Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

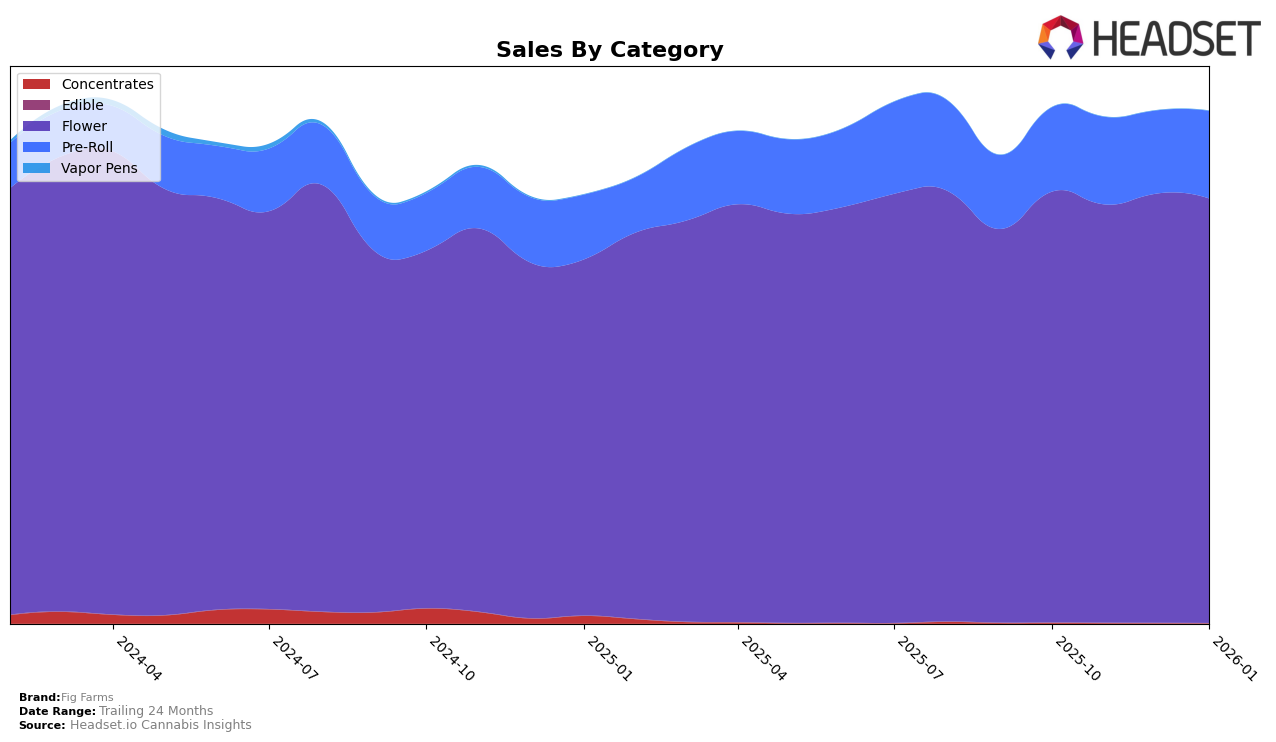

In the California market, Fig Farms has shown consistent performance in the Flower category, maintaining a solid position within the top 10 from October 2025 through January 2026. The brand ranked 10th in October and improved to 8th in November, before settling at 9th in both December and January. This stability in ranking reflects a steady demand for their flower products, with sales figures slightly increasing over this period. In contrast, their performance in the Pre-Roll category in California has been more variable. Although they started at the 28th position in October, they managed to climb to 25th by January, indicating a positive trend in consumer interest despite not consistently holding a strong top-tier position.

In Illinois, Fig Farms' presence in the Flower category has been less prominent, as they did not break into the top 30 rankings over the observed months. Their rank fluctuated slightly, moving from 55th in October to 57th by January, which suggests challenges in gaining traction in this market. This is further emphasized by the relatively lower sales figures compared to their California performance. The absence of Fig Farms in the top 30 indicates a potential area for growth or strategic adjustment to enhance their competitiveness in Illinois. The data highlights a clear contrast in Fig Farms' market penetration and consumer engagement between these two states.

Competitive Landscape

In the competitive landscape of the California flower category, Fig Farms has maintained a relatively stable position, ranking between 8th and 10th from October 2025 to January 2026. This stability contrasts with the dynamic shifts observed among its competitors. For instance, UpNorth Humboldt has shown a notable upward trajectory, climbing from 15th to 8th place, indicating a significant increase in market presence and potentially capturing a larger share of sales. Meanwhile, Coastal Sun Cannabis experienced fluctuating ranks, dropping to 16th in November before recovering to 11th by January, suggesting a volatile market performance. Alien Labs and Oakfruitland also demonstrated variability, with Alien Labs falling to 10th in January and Oakfruitland rising to 7th, highlighting the competitive pressures Fig Farms faces. Despite these shifts, Fig Farms' consistent ranking suggests a steady consumer base, though the brand must remain vigilant and adaptive to maintain its position amidst the evolving market dynamics.

Notable Products

In January 2026, Blue Face 3.5g continued to dominate as the top-performing product for Fig Farms, maintaining its number one rank despite a notable decrease in sales to 4,622 units. Cherry Martinelli 3.5g emerged as a strong contender, securing the second position with sales of 4,064 units, marking its debut in the rankings. Couch Rider 3.5g followed closely in third place with 3,752 units sold, also appearing for the first time on the list. Holy Moly Pre-Roll 1g ranked fourth, showing a slight improvement from its previous fifth-place position in October 2025. Rapper Weed 3.5g rounded out the top five, slipping from third place in December 2025, with sales of 3,478 units in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.