Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

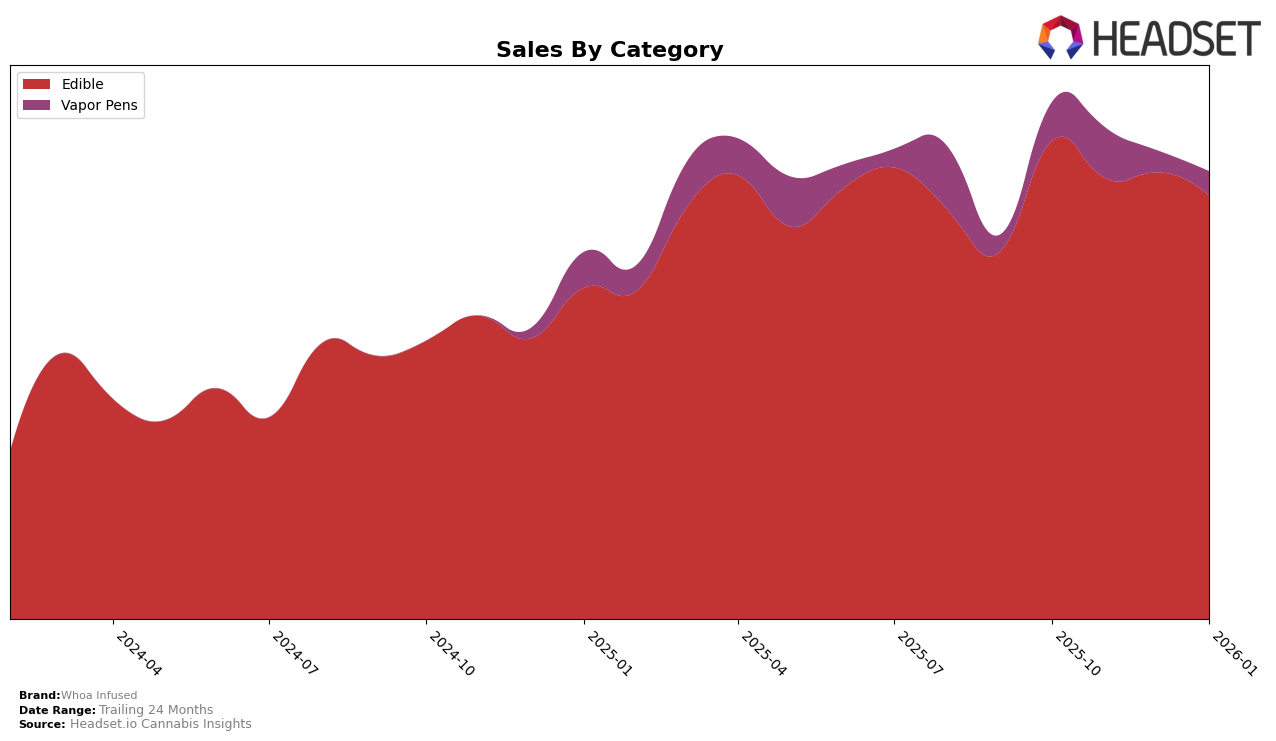

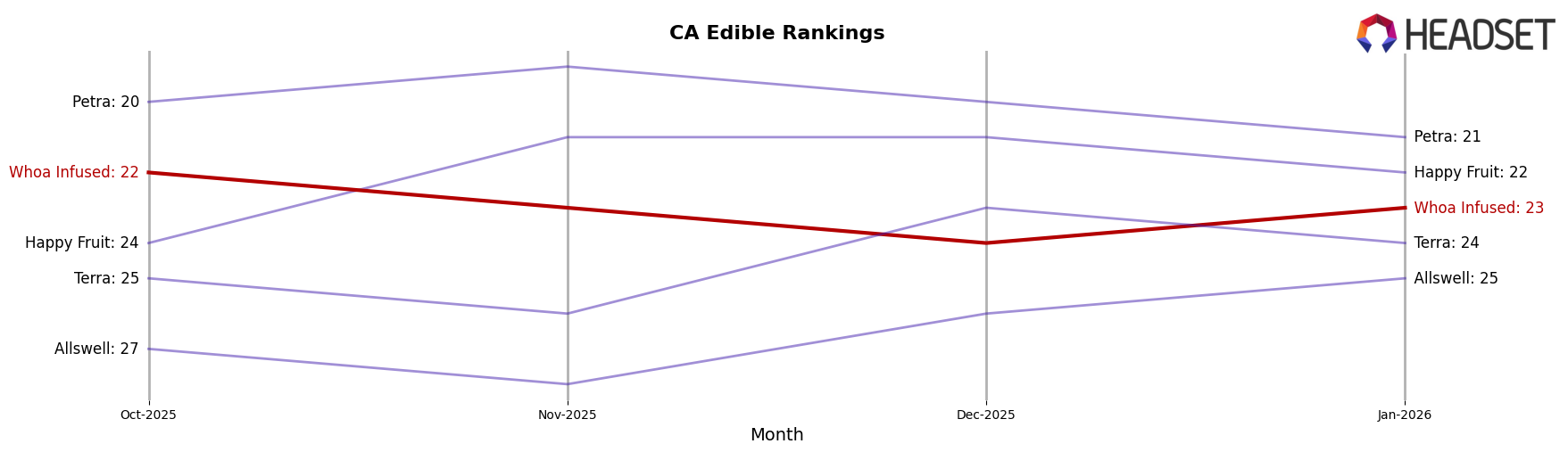

Whoa Infused has shown a consistent presence in the California market, particularly in the Edible category. Over the four-month period from October 2025 to January 2026, the brand maintained a ranking within the top 30, although it experienced some fluctuations. In October 2025, Whoa Infused was ranked 22nd, and despite a slight dip to 24th in December, it managed to climb back to 23rd in January 2026. This indicates a relatively stable performance, although the brand's sales figures reveal a gradual decline, with January 2026 sales at $248,428 compared to $280,684 in October 2025. Such stability in rankings, despite fluctuating sales, suggests that Whoa Infused has managed to maintain its market position amidst competitive pressures.

Notably, Whoa Infused's absence from the top 30 in other state markets or categories highlights a significant area for potential growth. The brand's consistent, albeit modest, performance in California suggests a strong foothold in this key market, but its lack of presence in other states or categories could indicate missed opportunities or untapped markets. This could be a strategic point for Whoa Infused to consider, as expanding their reach beyond California or diversifying their product offerings might bolster their overall market presence. Observing the brand's movements in the coming months could provide further insights into their strategic direction and adaptability in the evolving cannabis landscape.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Whoa Infused has experienced fluctuations in its ranking, notably dropping from 22nd in October 2025 to 24th by December, before slightly recovering to 23rd in January 2026. This period saw a decline in sales, contrasting with competitors such as Petra, which maintained a stronger position, ranking consistently higher and achieving notable sales growth. Meanwhile, Happy Fruit also outperformed Whoa Infused, holding a steady position around 21st place, indicating a more stable market presence. The competitive pressure from these brands suggests that Whoa Infused may need to innovate or adjust its strategies to regain its footing and improve its sales trajectory in this dynamic market.

Notable Products

In January 2026, Strawberry Gummy (100mg) maintained its position as the top-performing product for Whoa Infused, despite a slight dip in sales to 3701 units. Tangerine Gummy (100mg) rose to the second position, marking a significant comeback from its absence in the previous months. Pineapple Con chile Gummy (100mg) dropped to third place, continuing its decline from the first position in November 2025. Green Apple Gummy (100mg) secured the fourth position, consistent with its rank in November 2025. Meanwhile, Strawberry Lemonade Gummy (100mg) slipped to fifth place, following a steady decline in sales since November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.