Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

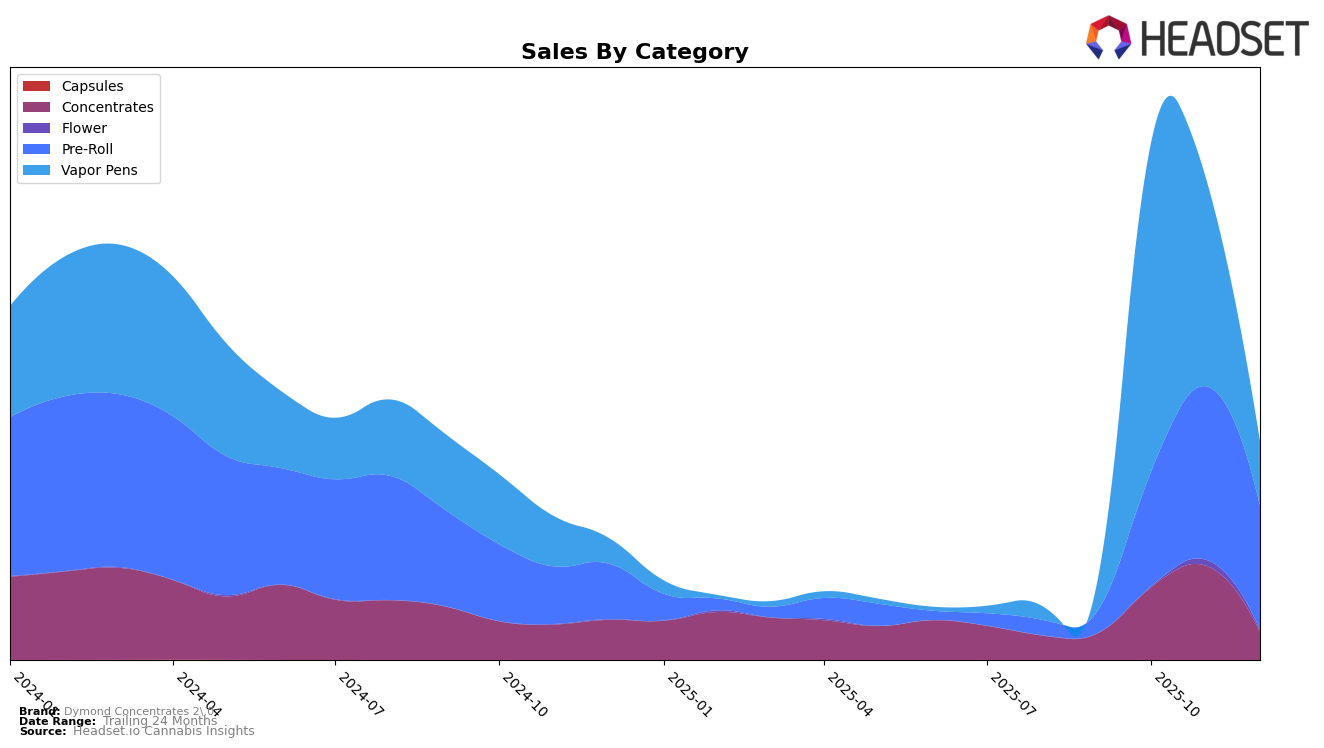

Dymond Concentrates 2.0 has shown notable fluctuations in its market performance across various categories in British Columbia. In the Concentrates category, the brand made a significant leap from being ranked 31st in September 2025 to an impressive 5th place in October, before experiencing a slight decline to 29th by December. This indicates a strong initial surge in popularity, possibly due to a new product launch or marketing campaign, followed by a stabilization period. Meanwhile, in the Vapor Pens category, Dymond Concentrates 2.0 achieved a remarkable rise to 3rd place in October from 54th in September, suggesting a robust acceptance of their products in this segment, although it tapered off to 31st by December. This pattern highlights the brand's potential to capture consumer interest quickly, albeit with some volatility.

In Ontario, Dymond Concentrates 2.0's presence was less prominent, with the brand only making an appearance in the Concentrates category in December 2025, ranking 53rd. This suggests that while the brand has managed to penetrate the market, it has yet to achieve significant traction compared to its performance in British Columbia. Moreover, the absence of rankings in other categories such as Pre-Rolls and Vapor Pens indicates that the brand is not yet a top contender in these segments within Ontario. This disparity between the two provinces could be attributed to regional preferences or distribution strategies, presenting an opportunity for the brand to reassess its approach to capture a larger market share in Ontario.

