Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

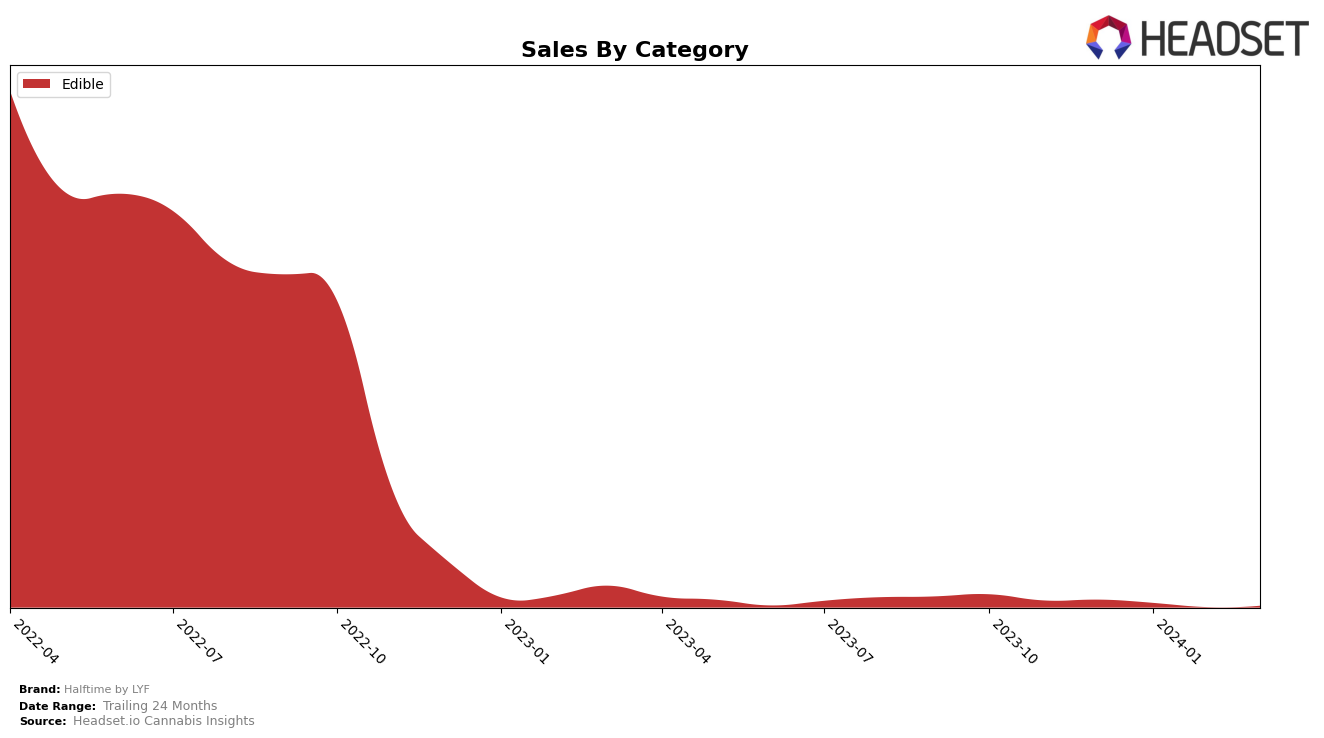

In the competitive landscape of edibles within the cannabis market, Halftime by LYF has shown a consistent performance in British Columbia, maintaining its position within the top 30 brands across the months from December 2023 to March 2024. This consistency is noteworthy, especially in a category as crowded and competitive as edibles. The brand's sales in British Columbia saw a dip from December 2023 to February 2024, dropping from 4457.0 to 2728.0, before making a slight recovery in March 2024 to 3047.0. This fluctuation in sales, while maintaining its rank, suggests a resilient demand for Halftime by LYF's offerings in the province, amidst varying market dynamics.

Contrastingly, the brand's journey in Ontario tells a different story. Initially ranked at 79 in December 2023, Halftime by LYF showed a promising upward trajectory in January 2024, moving up to rank 73. However, the absence of a ranking for February 2024 indicates that the brand did not make it into the top 30 edibles, a significant setback. Despite this, there was a notable recovery in March 2024, as evidenced by its rank of 82, even though this still falls outside the top 30. This rollercoaster performance highlights the challenges Halftime by LYF faces in Ontario's highly competitive edibles market, yet also suggests a certain level of resilience and potential for recovery.

Competitive Landscape

In the competitive landscape of the edible cannabis market in British Columbia, Halftime by LYF has experienced fluctuations in its ranking, indicating a challenging environment for brand positioning and sales. Starting from December 2023, Halftime by LYF was ranked 27th, and despite slight variations, it managed to climb one position to 27th by March 2024. This movement is modest when compared to competitors such as Rosin Heads, which saw a significant jump from 30th to 25th place in the same period, showcasing a remarkable improvement in both rank and sales. Another notable competitor, BLAST, experienced a dip in January but rebounded by March, indicating volatile market dynamics. Meanwhile, Legend Cannabis and THC BioMed have shown declining trends in both rankings and sales, suggesting potential opportunities for Halftime by LYF to capture a larger market share. The data suggests that while Halftime by LYF is maintaining a steady position, the brand needs to strategize effectively to leverage the shifting dynamics and improve its market standing amidst fierce competition.

Notable Products

In March 2024, Halftime by LYF's top product was the Peanut Butter Chocolate Cup (10mg) from the Edible category, maintaining its number one rank consistently since December 2023. This product saw a sales figure of 551 units in March, indicating its strong market presence and consumer preference. There was no other product data provided to compare rankings or sales figures for March 2024 or to analyze trends from previous months. Therefore, the Peanut Butter Chocolate Cup (10mg) stands out as the singular top-performing product for Halftime by LYF in the specified month. This analysis highlights the product's sustained popularity and dominance in the edible category within the cannabis market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.