Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

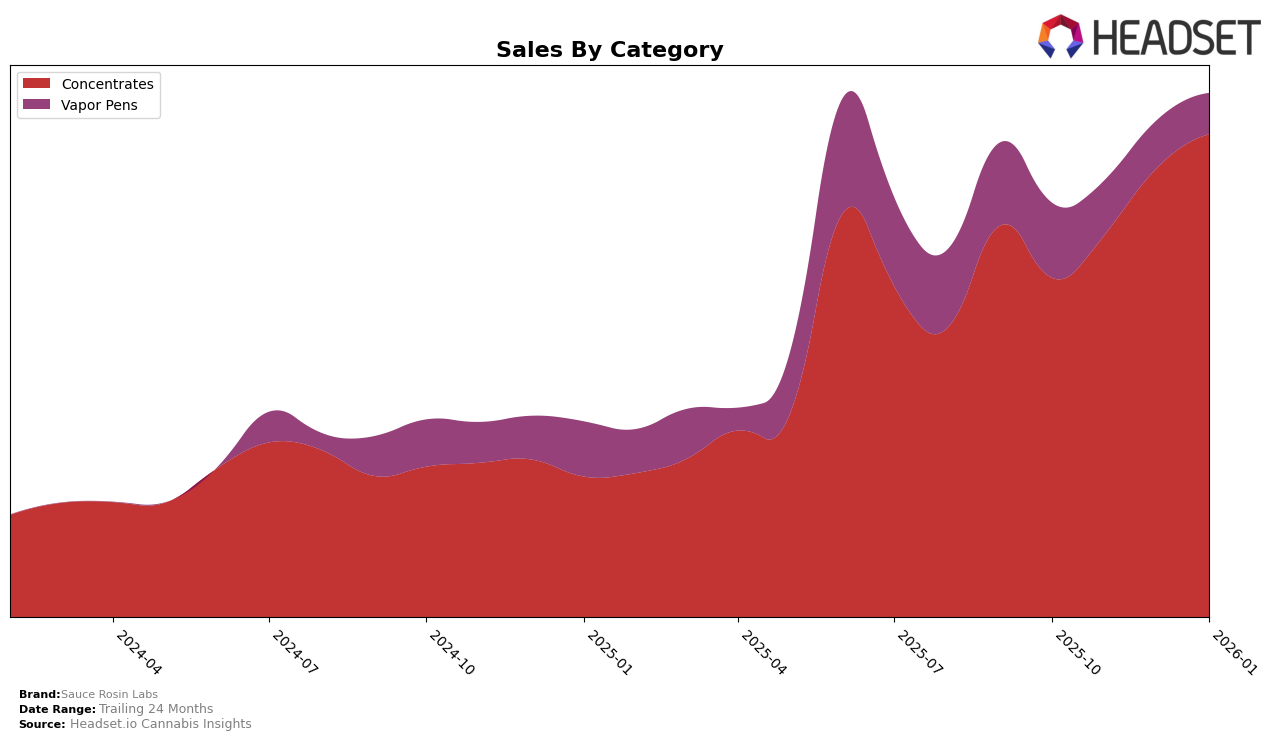

Sauce Rosin Labs has shown notable performance in the Concentrates category across both British Columbia and Ontario. In British Columbia, the brand maintained a strong presence, with rankings fluctuating between 6th and 11th place over the four months, indicating a stable market position. Despite a dip in November, their sales rebounded in December, suggesting resilience and a strong customer base. In Ontario, the brand demonstrated an impressive upward trajectory, climbing from 16th place in October to 9th in January, highlighting increased consumer preference or possibly successful marketing strategies in the region.

In contrast, Sauce Rosin Labs' performance in the Vapor Pens category was less prominent. In British Columbia, they did not make it into the top 30, which might point to challenges in penetrating this market segment or stronger competition. Similarly, in Ontario, the brand consistently ranked around the 98th position, indicating a struggle to gain significant traction. This disparity between categories could suggest a need for strategic adjustments in their Vapor Pens offerings or marketing approach to enhance visibility and sales in this category. The lack of top rankings in Vapor Pens in both provinces underscores potential areas for growth and improvement.

Competitive Landscape

In the competitive landscape of the concentrates category in Ontario, Sauce Rosin Labs has shown a notable improvement in its market position from October 2025 to January 2026. Initially ranked 16th in October 2025, Sauce Rosin Labs climbed to 9th by January 2026, indicating a positive trajectory in both rank and sales. This upward movement contrasts with competitors such as 1964 Supply Co, which saw a decline from 9th to 12th place, and MTL Cannabis, which dropped from 5th to 7th place. Meanwhile, Shatterizer maintained a steady position around the 10th rank, and BoxHot consistently ranked in the top 10, indicating strong competition. Sauce Rosin Labs' sales growth, particularly in January 2026, suggests a successful strategy in capturing market share and improving brand visibility, setting a promising outlook for continued advancement in the Ontario concentrates market.

Notable Products

In January 2026, the top-performing product from Sauce Rosin Labs was the Seasonal Sweet Exotics Pack Live Rosin (1g) in the Concentrates category, maintaining its first-place ranking from October and November, with a notable sales figure of 1517 units. The Papaya Live Rosin (1g) debuted impressively in second place, having no prior rankings. Signature - Grease Bucket Live Rosin (1g) held its ground at third, consistent with its previous performance in October and November. Signature - She-Ra Live Rosin (1g) slipped to fourth place from its debut in third in December. The Hybrid Solventless Live Rosin Cartridge (0.5g) maintained its fifth-place ranking, consistent with December's performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.