Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

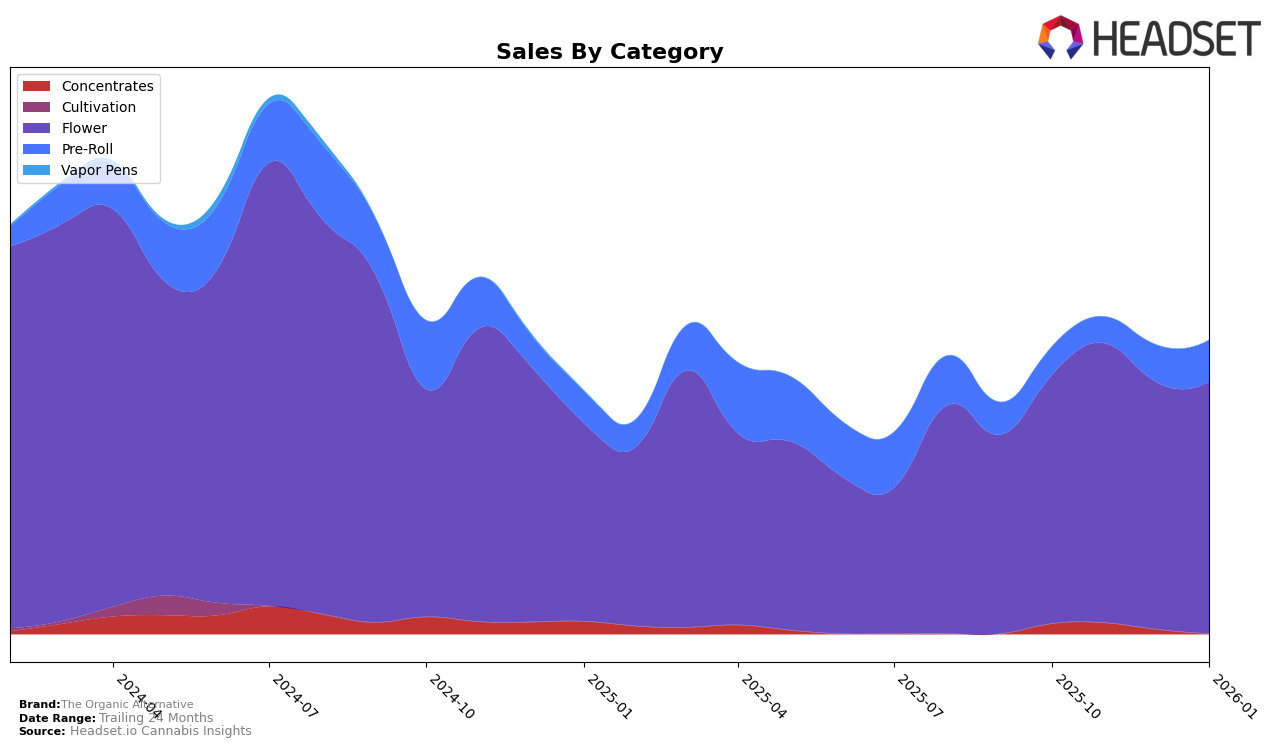

The Organic Alternative has shown varied performance across different product categories in Colorado. In the Flower category, the brand maintained a relatively stable presence, with rankings fluctuating slightly between 22nd and 30th place from October 2025 to January 2026. This consistency suggests a steady demand for their flower products, with a slight dip in December followed by a recovery in January. In contrast, the Concentrates category did not see the brand breaking into the top 30, indicating a potential area for improvement or a shift in consumer preference away from their offerings in this segment.

Regarding the Pre-Roll category, The Organic Alternative made noticeable strides, improving from 55th place in October 2025 to 38th by January 2026. This upward trend suggests a growing acceptance or popularity of their pre-roll products, possibly driven by product innovation or effective market strategies. However, the absence of a top 30 ranking in the Concentrates category across the months analyzed highlights a significant gap in their market penetration or competitiveness within this product line. Such insights can be pivotal for strategic planning and product development as the brand seeks to enhance its market position in Colorado.

