ranks quickly highlights its growing market presence and potential to capture more market share in the competitive British Columbia Vapor Pens category.

Notable Products

In January 2026, the top-performing product for Vox was Shufflez Diamond Infused Pre-Roll 2-Pack in the Pre-Roll category, maintaining its first-place rank for four consecutive months with sales of 11,873 units. The Big Shiny Popz Crushable Mixer Diamond Infused Pre-Roll 5-Pack also held steady at the second position, showing consistent sales performance. Puffz- Tango Strawmango Distillate Disposable and Cartridge both retained their third and fourth positions, respectively, in the Vapor Pens category, indicating stable demand. Meanwhile, Puffz - Grape Jamz Distillate Cartridge remained in fifth place, although its sales continued to decline month over month. These rankings reflect a stable product hierarchy for Vox, with no changes in the top five positions since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.