Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

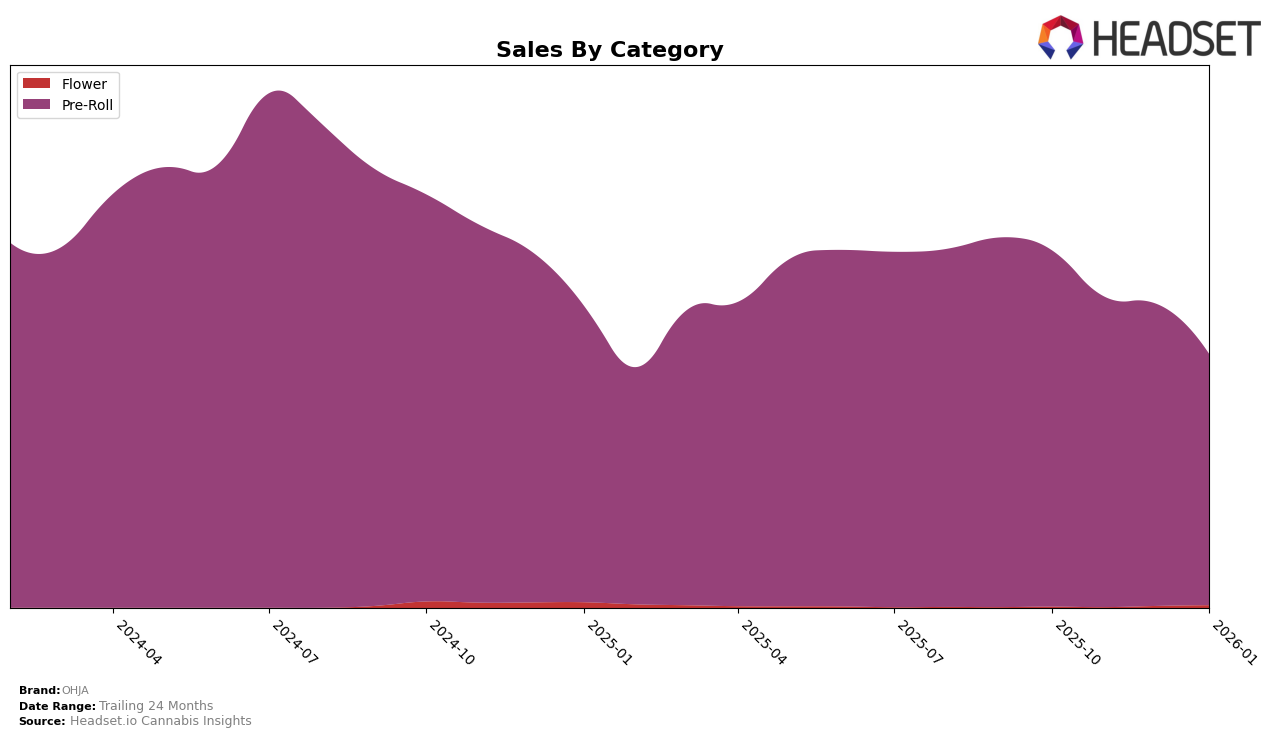

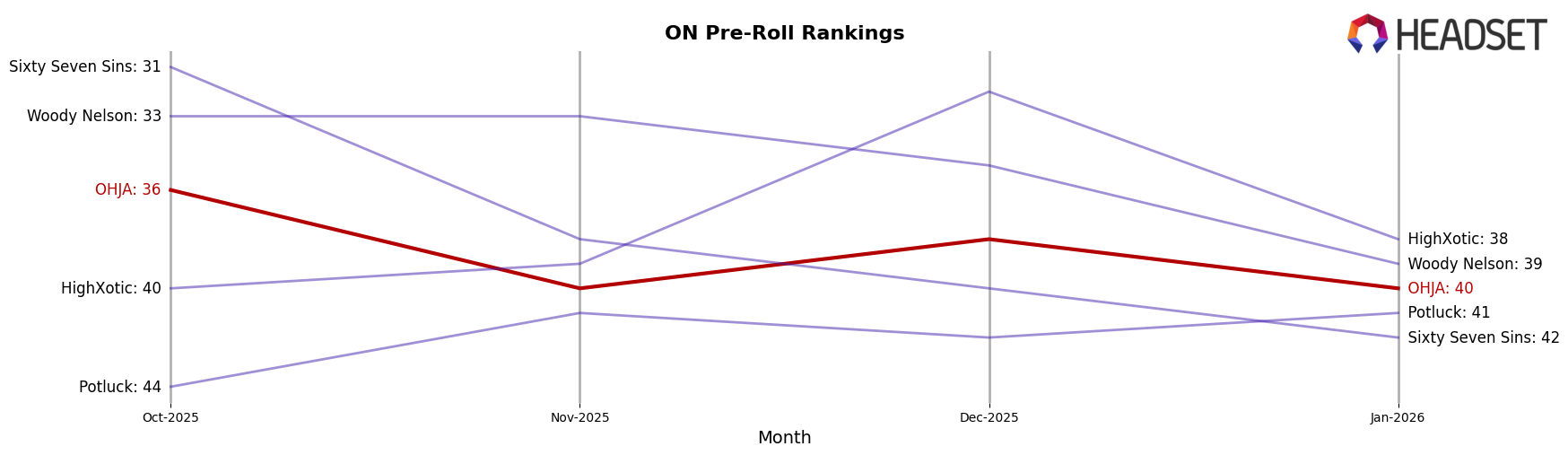

OHJA's performance in the Canadian cannabis market has shown variability across different provinces and categories. In the Pre-Roll category, OHJA has struggled to maintain a strong presence in Alberta, failing to break into the top 30 brands from October 2025 to January 2026. This indicates a challenging competitive landscape or potential issues in market penetration. Conversely, in Ontario, OHJA has consistently hovered around the 36th to 40th rank, suggesting a stable but not leading position in this significant market. The sales trend in Ontario shows fluctuations, with a noticeable dip in January 2026, which could be due to seasonal factors or increased competition.

In Saskatchewan, OHJA's performance in the Pre-Roll category is more promising, maintaining a position within the top 20 brands. The brand's ranking improved from 18th in October 2025 to 12th in November, before slightly declining to 15th in January 2026. This indicates a relatively strong market presence and potential for growth in this province. While the sales figures in Saskatchewan have seen some fluctuations, the brand's ability to stay within the top 20 suggests a loyal customer base or effective marketing strategies. This performance across provinces highlights the varying competitive dynamics and consumer preferences within the Canadian cannabis market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, OHJA has experienced notable fluctuations in its rankings and sales over the past few months. Starting