Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

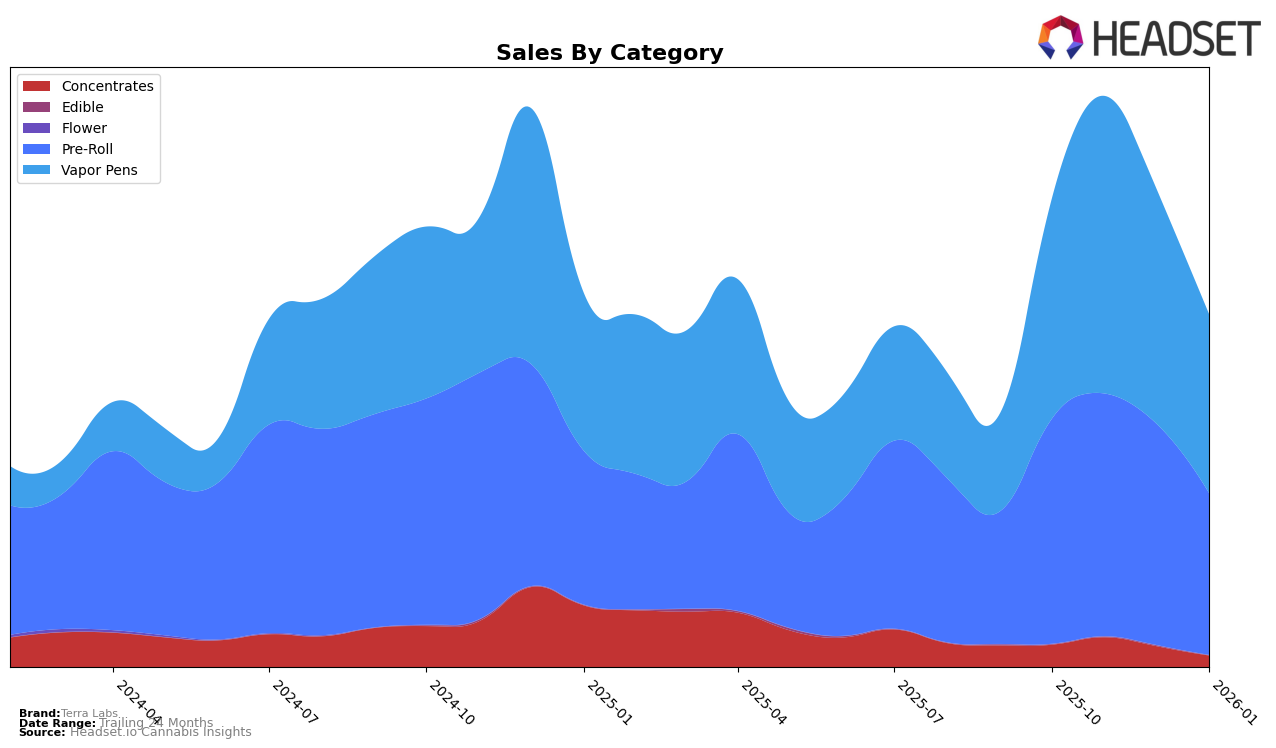

In British Columbia, Terra Labs has shown a varied performance across different cannabis categories. In the concentrates category, the brand experienced a downward trend in rankings, slipping from 15th place in October 2025 to falling out of the top 30 by January 2026. This indicates a potential loss in market competitiveness or consumer preference in this category. Conversely, the pre-roll category saw more stability, with Terra Labs maintaining a spot in the top 30, though it fluctuated between the 6th and 21st positions. Notably, the vapor pens category saw a consistent decline in ranking from 2nd to 10th place over the same period, suggesting a possible shift in consumer demand or increased competition.

In Saskatchewan, Terra Labs' presence in the pre-roll category was marked by a single appearance in October 2025, where it ranked 49th. This indicates that the brand is not a major player in the Saskatchewan market or that it has limited product offerings in this area. The absence of subsequent rankings in the following months highlights a potential area for growth or an indication that the brand is not focusing its efforts in this province. The data suggests that while Terra Labs has had some success in British Columbia, especially in the vapor pens category, its performance in other provinces like Saskatchewan is minimal, pointing to opportunities for strategic expansion or reevaluation of market strategies.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Terra Labs has experienced a notable shift in its market position from October 2025 to January 2026. Initially ranked 2nd in October, Terra Labs saw a decline to 10th place by January. This drop in rank coincides with a decrease in sales, indicating potential challenges in maintaining its market share. In contrast, competitors such as Sticky Greens and Vox have shown upward trends, with Sticky Greens climbing from 11th to 8th and Vox making a significant leap from 19th to 7th. Meanwhile, Versus and Trippy Sips have also improved their standings, suggesting increased competition in the market. These dynamics highlight the importance for Terra Labs to reassess its strategies to regain its competitive edge in the rapidly evolving vapor pen category in British Columbia.

Notable Products

In January 2026, Terra Labs' top-performing product was the Strawberry Tsunami Diamond Infused Pre-Roll 5-Pack (2.5g), which climbed to the number one spot despite a slight decrease in sales to 1218 units. The Grape Burst Infused Pre-Roll 3-Pack (1.5g) followed closely in second place, showing a consistent presence in the top ranks since November 2025. The Holiday Choc Mint Diamond Infused Pre-Roll (1g) slipped to third place, having previously held the second rank in December 2025. The Lemonade Lava Diamond Infused Pre-Roll 5-Pack (2.5g) made its debut in the rankings at fourth place. Meanwhile, the White Widow Pure Live Resin Cartridge (1g) maintained its position at fifth, indicating stable performance over the recent months.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.