Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

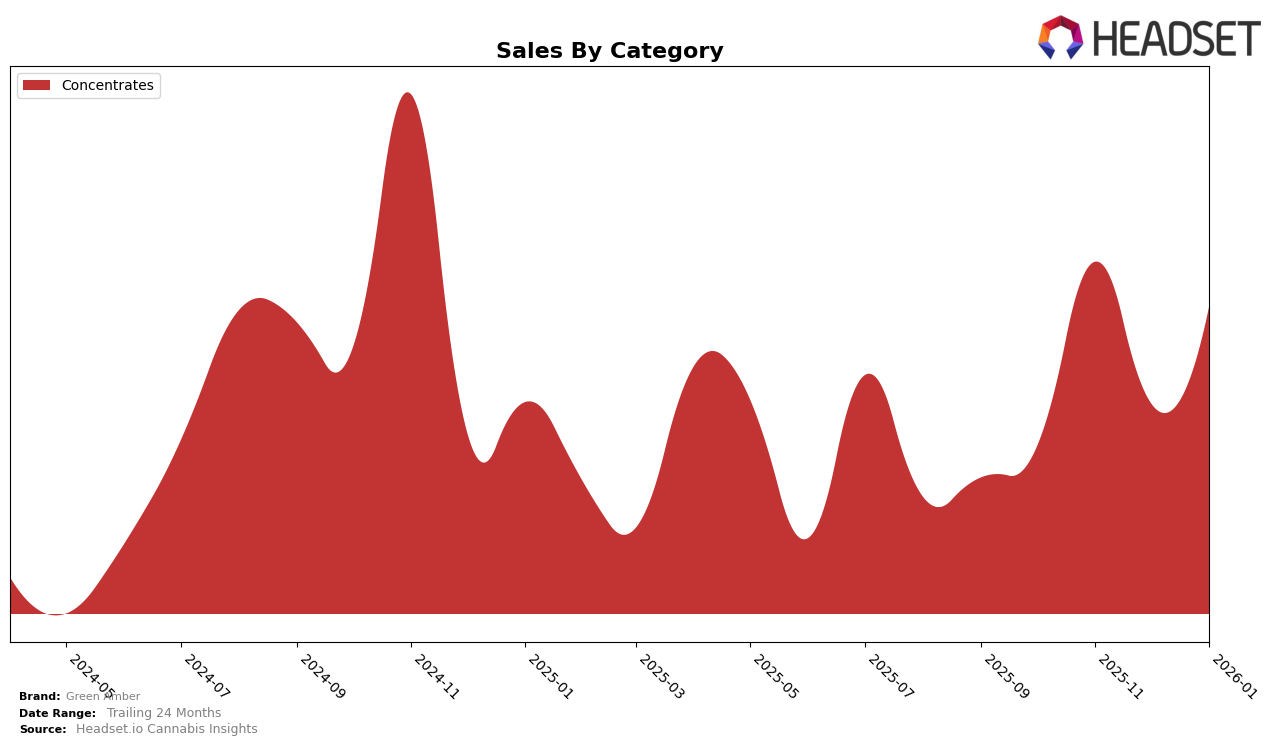

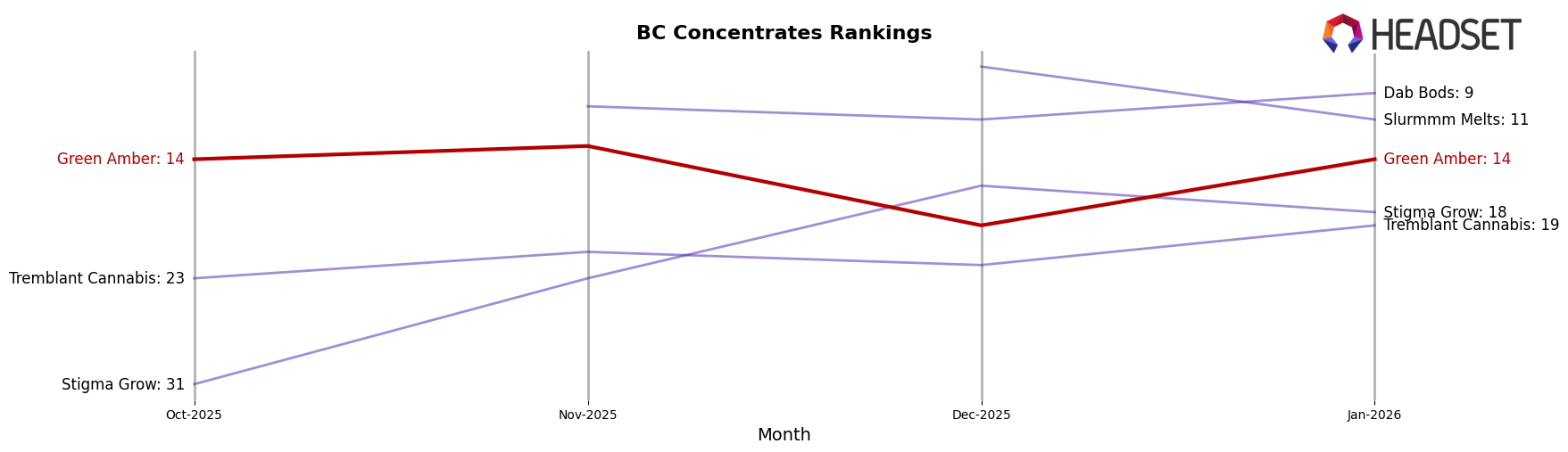

In the British Columbia market, Green Amber has shown dynamic performance in the Concentrates category over the past few months. Starting in October 2025, the brand was ranked 14th, and while it dipped to 19th in December, it managed to rebound back to 14th by January 2026. This fluctuation indicates a competitive landscape in the Concentrates category, but Green Amber's ability to regain its position suggests resilience and potential consumer loyalty. Notably, the brand was consistently within the top 20, which underscores its relevance in the market. However, the fluctuation in rankings might also point to challenges in maintaining consistent sales momentum.

Analyzing the sales figures, Green Amber experienced a notable increase in sales from October to November 2025, nearly doubling, which likely contributed to its improved ranking from 14th to 13th in November. Despite a drop in December sales, the brand's performance in January 2026 showed a recovery, aligning with its return to the 14th position. This recovery could be indicative of effective marketing strategies or seasonal demand shifts. The absence of ranking data outside the top 30 in any month would have been concerning, but Green Amber's presence in the rankings each month highlights its competitive stance within the British Columbia market.

Competitive Landscape

