Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

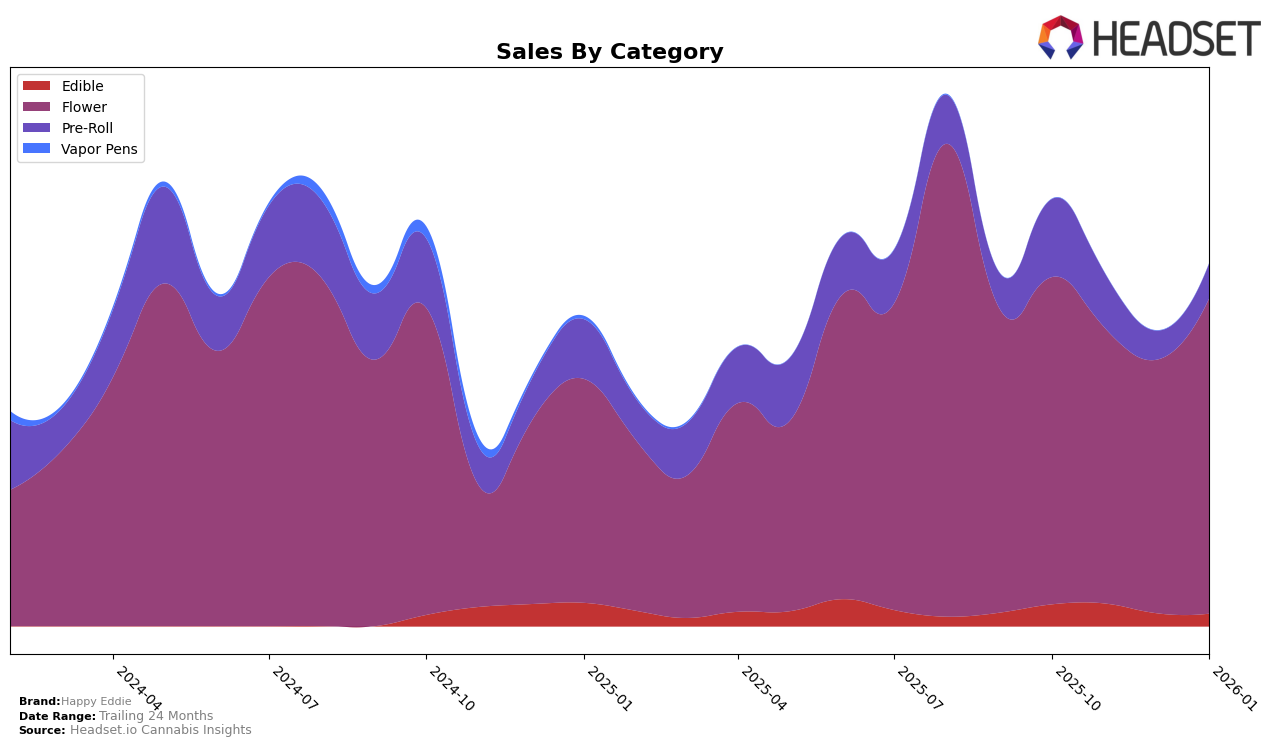

In examining Happy Eddie's performance across different categories and states, it's evident that the brand has experienced varied success. In Maryland, Happy Eddie's presence in the Edible category has been somewhat stable, maintaining a position within the top 30, although it slipped slightly out of this range in December 2025. The Flower category in Maryland shows a more dynamic movement, with Happy Eddie fluctuating between ranks 24 and 31, indicating a competitive landscape. Interestingly, the Pre-Roll category in Maryland saw a notable drop in rank from 24 in October to 42 in December, before recovering slightly in January. This fluctuation suggests a potential challenge in maintaining market share within this specific category.

Looking at other states, Happy Eddie's performance in the Flower category in Missouri reveals a positive trend, with the brand improving its rank from 63 to 52 over the four-month period. This upward trajectory might indicate growing consumer interest or effective distribution strategies in Missouri. Conversely, in New Jersey, Happy Eddie's Flower category ranking fell out of the top 30 by January 2026, highlighting a potential area for strategic improvement. The Pre-Roll category in New Jersey also did not maintain a top 30 position after October 2025, suggesting challenges in market penetration or competition. These insights provide a glimpse into the varying degrees of success and challenges Happy Eddie faces across different states and categories.

Competitive Landscape

In the Maryland flower category, Happy Eddie has experienced fluctuating rankings from October 2025 to January 2026, reflecting a dynamic competitive landscape. In October 2025, Happy Eddie held the 24th rank, but by November, it slipped to 28th, indicating a decline in market presence. This downward trend continued into December with a rank of 31st, before rebounding to 26th in January 2026. This volatility is contrasted by competitors such as Cookies, which improved its rank from 27th to 21st by December, and Small A$$ Bud, which saw a notable rise to 20th in November before stabilizing. Meanwhile, Redemption and Matter. both demonstrated varying degrees of rank stability, with Matter. showing a positive trend from 38th to 28th over the same period. These shifts suggest that while Happy Eddie faces challenges in maintaining its competitive edge, there is potential for recovery and growth, especially if it can capitalize on market opportunities and address the factors contributing to its fluctuating sales performance.

Notable Products

In January 2026, Zen Wen (3.5g) emerged as the top-performing product for Happy Eddie, climbing from the second position in December 2025 to first, with a notable sales figure of 3585. The 4 Degrees (3.5g) made its debut in the sales rankings, securing the second spot. Nigerian Silver (3.5g) experienced a slight drop, moving from first in December 2025 to third in January 2026. Mischief Pre-Roll 2-Pack (1g) maintained a steady presence, ranking fourth, having previously been unranked in December. Velvet Slippers (3.5g) remained consistent in the fifth position, showing a recovery from its dip in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.