Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

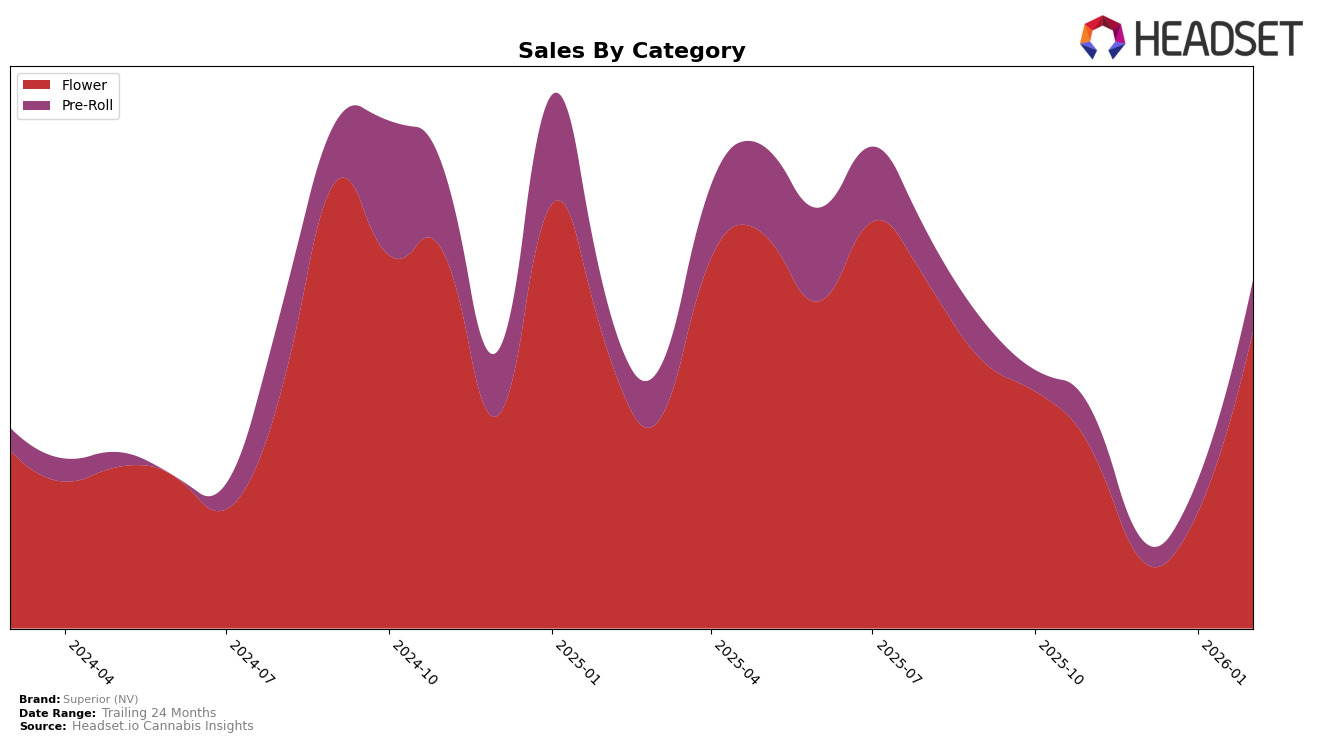

Superior (NV) has shown a notable performance in the Nevada market, particularly in the Flower category. In November 2025, the brand barely made it into the top 30, ranking 30th, but it experienced a significant drop in December, falling to 47th place. However, Superior (NV) rebounded in the following months, climbing back to 33rd in January 2026 and achieving an impressive 18th place by February. This upward trend suggests a strong recovery and growing consumer preference, with sales more than tripling from December to February. The brand's ability to recover and improve its ranking indicates effective strategies in product offerings or market penetration.

In the Pre-Roll category, Superior (NV) maintained a more consistent presence in the rankings within Nevada. Starting at 23rd place in November 2025, the brand slipped to 30th in December but managed to climb back to 28th in January 2026. By February, Superior (NV) had matched its Flower category performance with an 18th place ranking. This steady improvement across both categories in Nevada suggests a balanced approach to product development and marketing. The consistent top 30 presence in Pre-Roll, even during the dip in December, highlights the brand's resilience and potential for continued growth in this category.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Superior (NV) has shown a remarkable recovery in its market position from November 2025 to February 2026. Initially ranked 30th in November, Superior (NV) experienced a significant drop to 47th in December. However, the brand made a strong comeback, climbing to 33rd in January and achieving an impressive 18th position by February. This upward trajectory is indicative of a robust recovery in sales performance, particularly when compared to competitors like Polaris MMJ and Srene, both of which maintained relatively stable rankings throughout the period. Notably, Srene consistently outperformed Superior (NV) in terms of rank, peaking at 8th in December, while Polaris MMJ showed a similar recovery pattern, reaching 14th in December. Meanwhile, Khalifa Kush and Savvy also demonstrated competitive resilience, with Khalifa Kush improving its rank to 17th by February. Superior (NV)'s ability to rebound and improve its rank amidst strong competition highlights its potential for continued growth in the Nevada market.

Notable Products

In February 2026, the top-performing product for Superior (NV) was Alien Moon Pie Pre-Roll (1g) in the Pre-Roll category, which climbed to the number 1 rank with notable sales of 4152 units. Hawaiian Punch Pre-Roll (1g) followed in the second position, maintaining a strong presence despite dropping from its consistent top spot in previous months. Leftovers (3.5g), a new entrant in the rankings, secured the third position in the Flower category. Alien Moon Pie (3.5g) improved its position from fifth to fourth, showing a steady increase in sales. Pineapple Chunk (3.5g) rounded out the top five, slipping slightly from its second-place rank in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.