Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

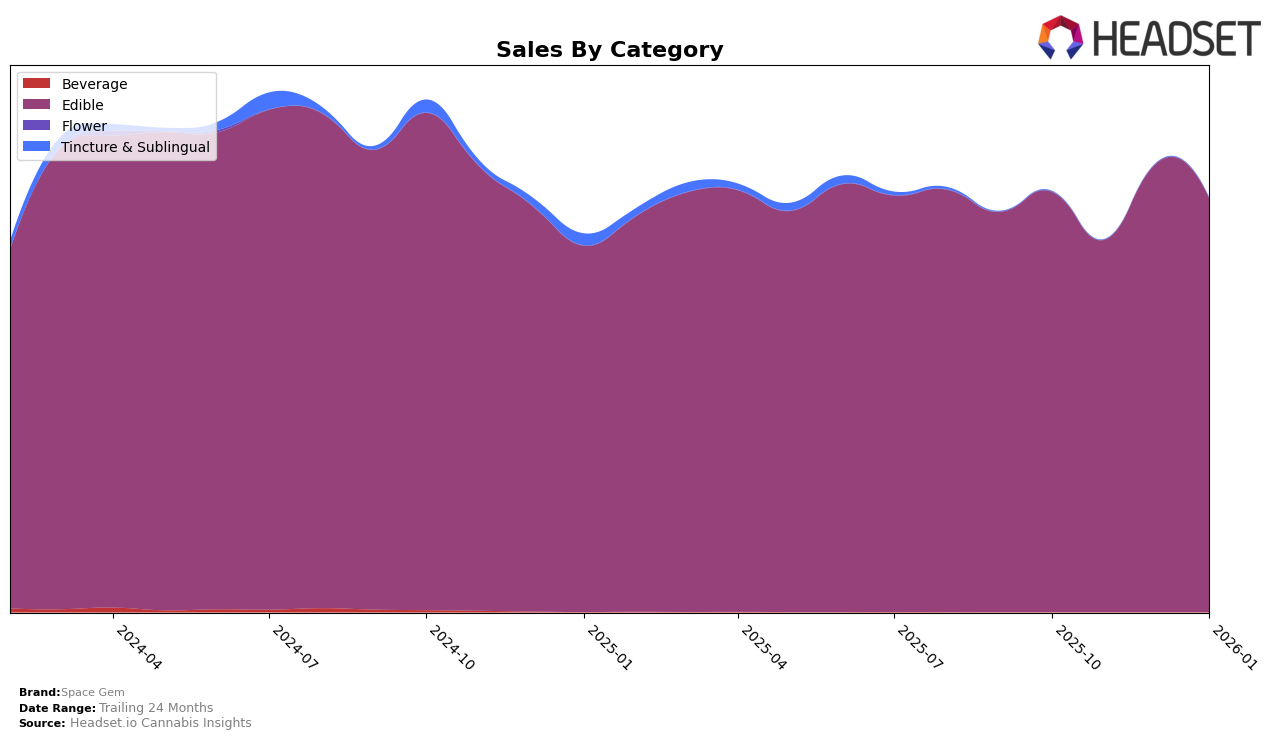

Space Gem has shown a consistent presence in the edible category within California, maintaining a position within the top 30 brands over several months. Notably, the brand's ranking improved from 24th in November 2025 to 20th by January 2026, indicating a positive trend in market performance. This upward movement is further supported by a fluctuation in sales figures, with a notable increase from November to December. However, despite the dip in sales from October to November, the brand managed to recover and improve its ranking, showcasing resilience and a strong market strategy.

While Space Gem has sustained its presence in California, it is important to note that the brand's absence from the top 30 rankings in other states or provinces suggests potential areas for growth and expansion. The brand's performance in California's competitive edible market is commendable, but the lack of data from other regions highlights a limitation in its geographic reach. This could either indicate a strategic focus on a single market or an opportunity to explore and establish a foothold in untapped areas. The brand's consistent improvement in California may serve as a benchmark for potential expansion strategies in the future.

Competitive Landscape

In the competitive landscape of the Edible category in California, Space Gem has shown a promising upward trajectory in its rankings from October 2025 to January 2026. Starting at rank 23 in October, Space Gem improved to rank 20 by January, indicating a positive shift in market positioning. This improvement is significant when compared to competitors like Kiva Chocolate, which fluctuated between ranks 15 and 18 during the same period, and Zen Cannabis, which maintained a steady position around rank 19. Space Gem's sales figures, although lower than some competitors, reflect a similar upward trend, particularly notable in December 2025. Meanwhile, Happy Fruit and Petra experienced more volatility, with Happy Fruit improving its rank slightly, while Petra saw a decline. These dynamics suggest that Space Gem is effectively capturing market share and could continue to climb the ranks if current trends persist.

Notable Products

In January 2026, the top-performing product from Space Gem was the Sweet Pink Lemonade Flying Saucer Gummy (100mg), which ascended to the number one rank with sales reaching 3,655 units. The Sour Space Drops Gummies 10-Pack (100mg), which had consistently held the top rank in previous months, slipped to second place. The Sweet Assorted Space Drops Gummies 10-Pack (100mg) maintained its third-place position from December 2025. The Flying Saucer - Sour Tangerine Gummy (100mg) remained stable, holding onto the fourth rank. Lastly, the Sour Assorted Space Drops Gummies 10-Pack (100mg) stayed in fifth, showing a slight decline in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.