Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the province of Alberta, Vox's performance in the Pre-Roll category has shown a steady decline in rankings from November 2025 to February 2026, starting from a rank of 40 and dropping to 46. This indicates a consistent downward trend in their market position within this category. Similarly, in the Vapor Pens category, Vox has also experienced a decline in rank from 29 to 41 over the same period. The downward movement in these rankings across both categories suggests challenges in maintaining competitive sales figures in Alberta's market.

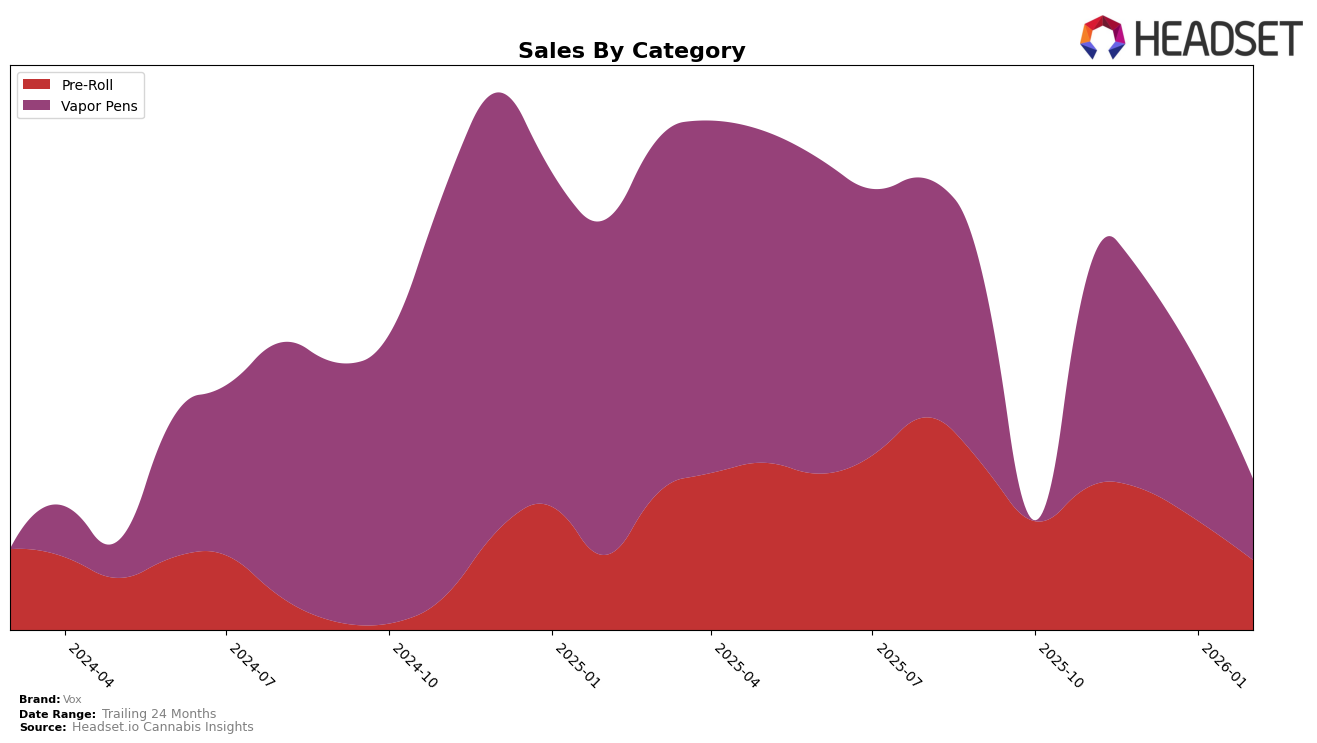

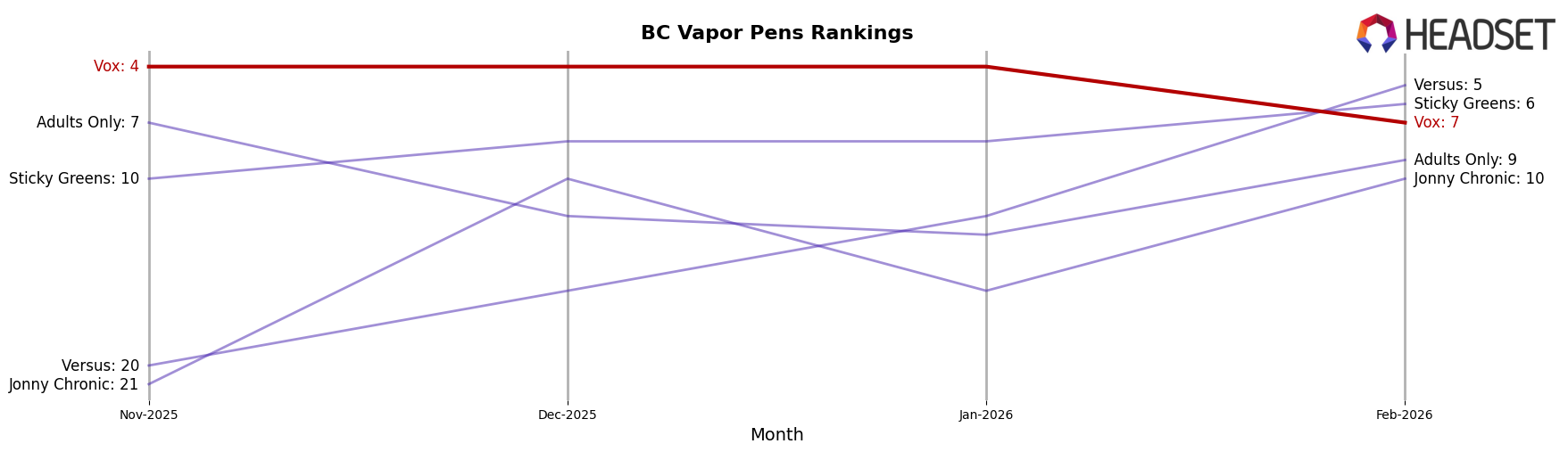

In contrast, British Columbia presents a mixed performance for Vox. While the brand's ranking in the Pre-Roll category improved significantly, breaking into the top 30 in January 2026 and maintaining a position close to it in February 2026, the Vapor Pens category displayed a different trend. Despite holding a strong position at rank 4 for several months, Vox experienced a drop to rank 7 by February 2026. This movement in rankings across categories highlights the brand's fluctuating performance and the competitive dynamics within the British Columbia market. Meanwhile, in Ontario, Vox's Pre-Roll category has not managed to break into the top 30, indicating potential areas for growth and market penetration.

Competitive Landscape

