Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

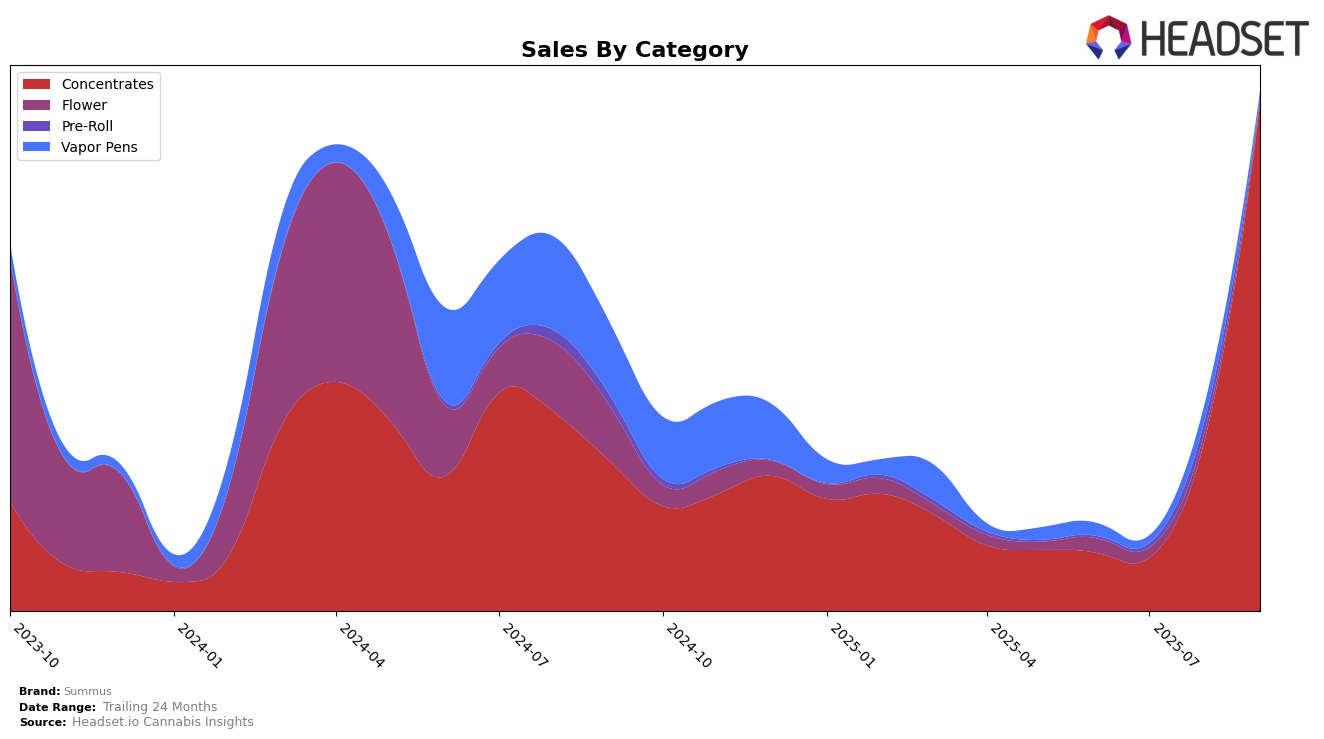

Summus has shown a notable upward trajectory in the Concentrates category within Arizona. After not ranking within the top 30 in June and July 2025, Summus made a significant leap to the 20th position in August and further climbed to the 9th position by September. This remarkable rise in ranking highlights a successful strategy or product launch that resonated well with consumers during this period. The jump from not being in the top 30 to breaking into the top 10 in just two months is indicative of a strong market presence and growing brand recognition in the state.

The sales figures for Summus in Arizona reflect this positive movement, with a dramatic increase from July to September. While specific sales numbers are not always disclosed, the significant growth in rank suggests a correlating surge in sales volume. Such a trend is likely the result of effective marketing strategies, product quality, or consumer preference shifts towards Concentrates. The absence of Summus in the top 30 for the earlier months underscores the impressive nature of their recent performance, signaling a potential for sustained success if the current momentum is maintained.

Competitive Landscape

In the competitive landscape of the Arizona concentrates market, Summus has demonstrated a remarkable upward trajectory in recent months. Starting from an unranked position in June and July 2025, Summus made a significant leap to 20th place in August and further climbed to 9th place by September. This surge in rank is indicative of a substantial increase in sales, aligning closely with the performance of established brands. Notably, Summus has surpassed Tru Infusion, which experienced a drop from 8th to 11th place over the same period. Meanwhile, TRIP and iLava maintained consistent ranks, suggesting stable sales, while Grow Sciences saw a slight fluctuation, dropping from 6th to 7th place. Summus's rapid ascent highlights its growing influence and potential to disrupt the current market dynamics, making it a brand to watch in the Arizona concentrates sector.

Notable Products

In September 2025, the top-performing product from Summus was Strawberry Gary Live Hash Rosin (1g) in the Concentrates category, which rose to the number one rank with sales of 1460 units. Jelly Breath Live Hash Rosin (1g) made a strong debut at the second position with notable sales figures. Chocolate Milk Live Hash Rosin (1g) experienced a slight drop, moving from second place in August to third in September, with 947 units sold. Secret Headband Live Hash Rosin (1g) maintained a consistent presence, ranking fourth after a steady climb from the fifth position in July. Elmers Fudge Live Hash Rosin (1g) entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.