Competitive Landscape

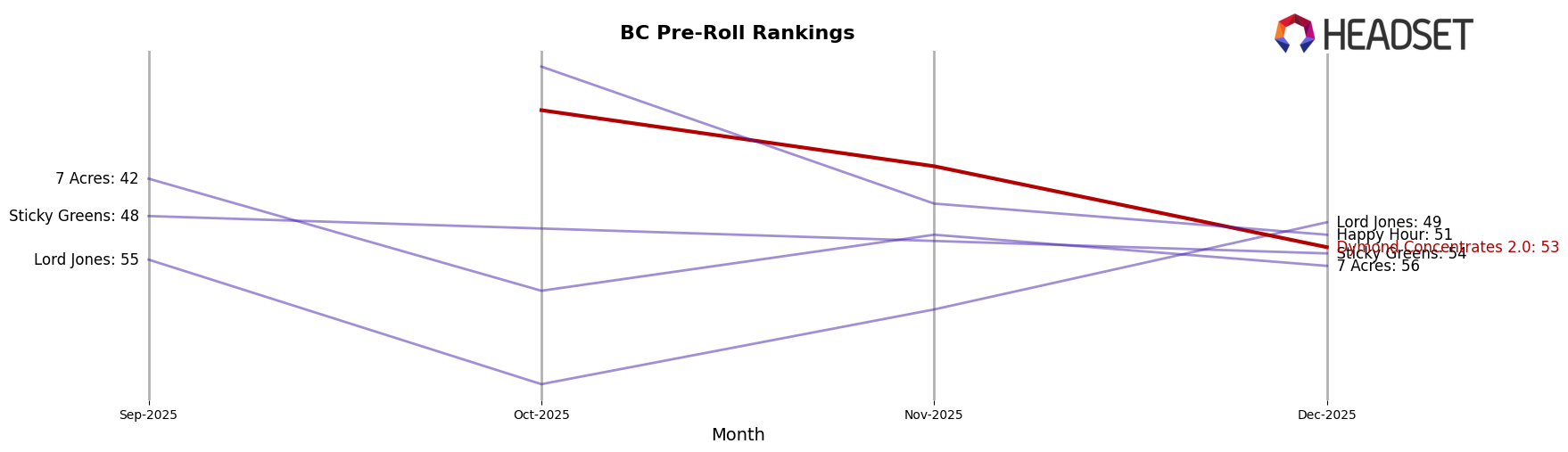

In the competitive landscape of the Pre-Roll category in British Columbia, Dymond Concentrates 2.0 has experienced notable fluctuations in its market position from September to December 2025. Initially absent from the top 20 rankings in September, Dymond Concentrates 2.0 made a strong entry in October, securing the 31st position, and maintained a presence in the top 60 through December. This upward trajectory was marked by a peak in sales during November, although a slight decline was observed in December. In contrast, Happy Hour consistently outperformed Dymond Concentrates 2.0, starting at rank 24 in October and maintaining a higher rank throughout the period. Meanwhile, 7 Acres and Sticky Greens exhibited more stable rankings, with 7 Acres showing a slight dip in December. These dynamics suggest that while Dymond Concentrates 2.0 has made significant strides, it faces stiff competition from established brands like Happy Hour, necessitating strategic efforts to sustain and enhance its market presence.

Notable Products

In December 2025, the top-performing product from Dymond Concentrates 2.0 was the Purple Punchsicle Diamonds & Sauce Infused Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank from November with notable sales of 2990 units. The Death Bubba Diamond Infused Pre-Roll 3-Pack (1.5g) also performed well, holding steady at the second rank despite a significant drop in sales compared to previous months. The Strawberry Clouds Live Resin Spectrum Cartridge (1g) ranked third, showing a decline from its previous top position in October. The Purple Punchsicle THCA Diamond Sauce Cartridge (1g) held the fourth rank, consistent with its performance in November. A new entry, Grape Runtz Mini Gems Kief Infused Pre-Roll 5-Pack (2.5g), debuted at the fifth position, filling a gap in the rankings from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.