Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

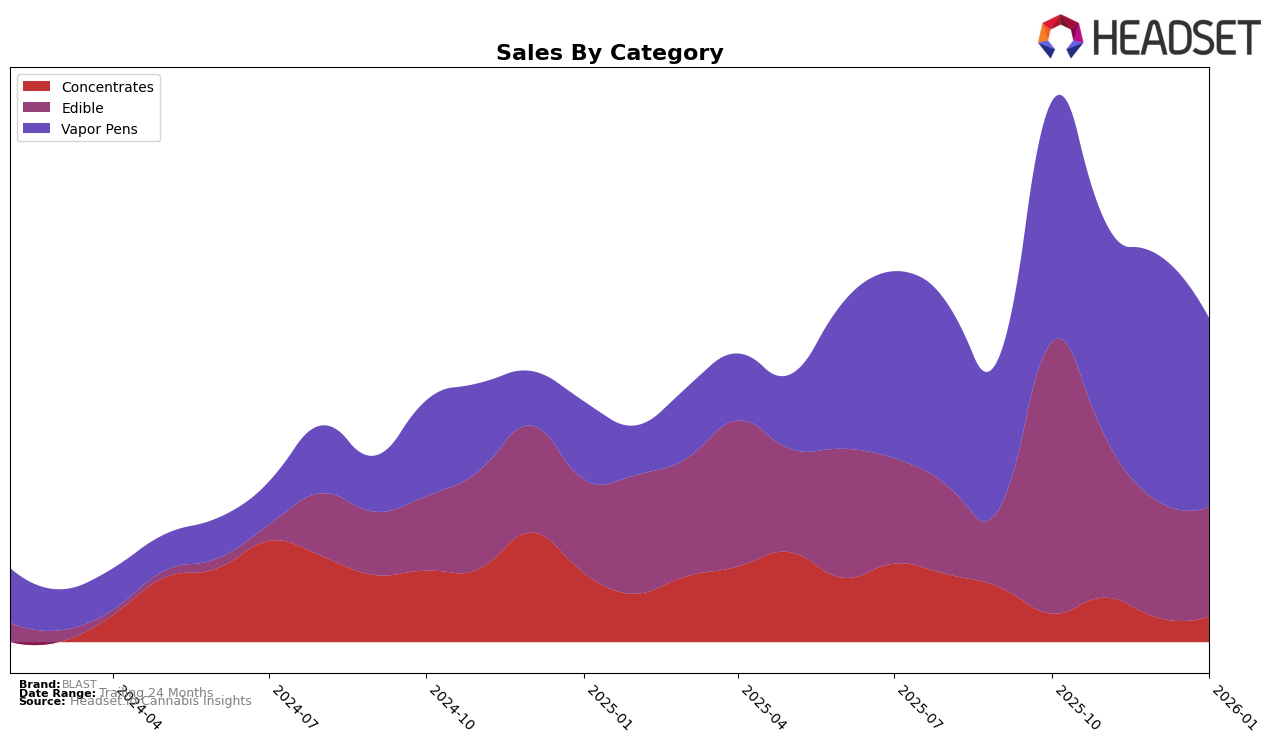

In British Columbia, BLAST has shown a consistent presence in the Edible category, maintaining a top 10 position from October 2025 to January 2026. However, there is a noticeable downward trend from a rank of 5 in October to 11 by January, indicating a possible decline in market share or increased competition. In the Vapor Pens category, BLAST's performance has been more volatile, with rankings fluctuating between 36 and 51 over the same period. Despite these fluctuations, the brand did not break into the top 30, suggesting that while they are active, they are not yet a dominant player in this segment.

In Alberta, BLAST's absence from the top 30 in the Vapor Pens category suggests a challenging market landscape or a strategic focus elsewhere. Meanwhile, in Ontario, BLAST has been hovering around the 90s in the same category, indicating a struggle to gain significant traction. On the other hand, Illinois presents a more stable scenario where BLAST has maintained a consistent ranking in the low 60s for Vapor Pens over the four-month period, pointing towards a steady, albeit modest, presence. These patterns highlight the brand's varied performance across regions, reflecting both opportunities and challenges in expanding their market footprint.

Competitive Landscape

In the competitive landscape of the Edible category in British Columbia, BLAST has experienced notable shifts in both rank and sales over the past few months. Starting from a strong position at rank 5 in October 2025, BLAST saw a decline to rank 11 by January 2026. This downward trend in rank is mirrored by a significant decrease in sales, suggesting a potential loss of market share. In contrast, competitors like Woody Nelson have maintained a relatively stable position, only slightly dropping from rank 4 to 9, while Wildflower Canada has shown an upward trajectory, improving from rank 15 to 10. The consistent performance of Chowie Wowie at rank 12 further emphasizes the competitive pressure BLAST faces. These insights highlight the dynamic nature of the market and the need for BLAST to strategize effectively to regain its competitive edge.

Notable Products

In January 2026, the top-performing product from BLAST was the LA Kush Cake Sour Pineapple Live Rosin Gummy (10mg), maintaining its first-place rank for the fourth consecutive month with sales of 7,222 units. The Animal Style Sour Wild Raspberry Live Rosin Soft chews (10mg) held steady in the second position, showcasing consistent demand. The CBN/THC 1:1 Lunar Eclipse Lemon Chamomile Live Rosin Gummy (10mg CBN, 10mg THC) climbed to the third rank from fifth in November, indicating a growing interest in this product. Bunch of Those Lemon Lime x Super Lemon Haze Gummy (10mg) experienced a decline, slipping from the top spot in October to fourth place by January. The new entrant, Solar Eclipse Live Rosin Chews 10-Pack (10mg CBG, 10mg THC), debuted at the fifth position, highlighting its potential in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.