In the competitive landscape of the concentrates category in British Columbia, Green Amber has demonstrated fluctuating performance in recent months. Notably, Green Amber's rank improved from 19th in December 2025 to 14th in January 2026, indicating a positive trend in market positioning. This improvement is significant given the competitive pressure from brands like Slurmmm Melts, which entered the top 20 in December 2025 at 7th place, and Dab Bods, consistently maintaining a top 10 position. Despite the competition, Green Amber's sales in January 2026 reflect a recovery from the dip in December, suggesting resilience and potential for growth. Meanwhile, Stigma Grow and Tremblant Cannabis have shown varying ranks but remain behind Green Amber in terms of recent sales performance. This dynamic environment highlights the importance of strategic positioning and product differentiation for Green Amber to sustain its upward trajectory in the concentrates market.

Notable Products

In January 2026, the top-performing product from Green Amber was Cosmic Punch Live Rosin (1g) in the Concentrates category, which rose to the first position with sales reaching 462 units. Strawberry Shortcake Live Rosin (1g) maintained its second-place ranking from the previous month with strong sales of 391 units. Tally Man Live Rosin (1g), which previously held the top spot in November and December 2025, dropped to third place with sales significantly decreasing to 50 units. Cereal Milk Live Rosin (1g) and Maple Waffles Live Rosin (1g) both shared the fourth position, with their sales remaining relatively stable compared to December 2025. Notably, Cosmic Punch Live Rosin (1g) showed a significant upward trend in the rankings, climbing from third place in December 2025 to first place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.