In the highly competitive Vapor Pens category in British Columbia, Vox has experienced notable shifts in its market position from November 2025 to February 2026. Initially holding a strong 4th rank in November and December 2025, Vox's rank slipped to 7th by February 2026. This decline coincided with a decrease in sales from December's peak, suggesting potential challenges in maintaining consumer interest or facing increased competition. Notably, Sticky Greens consistently outperformed Vox, climbing from 10th to 6th place, while Versus made a significant leap from 20th to 5th, indicating a strong upward trend. Meanwhile, Adults Only showed fluctuating performance, ending February 2026 just ahead of Vox at 9th place. These dynamics highlight the competitive pressures Vox faces and underscore the importance of strategic adjustments to regain its footing in the market.

Notable Products

In February 2026, the top-performing product for Vox was Shufflez Diamond Infused Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its rank at number one since November 2025, with sales reaching 11,577 units. Big Shiny Popz Crushable Mixer Diamond Infused Pre-Roll 5-Pack (2.5g) held steady in second place, continuing its trend from previous months despite a decrease in sales. Puffz- Tango Strawmango Distillate Disposable (1.2g) also retained its third place in the Vapor Pens category, although its sales figures have seen a consistent decline. Cherry Bomb Distillate Cartridge (1.2g) moved up to fourth place from fifth in January, showing a slight improvement in its rankings. Meanwhile, Puffz- Peach Melonberry Distillate Disposable (1.2g) entered the top five for the first time in February, indicating a rising interest in this new product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.