Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

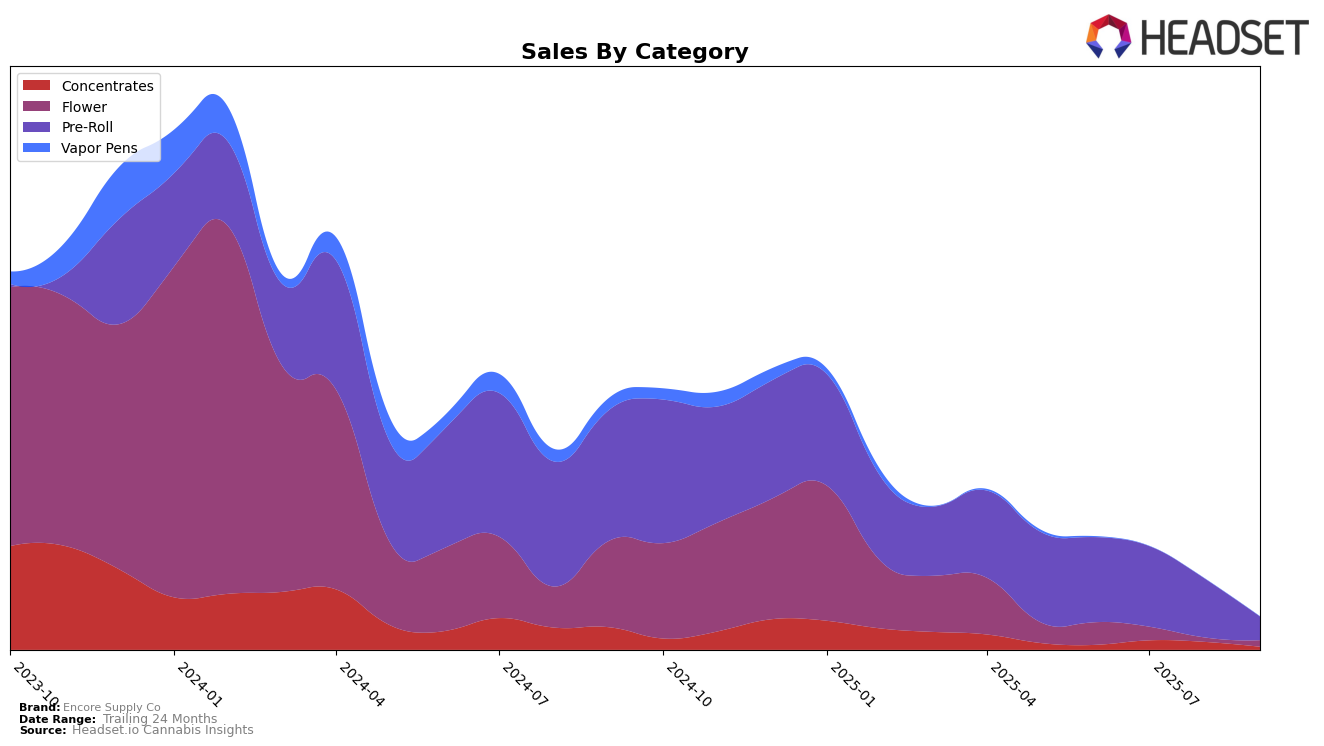

In the dynamic landscape of cannabis sales, Encore Supply Co has shown notable performance across different categories and markets. In the category of Concentrates within Saskatchewan, there was a visible shift as the brand moved from being outside the top 30 in June 2025 to securing the 13th spot in July, followed by a slight drop to 17th in August. This movement indicates a strong presence in the market, albeit with some fluctuations. However, in the Flower category, Encore Supply Co did not make it into the top 30 rankings in June and July, highlighting a potential area for growth or reevaluation of their market strategy in this segment.

The Pre-Roll category in Saskatchewan shows a different story, where Encore Supply Co was consistently ranked within the top 20, starting from 12th in June, moving to 15th in July, and settling at 20th in August. This consistent presence in the top ranks suggests a strong consumer base and brand loyalty in this category, despite a downward trend in sales from July to August. The absence of rankings in September across all categories could indicate a strategic withdrawal or a significant market shift. These insights into Encore Supply Co's performance reveal both strengths and areas for potential improvement in their market approach.

Competitive Landscape

In the competitive landscape of the Concentrates category in Saskatchewan, Encore Supply Co has experienced notable fluctuations in its ranking over the past few months. While it was absent from the top 20 in June 2025, it made a comeback in July, securing the 13th position. However, by August, it slipped to 17th place, indicating a potential challenge in maintaining its market position. This decline in rank coincides with a decrease in sales from July to August. In contrast, North 40 Cannabis maintained a consistent presence, ranking 14th in July and 16th in August, despite a slight drop in sales. Meanwhile, HWY 59 Cannabis appeared in the rankings in June but did not maintain a top 20 position in the following months. These dynamics suggest that while Encore Supply Co has the potential to climb the ranks, it faces stiff competition and must strategize to stabilize and enhance its market presence amidst fluctuating sales and strong competitors.

Notable Products

In September 2025, Encore Supply Co's top-performing product was the Peanut Butter Cake Pre-Roll 10-Pack from the Pre-Roll category, which climbed to the number one rank despite a decrease in sales to 551 units. The Mint Sour Pre-Roll 10-Pack moved up to the second position with increased sales from previous months, marking a significant improvement from its fifth-place ranking in July. Purple Fire Wax, a Concentrates product, rose to the third position, demonstrating a consistent upward trend from its debut in July. The Bison Breath Pre-Roll 10-Pack fell to fourth place, experiencing a sharp decline in sales compared to August. Korean BBQ Pre-Roll 10-Pack made its debut in the rankings, entering at fifth place, indicating potential growth within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.