Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

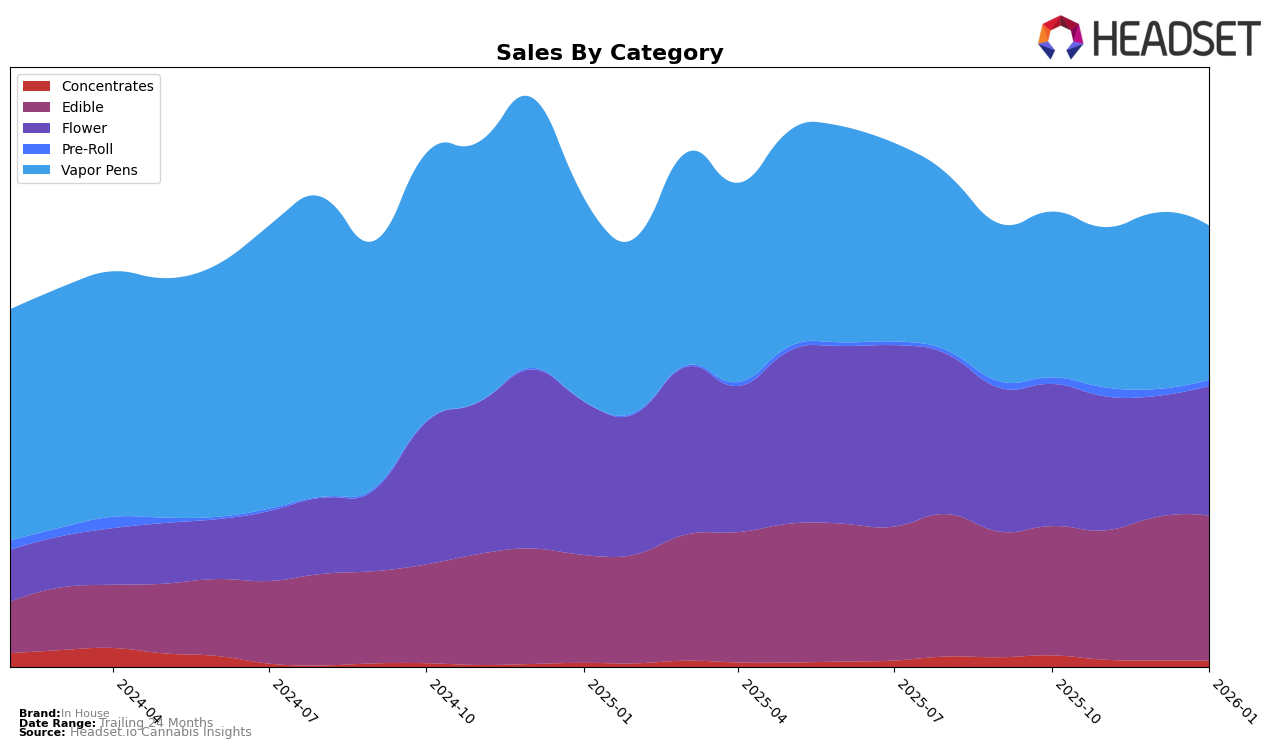

In House has demonstrated varied performance across different categories and states, with some notable trends and movements. In Illinois, the brand has shown improvement in the Edible category, moving from 31st to 27th place from October 2025 to January 2026, which indicates a positive trend in this segment. However, their ranking in the Flower category remains outside the top 30, fluctuating slightly but not breaking into a more competitive position. In the Vapor Pens category, In House has improved its standing, moving from 19th to 15th, which suggests a strengthening presence in this market. This upward trajectory in Vapor Pens is particularly noteworthy given the competitive landscape.

In Massachusetts, In House has maintained a stable position in the Edible category, consistently holding the 8th rank over the past months. This stability could indicate strong consumer loyalty or effective market strategies. In contrast, their performance in the Flower category has seen a downward shift from 17th to 21st place, suggesting potential challenges in this segment. Meanwhile, in Maryland, In House has achieved a commendable standing in the Edible category, maintaining a top 5 position, which highlights their strong foothold in this market. However, in the Vapor Pens category, despite a minor dip, they have managed to stay within the top 10, indicating a resilient performance amidst fluctuations.

Competitive Landscape

In the Maryland edibles market, In House has shown a consistent performance with a rank fluctuating between 4th and 6th place from October 2025 to January 2026. Despite this stability, the brand faces strong competition from leaders like Wyld, which has maintained a dominant position, albeit with a temporary absence from the top ranks in November 2025. Curio Wellness also presents a formidable challenge, consistently ranking just above In House. Meanwhile, Smokiez Edibles and Jams are both climbing the ranks, with Jams showing a notable upward trend from 10th to 6th place by January 2026. This competitive landscape suggests that while In House maintains a solid position, there is a pressing need to innovate and differentiate to climb higher in the rankings and increase market share.

Notable Products

For January 2026, the top-performing product from In House is the CBD/THC 5:1 Blood Orange Gummies 10-Pack, maintaining its first-place ranking from December with a notable sales figure of 13,076 units. The Cherry Lemonade Fast Acting Gummies 10-Pack moved up to the second position from third, showcasing a consistent increase in popularity. The Peach Mango Fast Acting Gummies 10-Pack experienced a drop, falling to third place after previously holding the top spot in November. The CBD/THC/CBN 3:2:1 Blueberry Dreams Nano Gummies 10-Pack remained steady in fourth place, showing gradual sales growth. Watermelon Fast Acting Gummies 10-Pack entered the rankings in December and held onto the fifth position in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.