Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

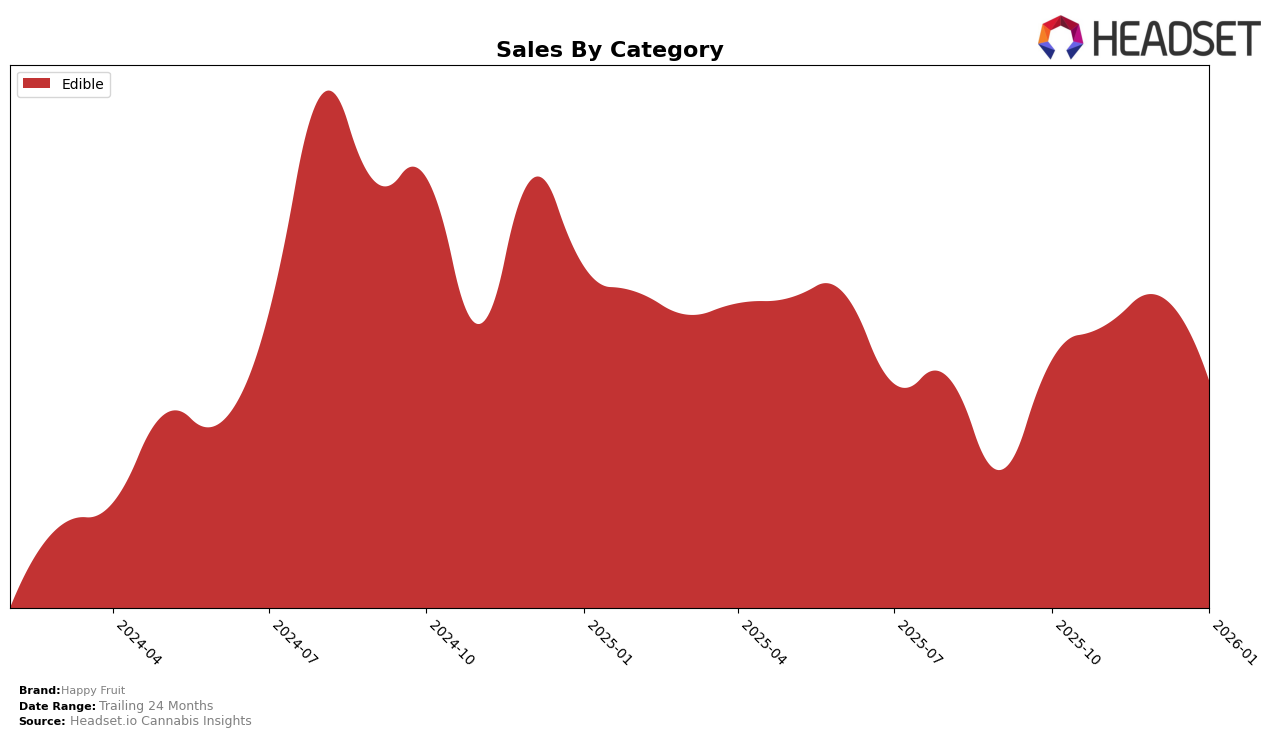

Happy Fruit has shown a consistent performance in the California edible category over the past few months. Starting from a rank of 24 in October 2025, the brand improved its position to 21 in November and maintained this rank through December before slightly slipping to 22 in January 2026. This indicates a steady demand for Happy Fruit's products in the California market, although the slight dip in January could suggest increased competition or seasonal fluctuations. Despite this, the brand's ability to remain within the top 30 consistently highlights its competitive edge and consumer appeal in the state.

While Happy Fruit's performance in California is noteworthy, it is important to consider its absence from the top 30 rankings in other states and categories. This absence could be seen as a missed opportunity for growth in those markets or a strategic focus on strengthening its presence in California. The brand's sales trajectory, which saw a peak in December 2025, followed by a decline in January 2026, might offer insights into consumer behavior and external market factors. Such trends are crucial for understanding Happy Fruit's positioning and potential areas for expansion or improvement.

Competitive Landscape

In the competitive landscape of the edible category in California, Happy Fruit has shown a dynamic performance over the past few months. Starting from October 2025, Happy Fruit was ranked 24th, but it climbed to 21st place by November and maintained this position through December before slightly dropping to 22nd in January 2026. This fluctuation in rank reflects a competitive market where brands like Petra and Space Gem have been strong contenders. Notably, Petra consistently held a higher rank, peaking at 19th in November, while Space Gem improved from 23rd to 20th by January. Despite these challenges, Happy Fruit's sales showed a positive trend, peaking in December, which suggests that while its rank may have fluctuated, consumer interest and sales volume remained robust. The consistent presence of Whoa Infused and Terra further highlights the competitive pressure in this segment, with both brands experiencing similar rank shifts. This analysis underscores the importance of strategic positioning and marketing efforts for Happy Fruit to maintain and improve its standing in the California edibles market.

Notable Products

In January 2026, the top-performing product from Happy Fruit was the THC/CBG/CBC 1:1:1 Raspberry Remedy Gummies 10-Pack, maintaining its December 2025 rank at number one with sales of 3,130 units. The THC/CBN 2:1 Moon Berry Indica Gummies 10-Pack moved up to the second position, improving from its fourth place in December. The CBD/CBG/THC 1:1:1 Peaceful Pineapple Gummies 10-Pack climbed to third place, despite a slight decrease in sales compared to the previous month. The THC/THCV 2:1 Strawberry Lifted Limeade Rosin Gummies 10-Pack fell two spots to fourth place. Berry Cool Solventless Rosin Gummies 10-Pack rounded out the top five, dropping from third place in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.