from October 2025, OHJA was ranked 36th, but it saw a dip to 40th in November, a slight recovery to 38th in December, and then back to 40th in January 2026. Despite these changes, OHJA's sales have shown some resilience, with a peak in December before a decline in January. Comparatively, Woody Nelson maintained a stronger position, consistently ranking higher than OHJA, although it too saw a drop from 33rd in October to 39th in January. Meanwhile, HighXotic improved its rank significantly in December, surpassing OHJA, but fell back to 38th in January. Potluck and Sixty Seven Sins both remained outside the top 20, with Potluck consistently trailing behind OHJA. These dynamics suggest that while OHJA faces stiff competition, particularly from Woody Nelson and HighXotic, there is potential for strategic improvements to regain and strengthen its market position.

Notable Products

In January 2026, OHJA's top-performing product was Raspberry Diesel Pre-Roll 10-Pack (3.5g) in the Pre-Roll category, maintaining its number one position from December 2025 with notable sales of 5,160 units. Lemon Cherry Gelato Pre-Roll 10-Pack (3.5g) secured the second spot, consistent with its December ranking, although its sales saw a decline. Lemon Mintz Pre-Roll 10-Pack (3.5g) rose to third place, up from fourth in December, despite a decrease in sales figures. El Jefe Pink Pre-Roll 10-Pack (3.5g) dropped to fourth place, following a similar downward trend. Mango Haze Pre-Roll 10-Pack (3.5g) maintained its fifth position from the previous month, rounding out the top five products for OHJA in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.