Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

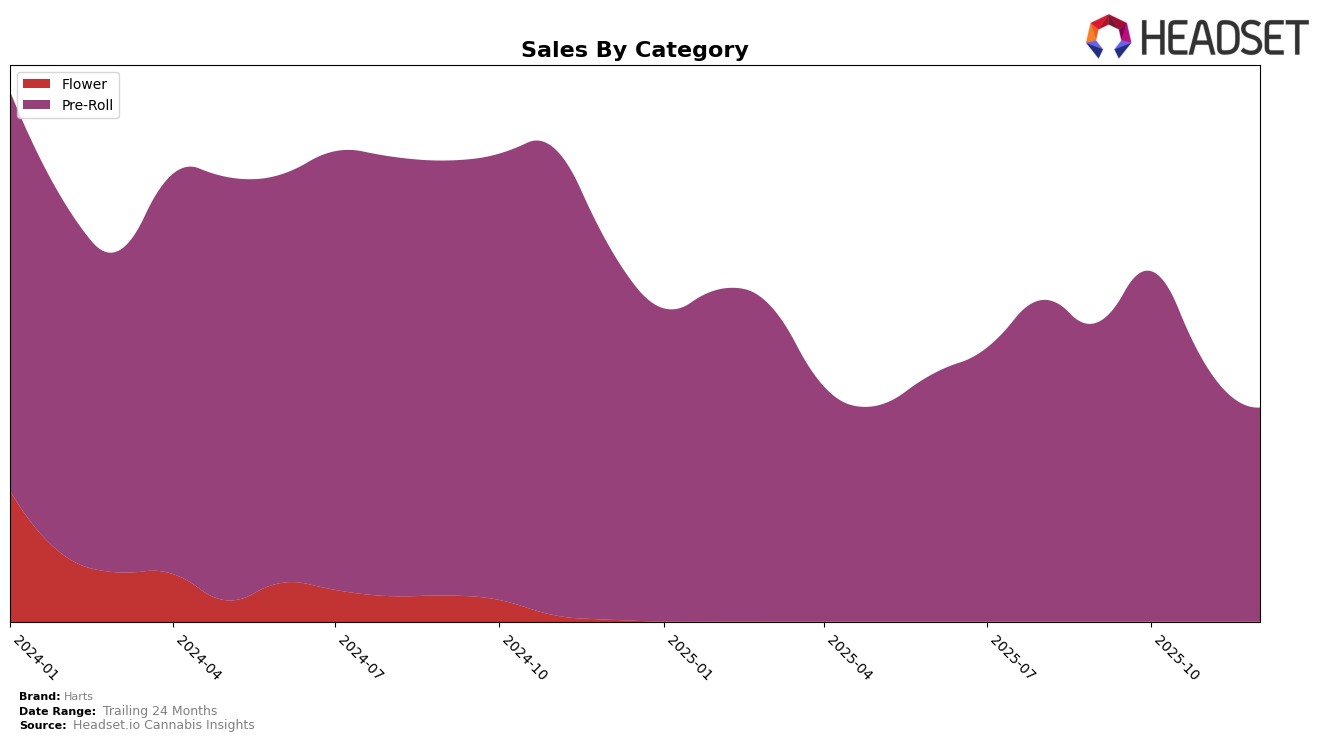

Harts has shown varying performance across different categories and regions, with notable fluctuations in their rankings. In the Pre-Roll category in Saskatchewan, Harts experienced a downward trend towards the end of 2025. Starting at rank 17 in September, they improved slightly to rank 15 in October, but then slipped to rank 18 in November and further down to rank 22 by December. This decline in ranking suggests a competitive market environment and possibly shifting consumer preferences that Harts may need to address. The decline in sales from October to December also aligns with this downward trend in rankings.

Despite the challenges in Saskatchewan, the overall performance of Harts across categories indicates potential areas for growth and strategic adjustments. The absence of Harts in the top 30 brands in some months could be seen as a missed opportunity, highlighting the need for targeted efforts to enhance market presence and brand visibility. While specific sales figures are not detailed here, the trends suggest that maintaining or improving their rank will require a focus on innovation and marketing strategies tailored to regional consumer demands. Further insights into other states or categories could provide a more comprehensive picture of Harts' market dynamics and opportunities.

Competitive Landscape

In the competitive landscape of the pre-roll category in Saskatchewan, Harts has experienced notable fluctuations in its rank and sales over the last few months of 2025. Starting from a strong position at rank 17 in September, Harts improved to rank 15 in October, but then saw a decline to rank 18 in November and further to rank 22 in December. This downward trend in rank corresponds with a decrease in sales from a peak in October. In contrast, North 40 Cannabis showed a consistent upward trajectory, improving from rank 29 in September to 19 by December, with sales showing a steady increase. Meanwhile, Front Porch also improved its rank from 31 in September to 21 in December, with a notable sales increase in November. Common Ground experienced a dip in November but maintained a relatively stable rank around the low 20s. These shifts suggest that while Harts initially held a competitive edge, the brand may need to strategize to regain its earlier momentum amidst the rising competition.

Notable Products

In December 2025, the top-performing product for Harts was the Watermelon Zkittlez Pre-Roll 10-Pack (3.5g) within the Pre-Roll category, maintaining its number one rank consistently from previous months despite a decrease in sales to 1319 units. The Screwface OG Pre-Roll 10-Pack (3.5g) also held its steady second-place position throughout the period. Cheetah Piss Pre-Roll 10-Pack (5g) showed notable improvement, climbing from fifth in October to third in December. Biscotti Pre-Roll 10-Pack (3.5g) made a comeback to fourth place after not being ranked in October and November. Meanwhile, Jungle Cake Pre-Roll 10-Pack (3.5g) dropped from third to fifth place, reflecting a decline in its sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.