Competitive Landscape

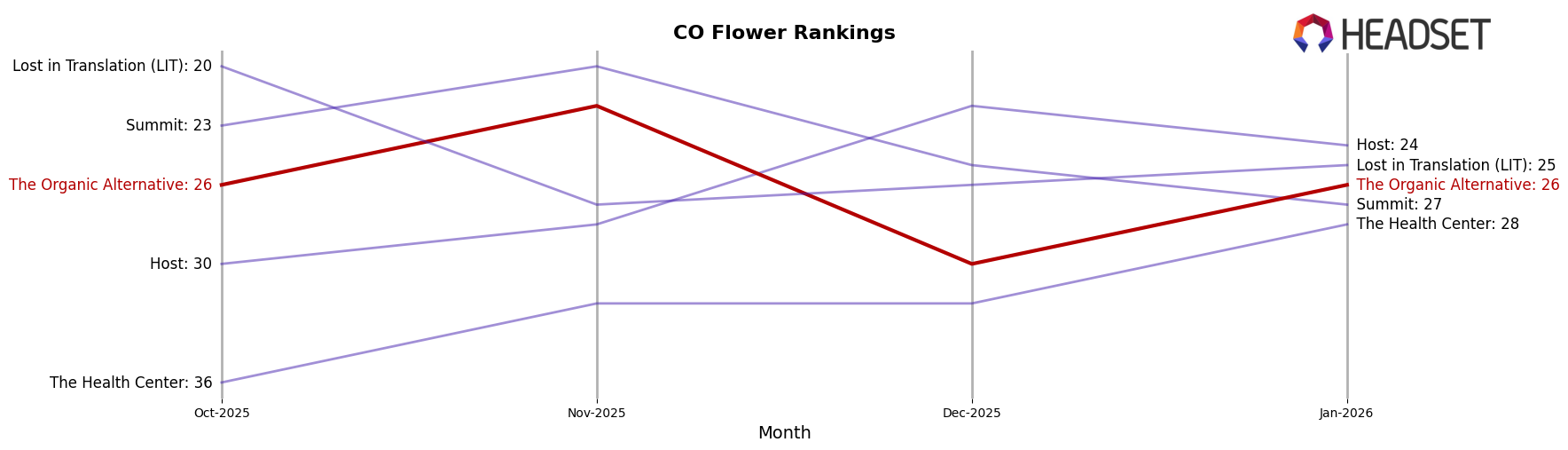

In the competitive landscape of the Flower category in Colorado, The Organic Alternative has experienced fluctuations in its market rank over the past few months, highlighting the dynamic nature of this sector. Starting at rank 26 in October 2025, The Organic Alternative improved to 22 in November, only to drop to 30 in December, before recovering slightly to 26 in January 2026. This volatility suggests a competitive environment where brands like Summit and Lost in Translation (LIT) are also experiencing shifts, with Summit's rank declining from 23 to 27 and LIT's fluctuating between 20 and 27 over the same period. Meanwhile, Host has shown a notable upward trend, improving from rank 30 to 24, which could indicate a growing market presence. These movements suggest that while The Organic Alternative remains a key player, maintaining and improving its position will require strategic efforts to navigate the competitive pressures from both established and emerging brands in the Colorado Flower market.

Notable Products

In January 2026, Lemon Delight (3.5g) secured the top position among The Organic Alternative's products, with sales reaching 888 units. Wedding Cake (3.5g) maintained its strong performance by holding the second spot, a consistent ranking from December 2025, although its sales slightly declined from 781 to 725 units. Blue Dream Pre-Roll (0.5g) experienced a drop from its first-place finish in December 2025 to third place in January 2026. Golden Goat Pre-Roll (0.5g) remained stable in fourth place, mirroring its December 2025 ranking. Mishawaka Jazz Cabbage (3.5g) saw a dip in its ranking, moving from third in December 2025 to fifth in January 2026, indicating a shift in consumer preference within the flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.