Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

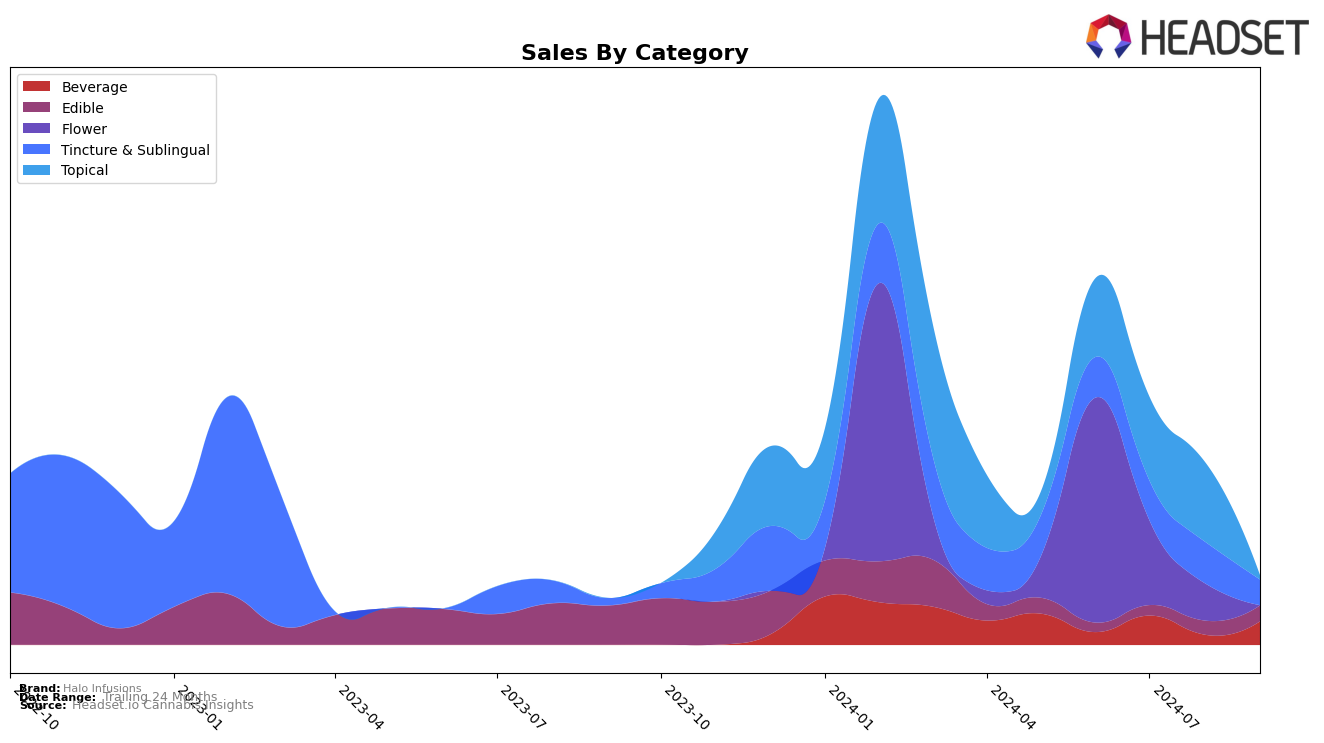

Halo Infusions has shown varied performance across different states and categories in recent months. In Arizona, the brand's presence in the Flower category has been notable, although it did not secure a spot in the top 30 rankings from July through September 2024. This absence from the top rankings could indicate a competitive market landscape or potential shifts in consumer preferences, suggesting areas where the brand might focus on strengthening its market position. Such insights are crucial for understanding the dynamics at play in this specific state and category.

Across other states and categories, Halo Infusions' performance data is not available, which might imply that the brand has not yet established a significant presence or faced intense competition. The lack of rankings in these areas could be viewed as an opportunity for market expansion or a need for strategic adjustments to capture a larger market share. Observing these trends and movements can offer valuable insights into the brand's overall market strategy and areas that might require further investment or innovation. Understanding these dynamics can be essential for stakeholders looking to gauge Halo Infusions' market trajectory.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, Halo Infusions has been navigating a challenging environment. As of June 2024, Halo Infusions was ranked 82nd, indicating a need for strategic adjustments to improve its market position. In contrast, competitors like Fig Farms and Amber were not ranked in the top 20, but their sales figures were significantly higher, suggesting a stronger market presence despite their absence from the top ranks. Meanwhile, Summus showed a positive trajectory, improving from 84th in June to 76th in August, which could indicate a competitive threat if this trend continues. Fourtwenty also experienced a drop from 68th to 75th between June and July, demonstrating the volatility within the market. For Halo Infusions, understanding these dynamics and leveraging advanced data insights could be crucial for enhancing their competitive strategy and boosting sales.

Notable Products

In September 2024, the top-performing product from Halo Infusions was Mango Flower Pop Candy (10mg) in the Edible category, which climbed to the number one spot with sales of 89 units. Watermelon Flower Pop Candy (10mg), also in the Edible category, maintained its position at number two, though its sales slightly decreased from the previous month. Orange Juice Drink (100mg, 8oz) in the Beverage category rose to third place, showing a consistent presence in the top rankings. Just Apple Juice Drink (100mg, 8oz), another Beverage product, debuted in fourth place, indicating a positive reception. Meanwhile, Canine CBD - Tuna Relief Oil (600mg CBD) entered the top five for the first time, reflecting a growing interest in pet-related products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.